Hurricane Helene brought flooding rains and devastated parts of the southeastern U.S. As a result, water treatment systems were destroyed, leaving no safe water to drink. For instance, the North Fork Water Treatment Plant, which supplies most of the drinking water to Asheville, North Carolina, was built in the 1970s and known for its clear water flowing from a large reservoir. However, when Helene hit with 14 inches of rain, even the backup water lines installed 25 feet underground after damages in 2004 were broken. Asheville’s woes highlight that the age of our nation’s water infrastructure, combined with the growing effects of climate change, can push systems to collapse.

The crumbling state of America’s water infrastructure poses significant challenges for many communities. A case in point is Asheville, which lacks a sedimentation-removal system in its water treatment plant. Implementing such a system would cost approximately $100 million, a substantial portion of Asheville’s $250 million annual budget. Instead, the city plans to add aluminum sulfate and sodium hydroxide to the reservoir to help sediment sink to the bottom, thereby clearing the water.

In 2022, Jackson, Mississippi, faced a similar crisis when rains led to the failure of the city’s already deteriorating water treatment plant, leaving residents without reliable tap water. The Environmental Protection Agency (EPA) estimates that it will require $625 billion over the next 20 years to modernize the nation’s public water systems.

Many urban water systems are in dire need of expensive fixes due to insufficient funding. The situation in Asheville is emblematic of a broader issue that could impact numerous communities across the country if mitigation efforts are not undertaken.

The cost of addressing America’s crumbling water infrastructure has risen significantly, from approximately $300 billion in 1995 to a higher figure in 2021, with most funds allocated to water distribution.

However, the EPA’s assessment, which is based on surveys of public water systems and focuses on immediate needs such as replacing lead-containing water distribution lines, does not encompass the full scope of the issue.

Future needs, particularly those related to climate change impacts like temperature extremes, droughts, and flooding rains, are not considered in the EPA’s assessment. Additionally, few water utilities have climate adaptation plans, as the federal government does not mandate them, and they rely on outdated weather history for risk assessment, which climate change is rendering obsolete.

Furthermore, the U.S. water industry, like many other critical sectors, is facing a growing worker shortage.

The EPA survey revealed that approximately 35% of small water systems and 50% of medium and large systems faced difficulties in hiring employees or obtaining contracted workers. This shortage is expected to worsen as more of the current workforce retires. Estimates suggest that 30% to 50% of the water industry workforce will retire in the next decade. Additionally, the increasing demand for water from AI-related data centers is exacerbating the water woes. As I mentioned in a recent article, artificial intelligence (AI) and cloud computing data centers are causing a soaring demand for water. Water is utilized by data centers for cooling computing equipment and in most forms of power generation. Already, water consumption by dozens of facilities in Virginia’s ‘data center alley’ has increased by almost two-thirds since 2019! The vast warehouses filled with computers and networking gear used about 1.

In 2023, data centers in the U.S. consumed 85 billion gallons of water, a stark increase from 1.13 billion gallons in 2019. According to Bank of America’s November estimate, data centers have become the 10th-largest water consumer in the country.

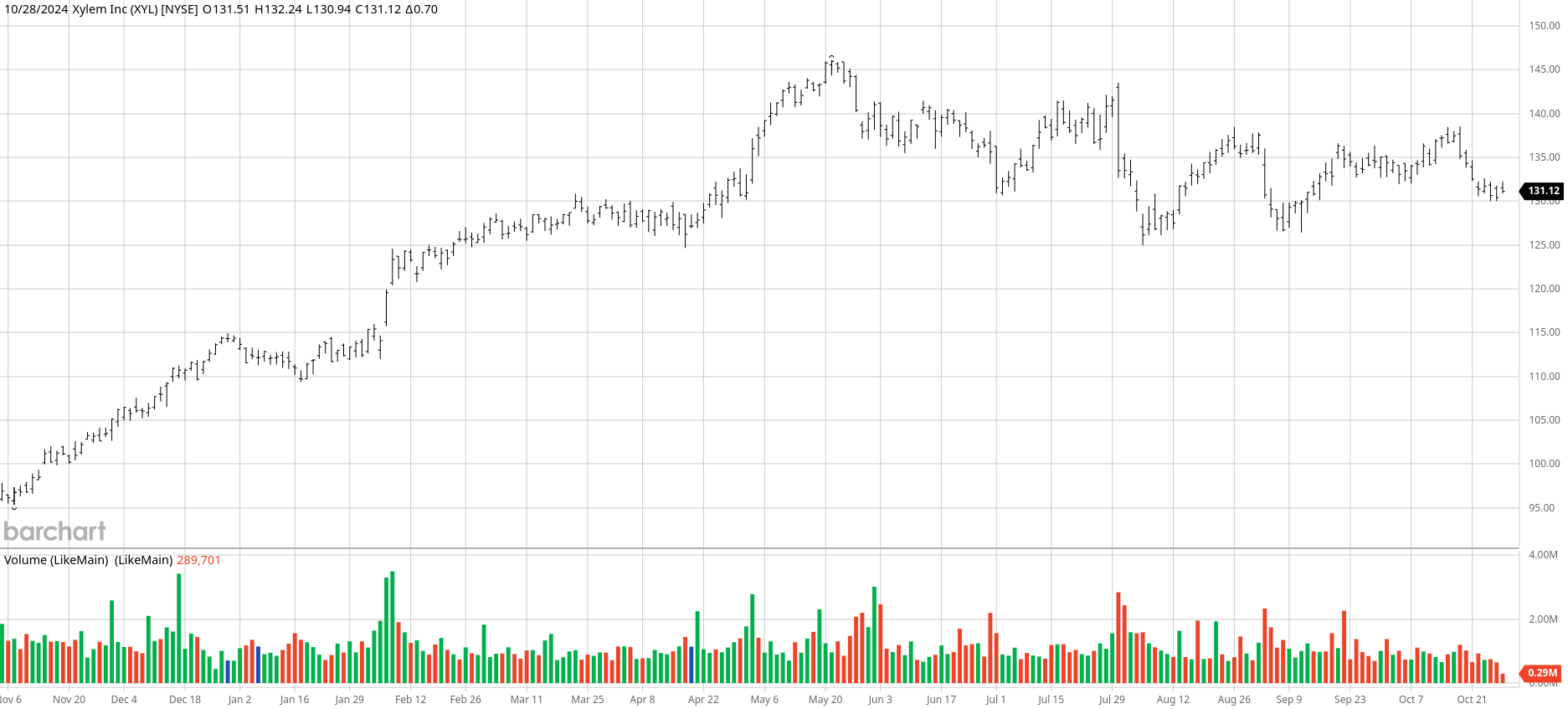

This surge in water consumption highlights a significant opportunity for the water treatment industry. One company poised to capitalize on this trend is Xylem (XYL). Over the past decade, Xylem has evolved from a mere pump manufacturer to a top-tier global provider of water solutions.

Xylem is well-positioned to benefit from broader trends in water conservation and sanitation, as well as from legislative and regulatory developments. These include the U.S. Inflation Reduction Act, Infrastructure Investment and Jobs Act, and similar regulations in Europe and the U.K.

Especially, Xylem’s Water Infrastructure division is reaping the benefits of increasing global demand for water transportation and treatment systems.

The $7.5 billion acquisition of Evoqua Water Technologies last year is expected to accelerate growth for Xylem by providing additional services and solutions for its customers. This merger created the world’s largest pure-play water technology firm. Updated EPA rules on PFAS and other contaminants in drinking water present an additional demand catalyst. Xylem uses its Evoqua acquisition to capture pollutants and develop innovative technologies for the detection and destruction of harmful substances. Xylem is also expanding its offerings through partnerships and smaller acquisitions, especially in the utility and industrial end markets. XYL stock is a buy anywhere below its 52-week high of $146.