Photo by Cottonbro Studio via Pexels. Investors often track insider buying activity as it can indicate company leadership’s confidence in the stock’s future performance. Insider buying happens when executives, board members, or major shareholders (owning 10% or more) purchase stock. This is seen as a bullish signal as these informed individuals are using their own money to buy shares.

Now, it’s worth noting some recent insider buying in shares of a dividend-paying building materials company. This under-the-radar stock has outperformed the S&P 500 Index ($SPX) and the Nasdaq Composite ($NASX) in 2024. Analysts are projecting more upside to come.

About CRH Stock. Founded in 1970 through the merger of two Irish companies, Dublin-based CRH (CRH) is one of the world’s largest suppliers of building materials and products.

CRH operates in three key areas: heavyside materials, building products, and distribution.

The company’s market cap is currently $63.4 billion. CRH stock is up 36.5% year-to-date and more than 80% over the past 52 weeks, outpacing the broader equities market. The stock offers a dividend yield of 1.48% based on its recently raised quarterly payout of $0.35. CRH has paid dividends for over 30 years. Insider Buying on CRH: On Oct. 18, longtime board member Siobhan Talbot made a sizable investment in the company’s stock. She purchased 2,000 shares of CRH at an average price of $93.8413 per share for a total value of about $187,683. Ireland-based Talbot has been a Director at CRH since 2018 and is a member of the Acquisitions, Divestments & Finance Committee; the Audit Committee, where she’s the resident financial expert; and the Nomination & Corporate Governance Committee. Her recent purchase is an insider move worth watching, particularly ahead of earnings from CRH on Nov.Notably, Talbot isn’t the only high-profile buyer of CRH lately. During Q2, Dan Loeb’s Third Point Capital added a new stake in CRH, with 650,000 shares. In other insider news, CRH has a management shake-up coming later this year. CFO Jim Mintern will take over for CEO Albert Manifold as part of a planned transition. Manifold will stay on in an advisory role for one year after he steps down in December. CRH has been a steady performer on the earnings front over the longer term. Revenues have expanded at a CAGR of 6.37% over the last five years and earnings at a rate of 14.85%. The company reported mixed results in the latest quarter. Earnings per share (EPS) of $1.89 beat expectations, while revenue fell slightly year over year to $9.

CRH had $3.9 billion of cash and cash equivalents and restricted cash on hand, down from $4.3 billion at the end of Q2 2023. The company reported revenue of $6.365 billion, missing estimates. However, CRH raised its full-year guidance to call for net income between $3.70-$3.85 billion and adjusted EBITDA of $6.82-$7.02 billion. When CRH reports earnings again in early November, Wall Street is looking for an adjust profit of $2.11 per share, on average, on revenue of $10.36 billion. CRH’s competitive advantage is rooted in its vertically integrated structure and comprehensive approach to building materials and solutions. By covering the entire process — from raw materials to finished structures like highways and bridges — CRH offers customers a seamless, end-to-end service. This model enables CRH to serve as a “one-stop shop” for infrastructure projects, adding value through its project management, design, and engineering capabilities.

CRH, a leading road paver in North America, stands to gain significantly from U.S. federal funding initiatives such as the Inflation Reduction Act and the Infrastructure Investment and Jobs Act. These initiatives offer increased revenue visibility due to their lower cancellation risk compared to private projects. For instance, the Federal Highway Program has allocated a substantial $350 billion for road infrastructure, an area where CRH excels.

Strategic acquisitions have also played a crucial role in enhancing CRH’s operations. In February 2024, CRH bolstered its market position in aggregates and cement by acquiring a portfolio of cement and ready-mixed concrete assets in Texas for $2.1 billion. This acquisition is projected to result in $60 million in cost savings by the third year post-closing, thanks to integration and operational efficiencies.

CRH, a major player in the global building materials industry, has recently bolstered its Australian operations through the acquisition of Adbri in July. This strategic move complements CRH’s existing strengths, as Adbri is a significant producer of lime, cement, and dry blended products in Australia. The acquisition aligns with CRH’s core competencies and enhances its growth prospects in the region, expanding its influence and opportunities.

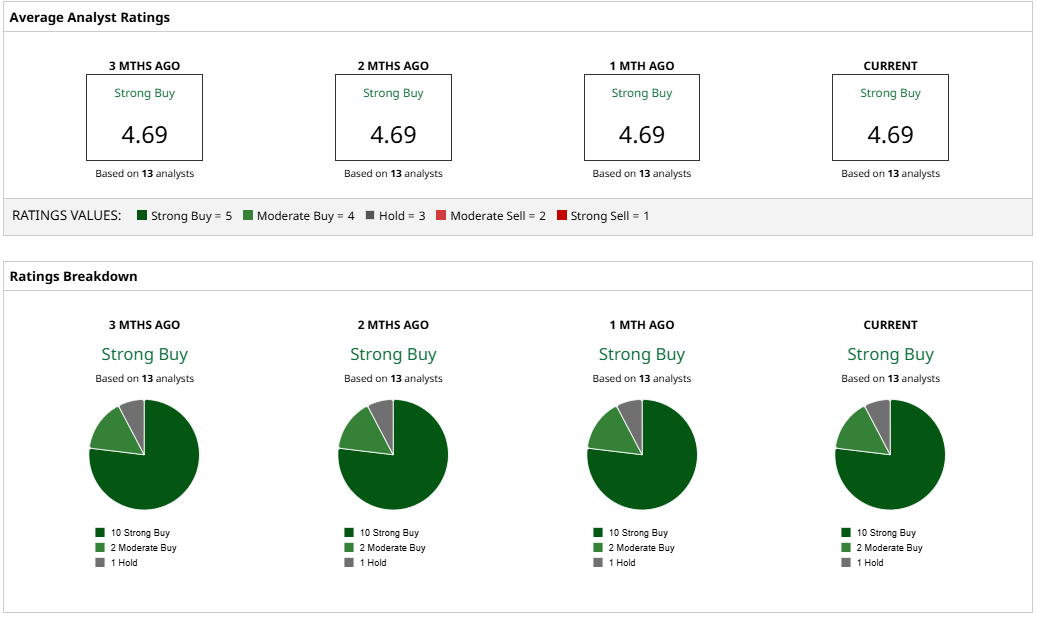

Analysts are particularly optimistic about CRH’s stock performance, with the majority assigning a ‘Strong Buy’ rating. Among the 13 analysts covering the stock, 10 have given a ‘Strong Buy’ rating, 2 a ‘Moderate Buy’ rating, and 1 a ‘Hold’ rating. The average target price for CRH is set at $101.92, suggesting an expected upside potential of approximately 8% from the current market levels. This positive outlook, coupled with the company’s strong operational model and strategic acquisitions, positions CRH as a ‘Strong Buy’ dividend stock that insiders are actively purchasing.