Penny stocks frequently go unnoticed, but their low prices can provide substantial returns for courageous investors. These stocks usually represent companies having innovative concepts and emerging market niches that are on the verge of breaking out. By investing early, investors can take advantage of significant growth as these hidden gems attract market attention and scale up rapidly. Known for their notorious volatility, penny stocks can experience drastic price fluctuations due to their relatively lower liquidity. This volatility can be nerve-racking for some investors as minor news or changes in investor perception can greatly impact share prices. There is also a high level of risk involved, and not every penny stock will become a multi-bagger. Thus, these investments are most suitable for those with a strong appetite for risk and a long-term investment horizon.

Volatility in penny stocks can be a double-edged sword; it brings risk but also the potential for significant gains. For investors seeking high-growth opportunities, three ‘Strong Buy’-rated penny stocks stand out: Planet Labs (PL), Uranium Royalty (UROY), and D-Wave Quantum (QBTS). Each of these stocks has the potential for a 70% or greater return based on Wall Street’s mean price targets.

Penny Stock #1: Planet Labs

Planet Labs (PL), founded in 2010 by three visionary NASA scientists, is a California-based company leading the way in global satellite imagery and geospatial solutions. The company’s mission is to image the entire world every day, and it operates the largest fleet of Earth observation satellites. Planet Labs provides essential data and advanced insights to over 1,000 customers in various sectors, including agriculture, forestry, intelligence, education, and finance.

Planet Labs makes change visible, accessible, and actionable, empowering users to unlock unique value from satellite imagery and transform how they understand and respond to the world around them. With a market cap of approximately $698 million, Planet Labs’ shares are up 11.6% over the past year. However, they are in negative territory on a year-to-date basis, down 4.6%. The stock has bounced back sharply from its April lows. Over the past six months, it has delivered gains of roughly 39%, compared to the broader S&P 500 Index’s ($SPX) return of 15.5% during the same time frame. Planet Labs revealed its fiscal 2025 Q2 earnings results in early September. During the quarter, the company achieved remarkable revenue growth, increasing 14% year-over-year to a record $61.1 million. Its customer base expanded by 7%, reaching a total of 1,012.

Planet Labs Inc. (PL) has demonstrated significant growth in Q2, particularly within the Defense & Intelligence sector where revenue increased over 30% year-over-year. The company’s gross margin has also shown improvement, rising to 53% from 49% in the same quarter of the previous year.

On an adjusted basis, PL’s loss per share for Q2 was $0.06, which is a slight improvement from the $0.07 loss per share in the year-ago quarter. This indicates a positive trend in the company’s financial performance.

CEO Will Marshall has highlighted the successful restructuring of the business towards an industry-aligned operating model, which has led to enhanced operational efficiency and an expansion in gross margin.

As we look ahead to Q3, the management of PL stock forecasts revenue between $61 million and $64 million, with a non-GAAP gross margin anticipated to be between 59% and 61%. Additionally, the company projects an adjusted EBITDA loss ranging from approximately $5 million to $2 million for the quarter. Capital expenditures are expected to be within the range of $13 million to $16 million.

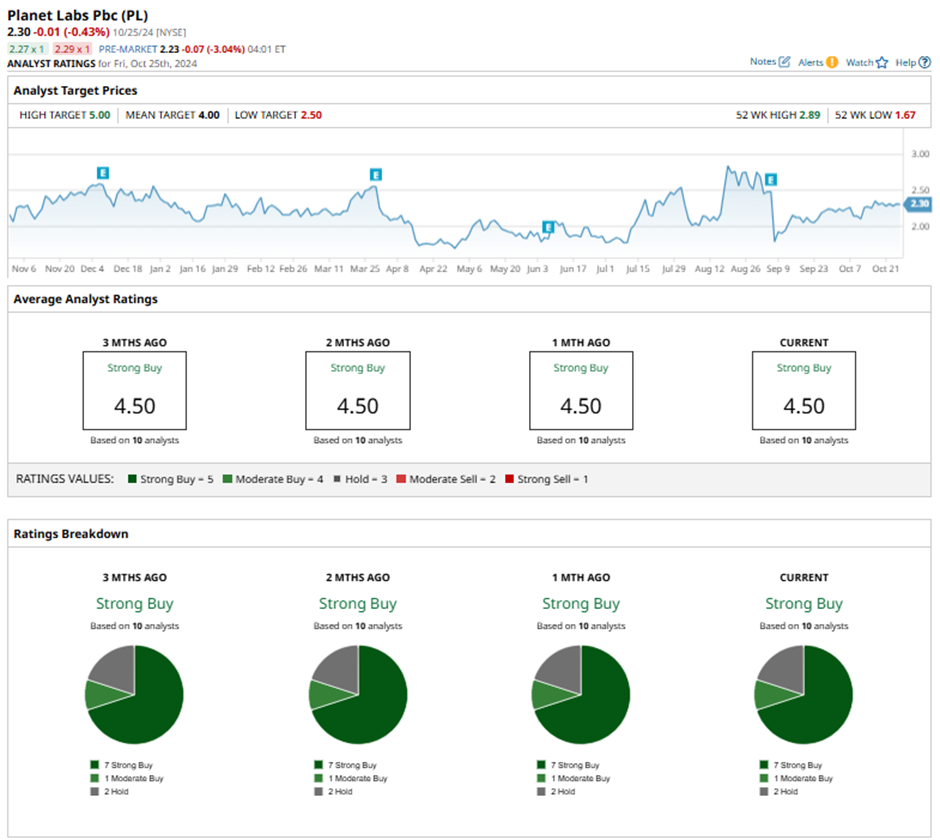

PL stock has garnered a consensus “Strong Buy” rating, with 7 out of 10 analysts recommending a “Strong Buy,” one suggesting a “Moderate Buy,” and two holding a “Hold” rating. The average analyst price target is $4.00, which indicates a significant potential upside of around 70.2% from the current price levels. Penny Stock #2: Uranium Royalty Corp. Canada-based Uranium Royalty Corp. (UROY) stands as the world’s only uranium-focused royalty and streaming company.Uranium Royalty is a standout company that offers investors exposure to uranium commodity prices (UXZ24) through strategic acquisitions of royalties, streams, debt, and equity in uranium companies. It trades physical uranium as well.

As the demand for carbon-free nuclear energy escalates, Uranium Royalty plays a crucial role as a capital provider for an industry demanding significant investments in production capacity. The company’s management team and board possess decades of experience in uranium and nuclear energy, allowing Uranium Royalty to leverage deep industry knowledge to identify and capitalize on lucrative investment opportunities. With a market cap of around $350 million, Uranium Royalty’s shares have seen a 7.5% gain on a year-to-date basis. Furthermore, the stock has outperformed the broader market over the past six months, achieving healthy gains of 26%.Uranium Royalty reported its fiscal Q1 earnings results on Sept. 12. In this quarter, the Vancouver-based company had a net loss of C$0.02 per share, an increase from a net loss of C$0.01 per share in the same quarter of the previous year. The wider net loss is mainly due to higher office and administration expenses and a change in deferred income tax recovery. Currently, the company has strong working capital of C$222 million ($159.8 million). As of July 31, it holds a significant 2,711,271 pounds of tri-uranium oxide. In a strategic move to enhance its portfolio, UROY made two notable acquisitions in Q1. On July 3, it acquired a 0.375% net smelter returns royalty on products from the Salamanca project, which includes the Retortillo, Zona 7, and Alameda mining projects in Spain, for C$0.7 million ($0.5 million).

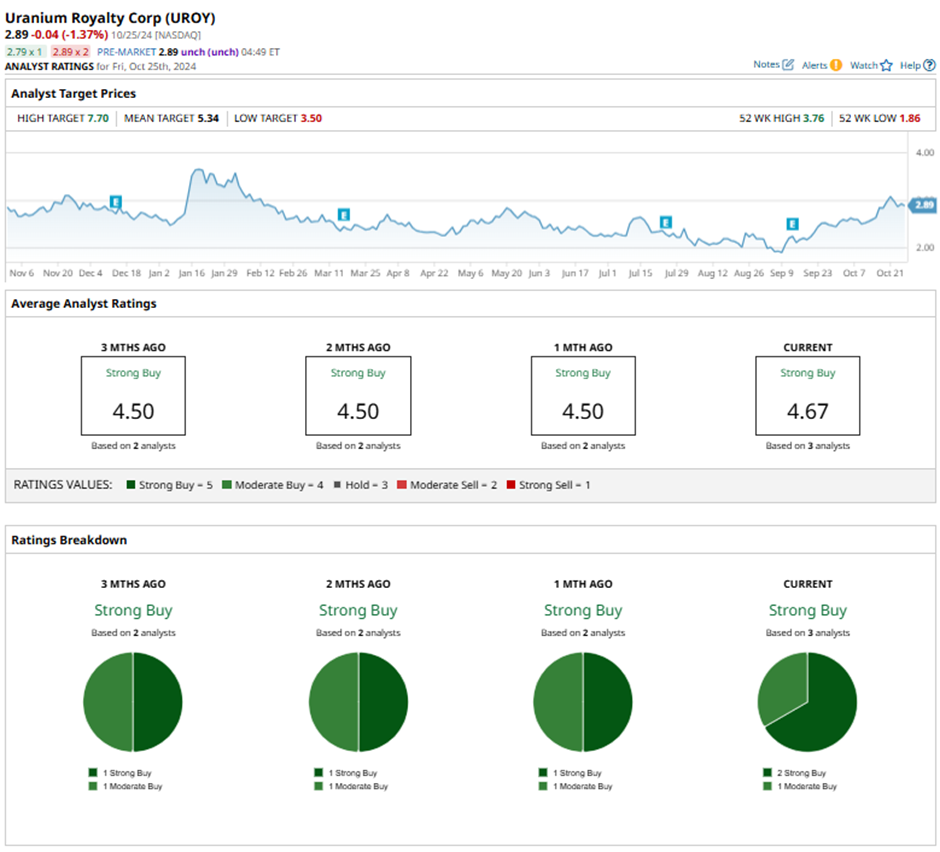

Penny Stock #1: Uranium Royalty Corp (UROY) has a consensus ‘Strong Buy’ rating on Wall Street. Of the three analysts offering recommendations, two suggest a ‘Strong Buy,’ and one has a ‘Moderate Buy’ rating. The average analyst price target of $5.34 indicates expected upside of almost 83% from current levels. Shortly after acquiring two projects for C$4.9 million ($3.5 million) in cash on July 31, Uranium Royalty secured a gross overriding royalty of 6% ‘Mine Price’ for the Churchrock uranium project. These acquisitions position the company to capitalize on the growing demand for uranium.

Penny Stock #2: [No details provided for Penny Stock #2] Penny Stock #3: D-Wave Quantum Inc. (QBTS), based in Palo Alto and valued at a market cap of $239.7 million, is a pioneer in quantum computing and recognized as the world’s first commercial supplier of quantum computers.Unlocking the potential of quantum technology for business and society, D-Wave is committed to delivering practical quantum applications that address a broad spectrum of challenges. These include logistics, artificial intelligence (AI), drug discovery, and financial modeling.

D-Wave’s cutting-edge technology has been embraced by leading organizations such as Mastercard (MA), Deloitte, Siemens Healthineers, and Lockheed Martin (LMT). This adoption highlights D-Wave’s capability to add significant value across various industries. Shares of D-Wave have experienced a nearly 76% increase over the past year, with more than a 28% rise on a year-to-date (YTD) basis. Following the company’s impressive Q2 earnings results on August 8th, D-Wave’s shares surged by more than 5% in the subsequent trading session. The company reported revenue of $2.2 million, representing a substantial 28% increase from the quarter of the previous year.The company has reported a 6% year-over-year increase in bookings for the quarter, reaching $2.7 million. This marks the ninth consecutive quarter of growth in this area.

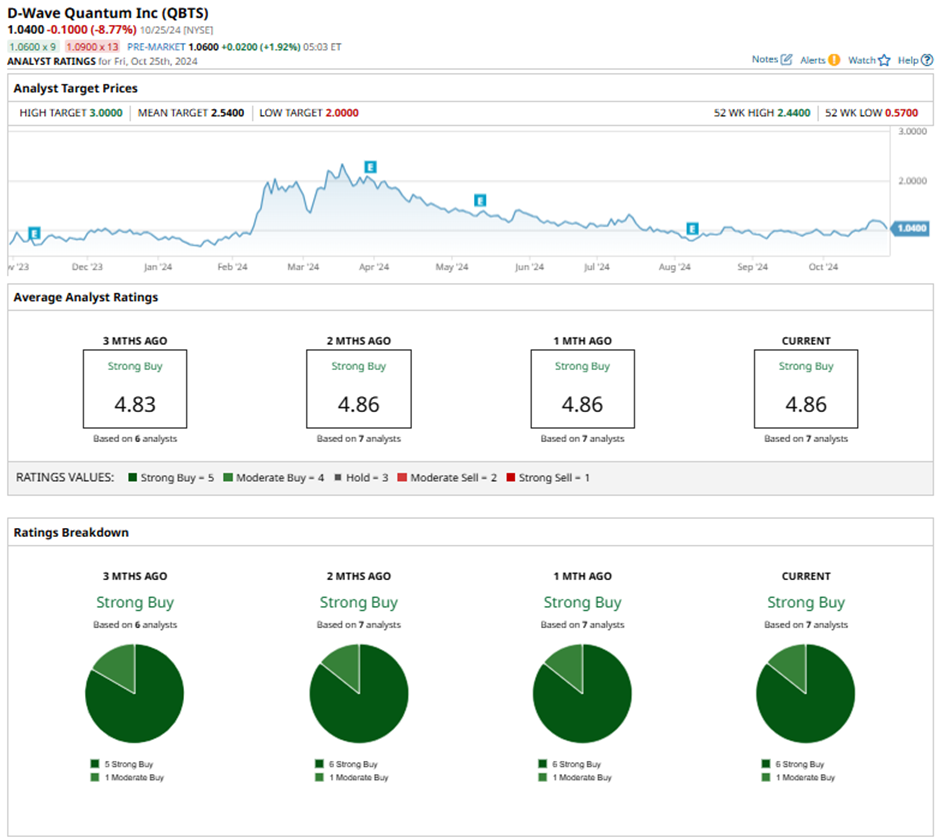

GAAP gross profit has seen a significant surge to $1.4 million, a 97% increase from the previous year. In Q2, the company’s adjusted EBITDA loss was $13.9 million, which is a nearly 7% improvement from the $14.9 million loss in the same quarter of fiscal 2023. This positive change is attributed to increased gross profit and reduced operating expenses, indicating a focus on operational efficiency. Moreover, the company has managed to reduce its loss per share to $0.10, a substantial improvement from the $0.21 loss per share in the year-ago quarter. As of June 30, D-Wave reported a consolidated cash balance of $40 million.For fiscal 2024, management reaffirmed its guidance for an EBITDA loss that’s narrower than its adjusted EBITDA loss of $54.3 million in fiscal 2023. The second quarter results of the company show continued traction on all fronts – revenue, bookings, customer acquisition, liquidity and technical advancements. CEO Dr. Alan Baratz said, “Our second quarter results show continued traction on all fronts – revenue, bookings, customer acquisition, liquidity and technical advancements.” Furthermore, the CEO emphasized D-Wave’s product innovations, such as the Advantage2 prototype, new nonlinear hybrid solver, fast anneal feature, and advances in quantum artificial intelligence, as key drivers of this momentum. Overall, Wall Street is highly optimistic, with a consensus “Strong Buy” rating for QBTS stock. Of the seven analysts covering the stock, six advise a “Strong Buy,” and one recommends a “Moderate Buy.” The average analyst price target of $2.

Investing in penny stocks can be a lucrative opportunity for those seeking high returns. Among the many, three standout penny stocks have been identified with significant upside potential, ranging from 70% to 124%. One of these stocks, with a current price level, indicates a staggering 124.8% potential upside.