In an August 27 Barchart article, the question was raised: can sugar futures prices recover? The analysis suggested that, based on the price action in coffee, cocoa, and FCOJ, sugar futures have the potential to recover significantly.

Sugar futures experienced an 11.67% increase in Q3 2024, ranking it as the second-best performing soft commodity after Arabica coffee beans. Over the first nine months of 2024, sugar prices were up by 10.16%, with Q3 closing at 22.67 cents per pound.

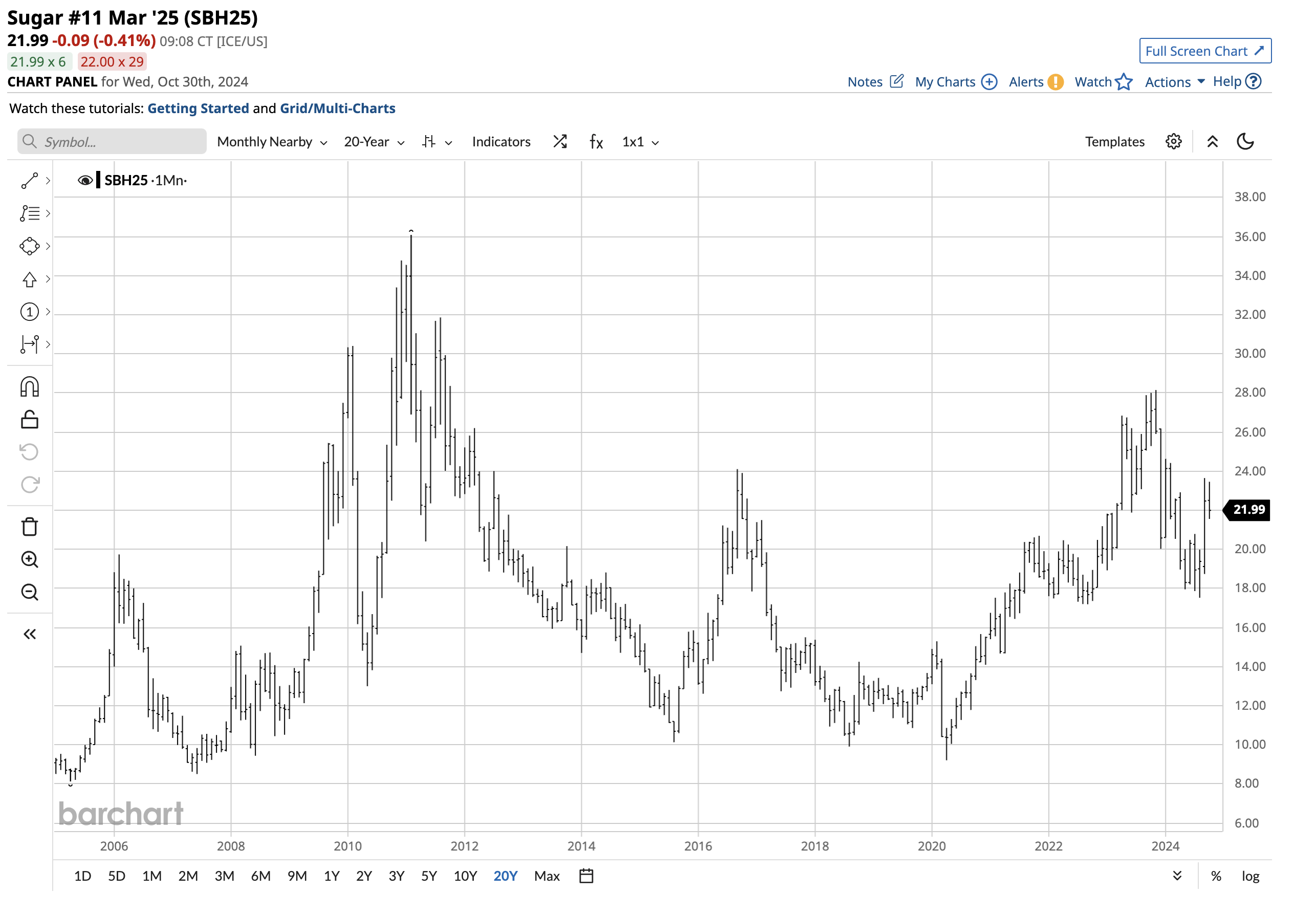

On August 23, nearby sugar futures were trading at 18.39 cents per pound, after reaching a continuous contract low of 17.52 cents. By late October, the nearby March 2025 world sugar futures contract had risen to around 22 cents per pound, indicating a market bottom in August.

The Teucrium Sugar ETF (CANE) tracks a portfolio of three ICE world sugar futures contracts, excluding the nearby contract. This ETF provides investors with exposure to the global sugar market, reflecting its performance and trends.

World sugar futures have experienced a remarkable recovery in 2023. In November, the continuous ICE world sugar futures contract reached 28.14 cents per pound, the highest price since October 2011. However, this upward trend has since lost momentum.

The monthly chart illustrates a significant downside correction, with world sugar futures plummeting 37.7% to a low of 17.52 cents in August 2024. Despite this, sugar futures have found a bottom above the September 2022 technical support level of 17.19 cents and have since recovered, reaching a high of 23.64 cents on the continuous contract in September 2024. As of the end of October, sugar futures are trading at 22 cents per pound, significantly higher than the August low.

Brazil plays a pivotal role in global sugar production, being the world’s leading free-market sugarcane producer and exporter. According to Statista, Brazil’s dominance in annual sugar production is evident in the chart provided.

Sugar prices have recently experienced a rally due to dry conditions in Brazil, which are affecting market sentiment and leading to revised downward sugar production forecasts for 2024 and 2025.

Sugar, a key ingredient in many food products and fuels, is particularly sensitive to gasoline and oil prices, especially in Brazil, where it is the primary ingredient in ethanol production.

The escalating conflict in the Middle East and potential supply concerns could further boost biofuel prices, including sugar, on top of Brazil’s adverse weather conditions.

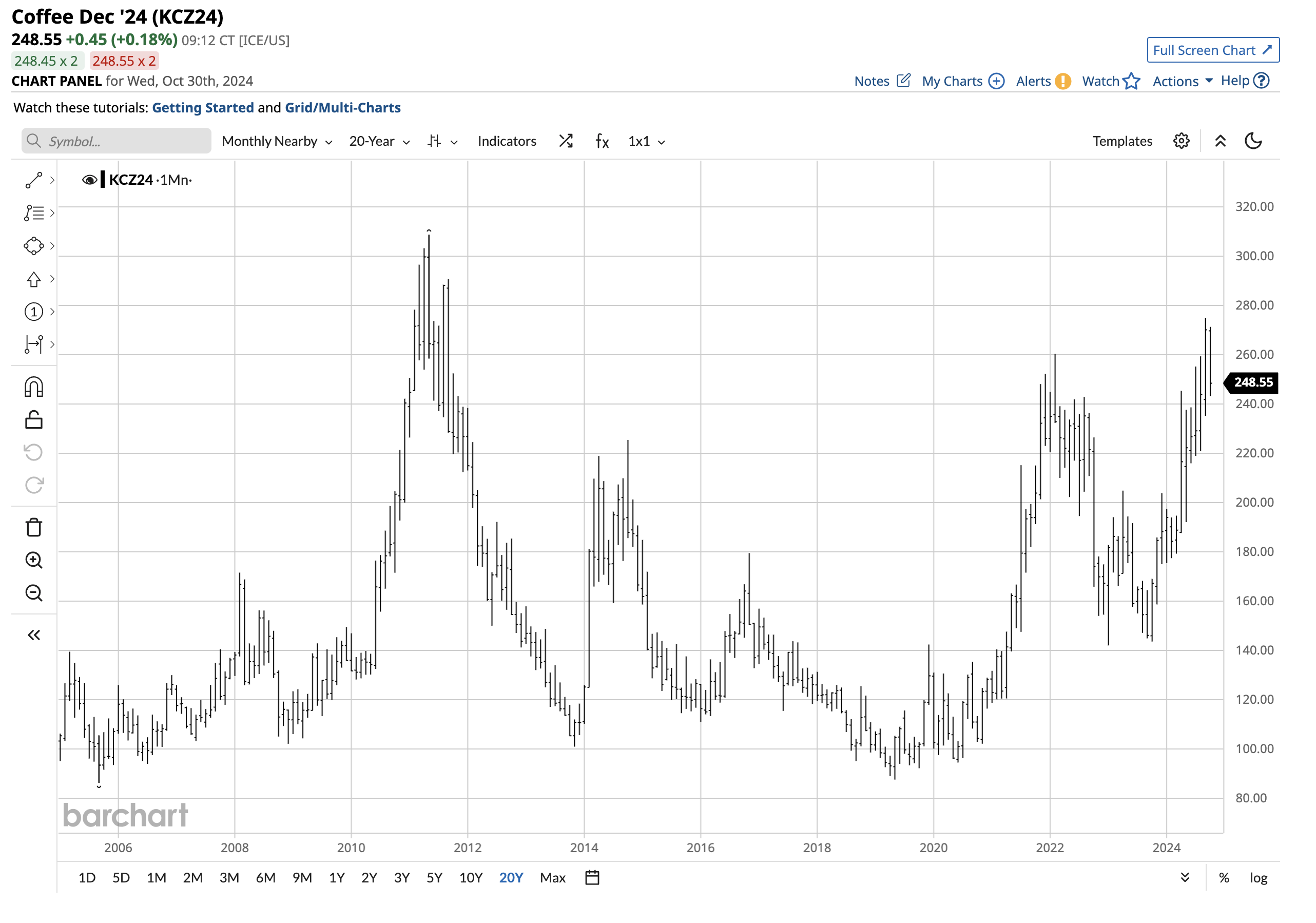

FCOJ and cocoa have already reached record highs, with coffee trending towards a critical upside target.

As a soft commodity, sugar has been part of the leading commodities asset class, with the softs driving higher in 2023 and through the first nine months of 2024.

The composite for five soft commodities, including sugar, Arabica coffee, cotton, cocoa, and frozen concentrated orange juice futures, saw an increase of over 36% in the first three quarters of 2024.

In 2024, the prices of frozen concentrated orange juice (FCOJ) reached an all-time high, surpassing $5 per pound before experiencing a correction. Brazil, known as the world’s leading orange producer, also dominates in Arabica coffee production and exports.

Cocoa prices have skyrocketed to record levels in 2024. The bullish trend in ICE Arabica coffee futures over the past few years is evident in the monthly chart. Factors such as adverse weather conditions and crop diseases in Brazil have contributed to the increase in coffee bean prices. The chart indicates that the upside target for the Arabica coffee futures market is over the $3 per pound level, with the most recent high at $2.7505 per pound. Historically, coffee futures have only surpassed the $3 level on three occasions: in 2011, 1997, and 1977. Despite cocoa and FCOJ prices hitting record highs in 2024 and coffee potentially challenging the $3 long-term technical resistance, world sugar futures are significantly below their record peak, with the record high being triple the current price.The long-term chart dating back to the early 1960s reveals that world sugar futures hit a record high of 66 cents per pound in 1974. Over the years, technical resistance is at the 44.84 cents high in November 1980 and the 36.08 cents peak in February 2011. With sugar futures at between 22 and 23 cents per pound, there could be considerable upside technical room if supply concerns continue to rise. The sugar ETF product is CANE. The most direct way to take a risk position in the world sugar futures market is through futures and futures options trading on the Intercontinental Exchange. Sugar is the only soft commodity with an ETF product that tracks futures prices. At $12.77 per share, the Teucrium Sugar ETF (CANE) has over $15.658 million in assets under management. CANE trades an average of nearly 50,000 shares daily and charges a 0.

The CANE ETF tracks a portfolio of three deferred world sugar futures contracts. To minimize roll risks, it excludes the nearby contract. CANE does an excellent job in this regard. During the latest rally in world sugar futures, the commodity rose 34.9% from the August 2024 low of 17.52 to the September 2024 high of 23.64 cents per pound. Over the same period, the CANE ETF rallied 25.8% from $10.91 to $13.73 per share. CANE tends to underperform the continuous world sugar futures contract on the upside but outperforms during downside corrections. If sugar futures are on a path to higher prices following other bullish soft commodities, CANE could be a product to sweeten your portfolio. It has a 22% management fee.