Tesla Inc., symbolized by its iconic logo, experienced its most significant single-day rally in over a decade following its Q3 results. Currently, Tesla’s stock (TSLA) is valued at $257.55, just 6% below its 52-week high. This recent surge has resulted in a 30.4% increase in Tesla’s electric vehicle (EV) stock over the past year and a 3.5% gain in 2024.

With a market capitalization of $826 billion, Tesla stands as the world’s largest automobile company, yet its stock trades at a 37.8% discount from its all-time highs. This article delves into the expectations of analysts for the EV giant and assesses whether investing in Tesla at its current valuation is advisable.

What is Tesla’s Target Price Now? Barclays, a leading brokerage firm, has recently increased its target price for Tesla from $220 to $235, while retaining an “equal weight” rating on the stock.

Barclays has identified Tesla as a top investment due to its improving gross margins and strong shipment forecast for 2025. In Q3 of 2024, Tesla reported a 19.8% gross margin, an increase from 17.9% in the same period last year. Additionally, Tesla anticipates a 20% to 25% rise in vehicle shipments for the next year, driven by the introduction of more affordable vehicles, which surpasses the estimated 15% growth.

Despite Barclays’ positive stance on Tesla, its revised target price is almost 9% lower than the current market price. Piper Sandler, on the other hand, has maintained a ‘buy’ rating for Tesla stock and increased its target price to $315 from $310, reflecting higher deliveries and margins.

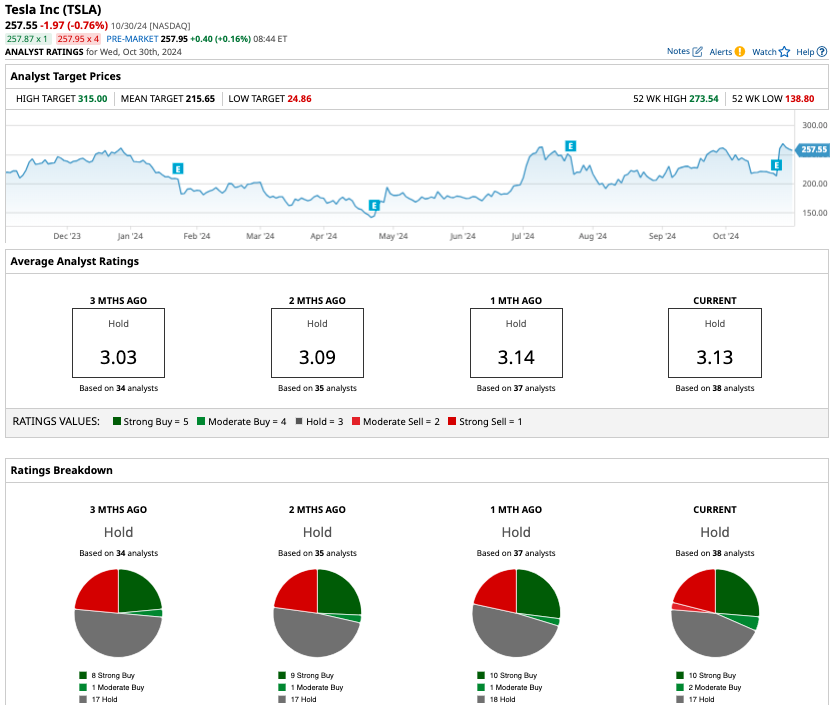

Among the 38 analysts tracking TSLA stock, the consensus rating remains a ‘hold.’ The breakdown of recommendations is as follows: 10 ‘strong buy,’ two ‘moderate buy,’ 17 ‘hold,’ one ‘moderate sell,’ and eight ‘strong sell.’

Tesla stock soared 21.9% on Oct. 24 after reporting revenue of $25.37 billion and adjusted earnings per share of $0.72, topping Wall Street’s forecast for adjusted EPS of $0.58 in the September quarter. The company’s bottom line was boosted by $739 million from environmental regulatory credits. Notably, Tesla also reported $326 million in revenue from its full self-driving (FSD) operating system. During the Q3 earnings call, CEO Elon Musk said Tesla would start production of the Cybercab, a robotaxi, by the end of 2026. Further, Musk predicted that Tesla would begin driverless ride-hailing of existing cars in markets such as Texas and California. The average target price for Tesla stock is $215.65, over 16% below the current trading price.

Tesla’s latest price-target hike, despite being labeled as bullish, actually carries a bearish undertone. Elon Musk has a history of missing deadlines for product launches, including a fully autonomous vehicle which has been promised for nearly a decade.

Tesla anticipates that its robotaxi service will diversify its revenue streams and generate billions annually once scaled. However, the company must successfully deliver a vehicle ready for the future and meet stringent regulatory standards. Additionally, Tesla faces stiff competition from companies like Alphabet (Waymo), Uber, and General Motors, all of which are heavily investing in autonomous driving technology. The consensus among analysts tracking Tesla’s stock is that adjusted earnings are expected to rise from $2.47 per share in 2024 to $3.26 per share in 2025. Considering Tesla’s volatile profit margins and free cash flow, TSLA stock is deemed expensive at 79 times forward earnings.Tesla has achieved a remarkable increase in its free cash flow, nearly tripling it to $2.74 billion in Q3 of 2024, as compared to $849 million during the same period last year. This substantial growth is attributed to the company’s strategic focus on cost-cutting.

Despite this impressive performance, Tesla’s stock, denoted as TSLA, is still considered overvalued in the current challenging macroeconomic climate. The annual free cash flow run rate is estimated at $11 billion, which further supports the bearish outlook on the stock.