In our innovation-driven world, semiconductors are the unsung heroes that power our daily lives. They are essential components in everything from smartphones to artificial intelligence (AI) systems that are transforming various industries. As AI continues to revolutionize automation and digital connectivity, the demand for these vital chips is rapidly increasing.

Piper Sandler analysts predict that the semiconductor sector will flourish in the upcoming quarters, primarily due to the ongoing momentum in AI compute markets. They believe that AI-related demand will keep providing growth opportunities, benefiting the largest compute-focused semiconductor companies.

Despite the undeniable momentum in AI, Piper Sandler’s outlook for analog and mobile segments is more cautious. They suggest that while AI is driving growth, other segments may not experience the same level of expansion.

The anticipated recovery in automotive and industrial markets has faced hurdles, particularly in the latter half of 2024. Lower interest rates and a stabilizing macro environment have provided a modest lift, but Piper Sandler analysts urge caution, suggesting that robust growth in these sectors remains elusive.

Amid this mixed market landscape, the brokerage firm has spotlighted three chip stocks poised for success: Advanced Micro Devices, Inc. (AMD), Microchip Technology Incorporated (MCHP), and ON Semiconductor Corporation (ON). These three semiconductor stocks are analyst favorites for their potential in the current market conditions.

AMD stands out for its critical role in the AI computing arena, driving the next wave of AI innovations. It is a leader in this space and is expected to benefit from the growing demand for AI technology.

On the other hand, Microchip Technology and ON Semiconductor are making waves as top choices in the analog sector. Both companies have substantial exposure to China, where demand trends are showing signs of stability, making them attractive investment options.

Let’s examine these three top-rated chip stocks more closely. Semiconductor Stock #1 is Advanced Micro Devices. Based in Santa Clara, Advanced Micro Devices, Inc. (AMD) is a giant in the semiconductor industry. It offers a wide range of high-performance and adaptive processor technologies. Since its inception in 1969 as a Silicon Valley startup, AMD has become a global powerhouse. It provides cutting-edge CPUs, GPUs, FPGAs, and Adaptive SoCs, along with extensive software expertise. With a market cap of approximately $269 billion, shares of this mega-cap stock have risen 55.6% in the past year, outperforming the broader S&P 500 Index’s 40% gain during the same period. On October 29, AMD reported its Q3 earnings results. Revenue was $6.8 billion, a solid 18% year-over-year increase and slightly exceeding Wall Street’s projections.

Three semiconductor stocks have emerged as favorites among analysts.

The first company reported an adjusted EPS of $0.92, marking a 31% annual increase and surpassing expectations. In the recent quarter, this chipmaker demonstrated exceptional performance across its various segments.

The Data Center segment achieved a record-breaking $3.5 billion in revenue, a staggering 122% year-over-year growth, primarily driven by the soaring sales of AMD Instinct GPUs and EPYC CPUs. This significant increase has contributed to the chip giant’s adjusted gross margin, which jumped to 54% from 51% in the same quarter of the previous year, highlighting the substantial impact of its flourishing data center business.

The Client segment also showed commendable results, with revenue reaching $1.9 billion, a 29% increase compared to the year prior. This growth was propelled by the strong market interest in the innovative Zen 5 Ryzen processors.

On the other hand, the gaming segment encountered challenges, with revenue plummeting 69% to $462 million year over year, attributed to the decline in semi-custom revenue.

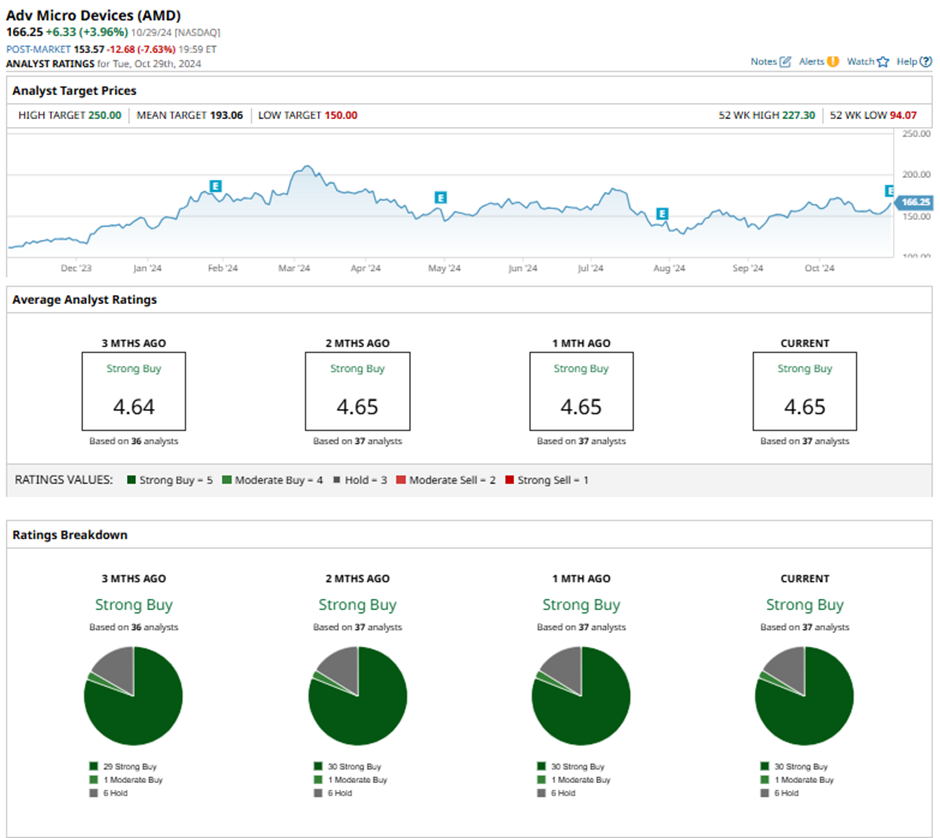

CEO Dr. Lisa Su stated, “Looking forward, we see significant growth opportunities across our data center, client and embedded businesses driven by the insatiable demand for more compute.” For the final quarter of fiscal 2024, management projects revenue to be around $7.5 billion, with a margin of plus or minus $300 million. This midpoint forecast shows an impressive year-over-year growth of approximately 22% and a sequential increase of about 10%. Additionally, the company anticipates maintaining a non-GAAP gross margin of approximately 54%. Analysts tracking Advanced Micro Devices expect the company’s profit to increase 28.6% year over year to $2.56 per share in fiscal 2024 and jump another 70.7% to $4.37 per share in fiscal 2025. AMD stock has an overall consensus “Strong Buy” rating. Out of the 37 analysts offering recommendations for the stock, 30 suggest a “Strong Buy,” one advocates a “Moderate Buy,” and the remaining six give a “Hold” rating.

Semiconductor Stock #2: Microchip Technology. Arizona-based Microchip Technology Incorporated (MCHP) is a leader in smart, connected, and secure embedded control solutions. It provides user-friendly development tools and a comprehensive product portfolio. Serving around 120,000 clients in various sectors like industrial, automotive, consumer, aerospace and defense, communications, and computing. Microchip helps optimize designs, minimize risks, and reduce overall system costs and time to market. With a market cap of $42.4 billion, the company is known for its excellent technical support, reliable delivery, and high-quality solutions. It is a trusted partner in innovation.

The average analyst price target of $193.06 indicates a 29% potential upside from current price levels.MCHP stock has risen approximately 8% over the past 52 weeks. However, it is down 15% year-to-date. On Sept. 5, Microchip Technology distributed a quarterly dividend of $0.454 per share. This represents a year-over-year increase of 10.7% from the previous dividend of $0.41 per share. The company’s annualized dividend of $1.81 per share results in a highly attractive 2.30% yield. Executive Chair Steve Sanghi emphasized that despite current market challenges, Microchip is committed to returning 100% of its adjusted free cash flow to shareholders by the March 2025 quarter. Since initiating dividends in 2003, Microchip has increased its dividend 82 times. On Aug. 1, Microchip Technology released its fiscal 2025 Q1 earnings results. Net sales of $1.2 billion decreased 46% year-over-year but matched Wall Street’s expectations.

In the recent quarter, Microchip Technology Inc. reported an Adjusted EPS of $0.53, a significant decrease from last year’s $1.64 per share. Despite this, it surpassed analysts’ expectations.

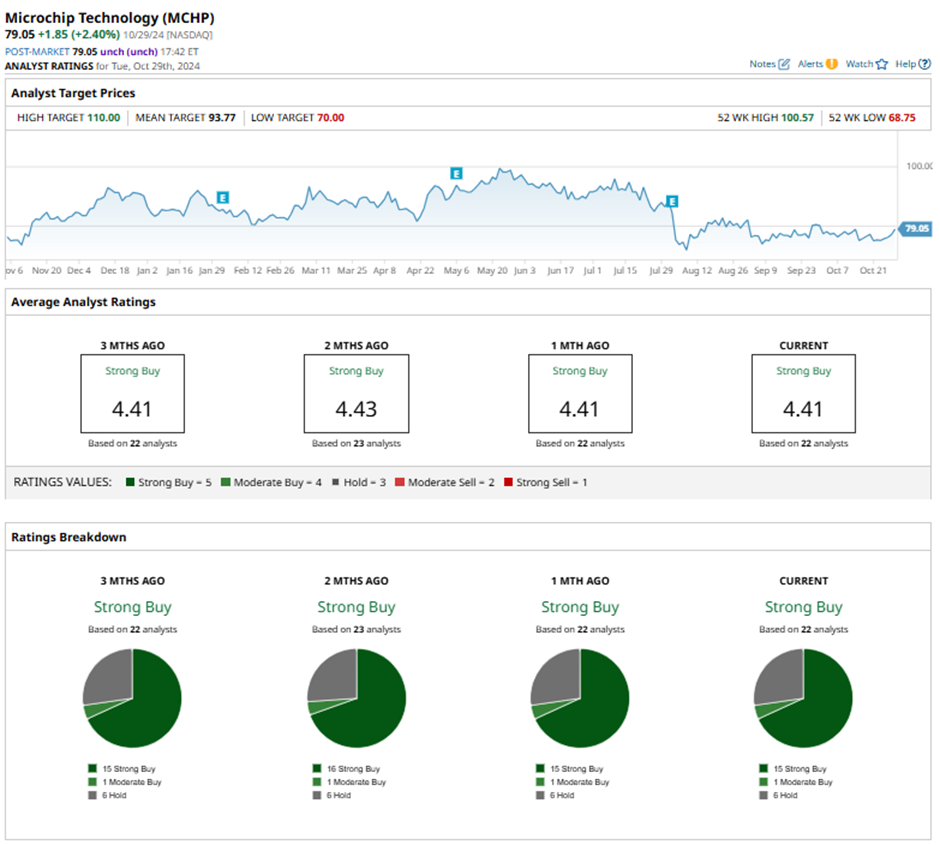

During this period, Microchip returned approximately $315.3 million to shareholders, comprising $242.6 million in dividends and $72.7 million through strategic share repurchases. This action underscores the company’s commitment to delivering value and its confidence in long-term growth. Looking ahead to Q2 of fiscal 2025, management anticipates net sales to be between $1.12 billion and $1.18 billion, with adjusted gross profit margins projected to be between 58.5% and 59.5%. Furthermore, net income is expected to range from $217.5 million to $252.4 million, equating to adjusted earnings per share of $0.40 to $0.46. On Wall Street, MCHP stock has earned a consensus “Strong Buy” rating. Out of 22 analysts covering the stock, 15 recommend a “Strong Buy,” one suggests a “Moderate Buy,” and the remaining six advise a “Hold.”The average analyst price target of $93.77 indicates an expected upside potential of 23% from current price levels. Semiconductor Stock #3: ON Semiconductor. ON Semiconductor Corporation (ON), based in Arizona, is a leader in integrated semiconductor products. It offers a wide range of functions such as power switching, signal conditioning, circuit protection, amplification, and voltage regulation. With a market cap of approximately $32 billion, ON’s groundbreaking power technologies are crucial for driving automotive electrification, enabling lighter electric vehicles (EVs), fast-charging systems, and sustainable energy solutions for solar, industrial power, and storage. While ON Semiconductor is still down 11.2% on a year-to-date basis, investors have responded positively to the company’s impressive quarterly earnings this week.

On October 29, shares of ON Semiconductor closed up more than 3%. Investors responded to Q3 results. The company generated $1.8 billion in revenue, exceeding Wall Street’s expectations. Adjusted EPS of $0.99 also topped estimates. ON Semiconductor has returned 75% of its free cash flow through stock buybacks in the past year, demonstrating its commitment to shareholders. In Q3, the Power Solutions Group (PSG) and Advanced Mobility Group (AMG) were key revenue contributors despite year-over-year declines. The Intelligent Sensing Group (ISG) posted an 11% sequential growth. By focusing on strategic investments and prudent financial management, ON Semiconductor kept its revenue stable amid industry headwinds, showing its resilience and shareholder-first approach.

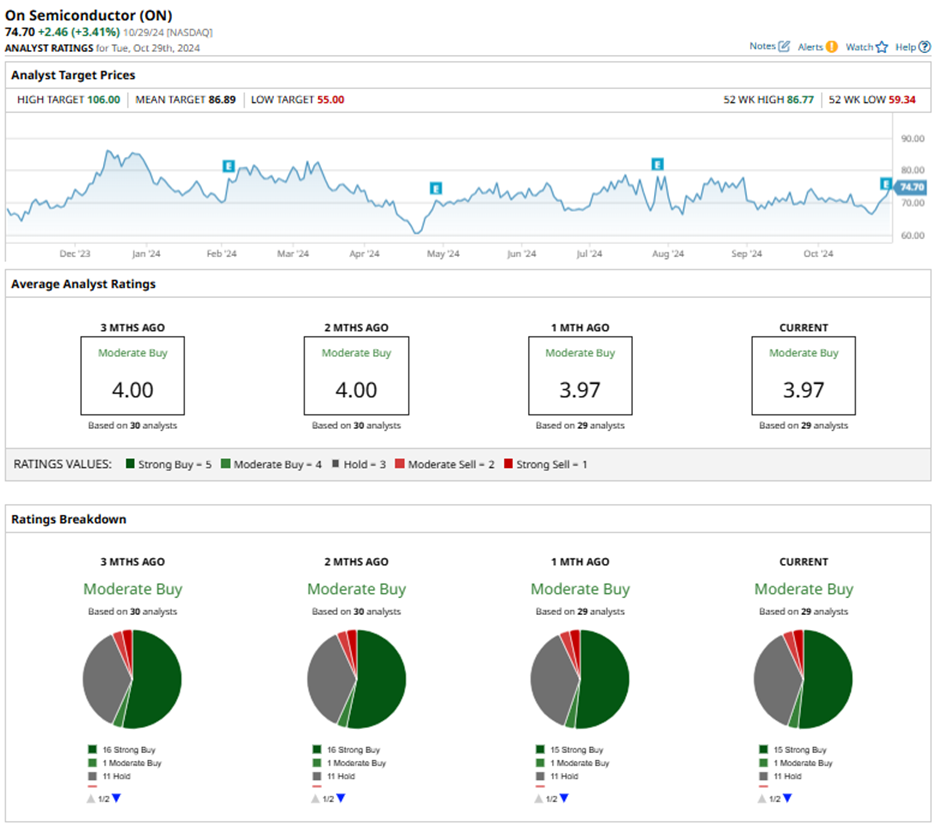

CEO Hassane El-Khoury, while reflecting on the company’s Q3 performance, said, ‘As power demands continue to rise across our key markets, and the need for greater efficiency becomes paramount, we are investing to win across the entire power spectrum to ensure that onsemi is best positioned to gain share in automotive, industrial and AI data center.’ Looking forward to the final quarter of fiscal 2024, management anticipates revenue to range between $1.71 billion and $1.81 billion. Gross margins are expected to range from 44% to 46% on a non-GAAP basis. Adjusted EPS is expected to land between $0.92 and $1.04. ON stock has a consensus “Moderate Buy” rating overall. Of the 29 analysts in coverage, 15 suggest a “Strong Buy,” one recommends a “Moderate Buy,” 11 maintain a “Hold,” one says it’s a “Moderate Sell,” and one has a “Strong Sell” rating.

Analysts have identified three semiconductor stocks that are currently favored in the market. The average analyst price target for these stocks is set at $86.89, which suggests a significant potential upside of 17.9% from the current trading prices.