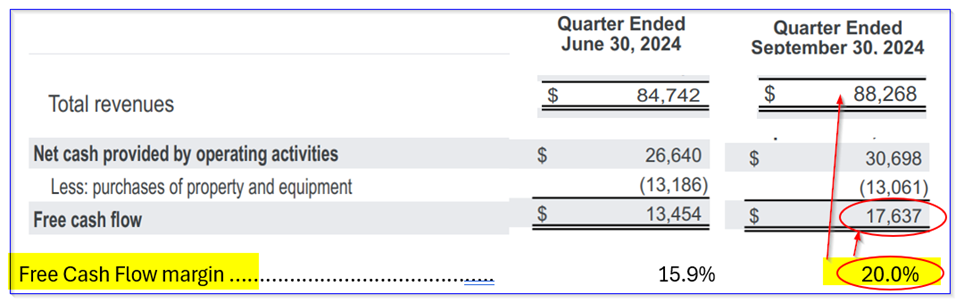

Alphabet Inc. (GOOG, GOOGL) has reported robust Q3 revenue and free cash flow (FCF) growth. On October 29, the company’s FCF margin dramatically increased to 20%, a significant rise from 16% in Q2. This substantial growth could potentially drive the value of GOOG stock to reach $3 trillion within the next year, with a per share value of $244, indicating a possible 40% increase.

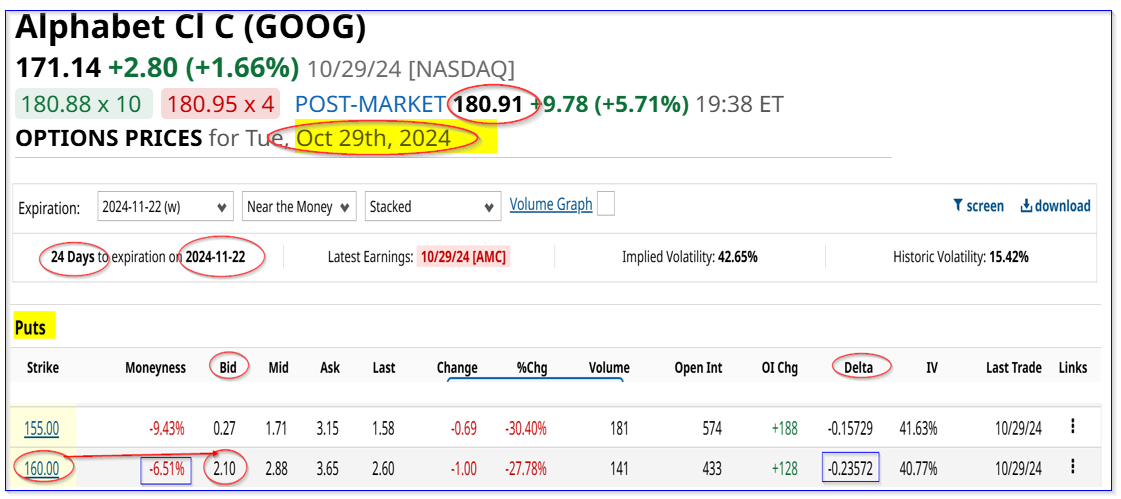

GOOG’s stock closed at $171.14 on Thursday, October 29. Post the market close, the stock value surged by +6.0%, exceeding $18 per share. In a recent Barchart article published on October 27, titled “What to Expect with GOOG Stock Ahead of Alphabet’s Upcoming Earning Release,” I predicted that if Alphabet’s Q3 FCF margins surpassed 16%, GOOG stock could experience an upward trend. My analysis suggested that any FCF result over $16 billion would be a bullish signal for GOOG stock.

Moreover, Barchart reports today that options for GOOGL and GOOG are trading in heavy volumes. GOOG options offer good income opportunities and buy-in target prices for cash-secured short-put options players. Alphabet reported a 15% year-on-year higher revenue at $88.3 billion in Q3. Its free cash flow (FCF) exceeded $17.67 billion, increasing the FCF margin for the quarter to 20% from almost 16% in Q2. The strong result was driven by a 13% year-on-year rise in Google Services sales, led by Google Search & Other, as well as Subscriptions, platforms, devices, and YouTube. Additionally, Google Cloud revenue rose 35% year-on-year. Its operating margins stayed strong at 32%, comparable to last quarter.

Alphabet’s Q3 free cash flow experienced a significant increase, jumping from $13.45 billion in Q2 to over $17.6 billion. Despite relatively flat capital expenditure (capex) spending, this surge indicates that Alphabet has managed to extract more cash savings and flow from its existing operations through higher revenue. This is the essence of operating leverage: higher revenue, stable costs, and stable capex spending can exponentially boost cash flow.

This increase in cash flow is expected to significantly impact Alphabet’s company value in the future. Analysts predict that Alphabet’s revenue will rise to $386.6 billion in the following year. If the company can maintain a free cash flow (FCF) margin of at least 19.5%, its FCF could reach $75.387 billion (calculated as 0.195 x $386.6 billion).

Furthermore, following the robust Q3 results, sell-side Wall Street analysts covering Alphabet’s stock may consider raising their revenue forecasts. This could provide investors with good income plays through options activity.

Alphabet’s Q3 free cash flow (FCF) has surged, which could significantly impact its market value. Assuming a conservative estimate of $75 billion in FCF for the next year, and using the average 2.5% FCF yield metric, Alphabet’s stock could potentially reach a market value of $3 trillion. This represents a 43% increase over Thursday’s closing market value of $2.086 trillion and a 35.7% increase over its after-hours market cap of $2.21 trillion. Consequently, GOOG stock could be worth 35.7% more than its current $180 stock price, equating to $244 per share.

Analysts are expected to raise their price targets in the coming week, which may contribute to further stock appreciation. In my previous article, I discussed a strategy to capitalize on this situation by selling short out-of-the-money (OTM) put options in nearby expiration periods.For example, shorting the $155 strike price put option expiring Nov. 15 was suggested. The premium has fallen from $2.00, providing a 1.29% yield to short-sellers, to just $1.25 today. Though it has made investors a good deal of money, the yield is now just 0.80% ($1.25/$155.00). For new investors, it makes sense to short the Nov. 22 $160.00 strike price put with a bid price of $2.10. This provides short-sellers a 1.31% immediate yield ($2.10/$160.00). GOOG puts expiring Nov. 22 – As of Oct. 29, 2024. Moreover, this play works best for existing investors as they make money by selling the OTM puts and if GOOG stock keeps rising. After all, GOOG stock looks very attractive for value investors over the next year as shown. This could be attracting investors in heavy options activity as reported by the Barchart Unusual Stock Options Activity Report.