Valued at $43.4 billion by market cap, Monolithic Power (MPWR) is a semiconductor stock. The company designs, develops, and sells semiconductor-based power electronic solutions for markets like computing and storage, automotive, industrial, and communications. It provides direct current to integrated circuits (ICs) that control voltages in various electronic systems and devices. The company also offers lighting control ICs used in systems providing the light source for LCD panels in computers, car navigation systems, TVs, and more. Monolithic Power went public in November 2004 and has returned 9,200% to investors. If we adjust for dividend reinvestments, cumulative returns are closer to 10,350%. Artificial intelligence and machine learning concept – by amgun via iStock.

Monolithic Power’s robust performance is attributed to its significant revenue and earnings growth. From $628 million in 2019, sales have skyrocketed to $1.8 billion by 2023, reaching $1.9 billion in the last 12 months. Concurrently, its free cash flow has surged from $120 million in 2019 to an impressive $630 million in the past year.

Despite MPWR stock outperforming broader markets, the company’s forthcoming earnings report, scheduled for Wednesday, Oct. 30, post-close, will be pivotal in influencing the stock’s short-term trajectory.

What can investors anticipate from Monolithic Power for Q3 of 2024? The company is strategically positioned to benefit from the escalating demand for AI-driven technologies. It has demonstrated its prowess in adopting advanced cooling mechanisms, which affords it a competitive edge over its peers.

Analysts tracking Monolithic Power anticipate it to report sales of $600.6 million and adjusted earnings of $3.97 per share in Q3 of 2024. In the year-ago period, it reported revenue of $475 million and earnings of $3.08 per share. Revenue is forecast to grow by 26.5%, and earnings growth is projected at 29% in the September quarter. During its last earnings call, Monolithic Power forecasted revenue between $590 million and $610 million for Q3, which was higher than the previous consensus revenue estimates of $550 million. Monolithic Power is experiencing strong demand from enterprises upgrading their cloud and network infrastructure to support artificial intelligence (AI) capabilities. Its enterprise data segment is the key driver of sales growth. In Q2, the business reported sales of $187.

Monolithic Power’s sales have shown significant growth, with the AI server market contributing $3 million, up from $48 million in the previous year. This segment now represents 37% of total sales, a substantial increase from the 8.6% recorded in 2020.

The company’s strategic focus on innovation and adaptability to market demands has allowed it to maintain a competitive edge during market turbulence. Monolithic Power’s strong balance sheet offers flexibility for future growth initiatives.

The expansion of the AI server market is a key driver for the company in 2024. Despite sluggish demand in its automotive business due to challenging macro conditions, Monolithic Power’s strong earnings growth supports a quarterly dividend of $1.25 per share for its shareholders, translating to a yield of 0.

Monolithic Power Systems’ (MPWR) stock has seen its dividend payouts increase by more than 25% on average over the past five years, with a current payout ratio of 45%. This suggests a continuation of dividend growth in the future.

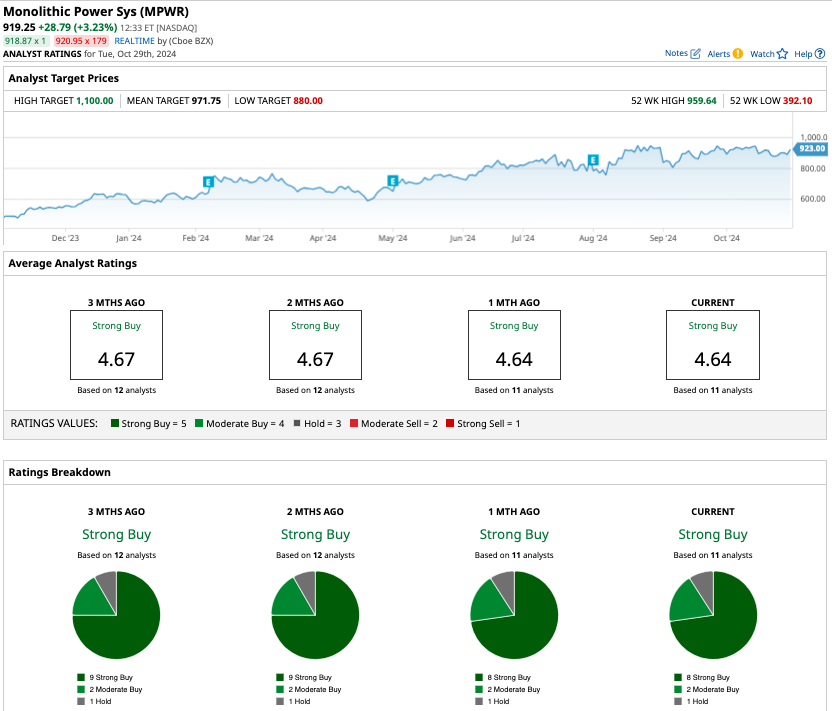

Out of 11 analysts covering MPWR, eight have a ‘strong buy’ recommendation, two suggest a ‘moderate buy,’ and one advises ‘hold,’ resulting in an overall ‘strong buy’ consensus. The average target price for MPWR is $971.75, with the highest forecast reaching $1,100. Wall Street anticipates a significant increase in Monolithic Power’s sales, from $1.8 billion in 2023 to $2.6 billion by 2025. The adjusted earnings per share are expected to grow from $11.78 to $17.40 during this period. Despite trading at a forward earnings multiple of 53, which is considered high, MPWR’s adjusted earnings are projected to grow by 25% annually through 2028.