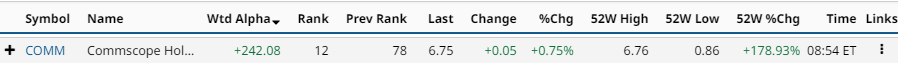

CommScope Holding Co. (COMM) experienced a significant rise in the Barchart Top 100 Stocks to Buy list on Monday, climbing 66 spots to reach the 12th position. The company’s weighted Alpha of 242.08 is 35% higher than its 52-week gain of 178.93%.

A stock’s weighted Alpha exceeding its 52-week percentage change often indicates that recent gains have been more substantial than those earlier in the year, suggesting strong momentum. While this doesn’t guarantee continued momentum, it may pique the interest of aggressive investors in considering COMM stock.

Despite my limited knowledge of CommScope, a review of its stock chart since its IPO in October 2013 (at $15) and over the past five years strongly suggests that its shares may have bottomed out.

The North Carolina company, CommScope Holding Co., dates back to 1961 when it was a division of Superior Continental Cable. It sold CATV systems and a coaxial cable called CommScope. The parent company was acquired by Continental Telephone Co. in 1967. Nine years later, the division became an independent company.

When I looked at its closing prices for the last year and saw that it hit an all-time low of 86 cents on May 1. I immediately thought a “reverse split” was in the cards. So did the investors commenting on Layoff.com. On April 18, someone with the handle Bubs said, “Just voted on the CommScope Holding Company proposals for the shareholder meeting. I encourage all to do so!” It seems to have battled back, up 705% in the six months since the all-time low. What’s up with that?As I mentioned earlier, CommScope was taken public in 2013. In 2011, it was acquired by The Carlyle Group (CG). In April 2019, CommScope acquired Arris International, the maker of set-top cable boxes and modems, for $7.4 billion including debt assumption. This appears to be where CommScope’s troubles began. According to S&P Global Market Intelligence, in 2013, the year CommScope went public, its total debt was $2.51 billion. In 2015, due to the $3.0 billion acquisition of TE Connectivity’s (TEL) Broadband Network Solutions business providing fiber optic and copper connectivity for wireline and wireless networks and small-cell distributed antenna system (DAS) solutions for the wireless market, its debt jumped to $5.24 billion. In 2019, after acquiring Arris, its total debt reached $10.

CommScope Holding Co.’s Altman Z-Score, which predicts the likelihood of bankruptcy proceedings in the next 24 months, is -0.27, suggesting a possibility. Its current total debt is 9.2x its EBITDA. In 2013, the multiple was 3.7x. In the latest 12 months through June 30, it paid out $677 million in interest, more than 3x of what it paid out in 2013. Its financial situation is poor and it traded below $1 in April. The company reported Q2 2024 results in early August that beat analyst expectations on the top and bottom lines. Revenue was $1.39 billion, $180 million higher than the Wall Street estimate. On the bottom line, it earned 34 cents, while analysts expected a three-cent loss.

In a potentially frothy market, stocks that exceed earnings expectations, like CommScope, often experience a significant surge, attracting speculators and meme-stock investors.

Despite a 17% decline in core net sales in Q2 2024 compared to Q2 2023, CommScope’s adjusted EBITDA rose by 19.5% to $302.1 million, and its adjusted earnings per share doubled from 17 cents to 34 cents.

The Connectivity and Cable Solutions (CCS) segment is pivotal to CommScope’s future growth. CEO Chuck Treadway highlighted in the Q2 2024 press release, “We are pleased with our CCS performance as datacenter and GenAI were strong drivers of growth. We are well positioned to take advantage of what we believe to be a multi-year growth cycle in this business.”

This segment contributed 57% of the company’s adjusted EBITDA in the second quarter.

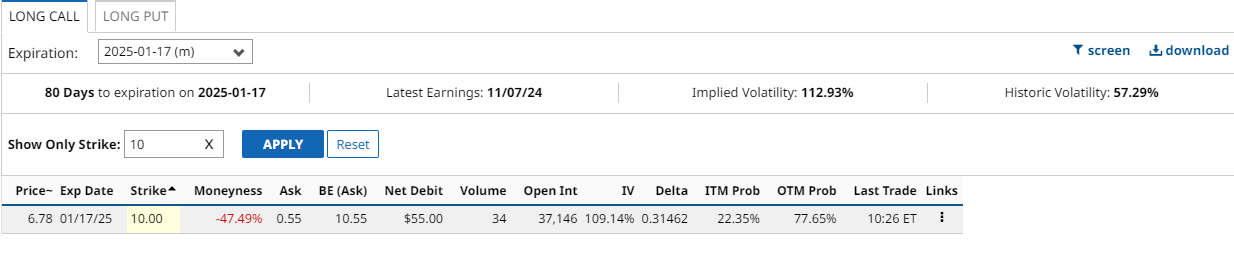

In July, CommScope Holding Co. agreed to sell its OWN (Outdoor Wireless Networks) and DAS (Distributed Antenna Systems) businesses for $2.1 billion. The deal is expected to close by June 2025, with $1.27 billion in debt due. This sale helps reduce its total debt. Excluding the divisions to be sold, its adjusted EBITDA in 2023 was $725 million. The company expects 2024 full-year adjusted EBITDA of $750 million at the midpoint of its guidance. In the second quarter, there is a small gain of 3-4% over 2023, but an increase nonetheless. Given the above two points, the 705% jump seems justified. However, the next 705% ($47.59%) won’t be nearly as easy. It has never traded that high, although it came close in 2017. If you’re an aggressive investor, I like this call option expiring in 80 days.

CommScope Holding Co.’s recent movement in the top 100 stocks has raised questions about whether it’s a good time to invest. Here are three reasons to consider the Jan. 17/2025 $10 call option:

1) It requires only a 5.5% investment of your own money to secure the right to purchase 100 shares.

2) If the stock appreciates by $1.75 (25.8%) before the option expires, you can potentially double your money by selling it.

3) There is ample time to recover from any negative impact should the company’s earnings report on November 7th be unfavorable.

However, for risk-averse investors, it’s best to avoid this investment altogether.