Join me for a free grain webinar every Thursday at 3pm Central. We’ll discuss supply, demand, weather, and analyze the charts. Sign Up Now!

Commentary:

The current pace of grain production is approximately 100 million bushels below the mark, but this gap can close rapidly if Brazil’s weather reverts to hot and dry conditions.

On the other hand, if the growing season in South America remains mild without significant weather threats, ending stocks will not drop below 500 million bushels, a level that is considered excessively high in relation to comfortable stock-to-usage ratios.

The corn balance sheet has been gradually diminishing due to an aggressive export pace to Mexico and ‘Unknown Destinations.’ Despite this, the demand is offset by a growing 24/25 corn crop that expands with each monthly supply and demand report from the USDA.

While I believe that corn export demand will eventually prevail, this triumph may not materialize until well after the harvest season. There are many uncertainties and variables at play, but for those who store corn or beans, I recommend considering the following hedge trades.

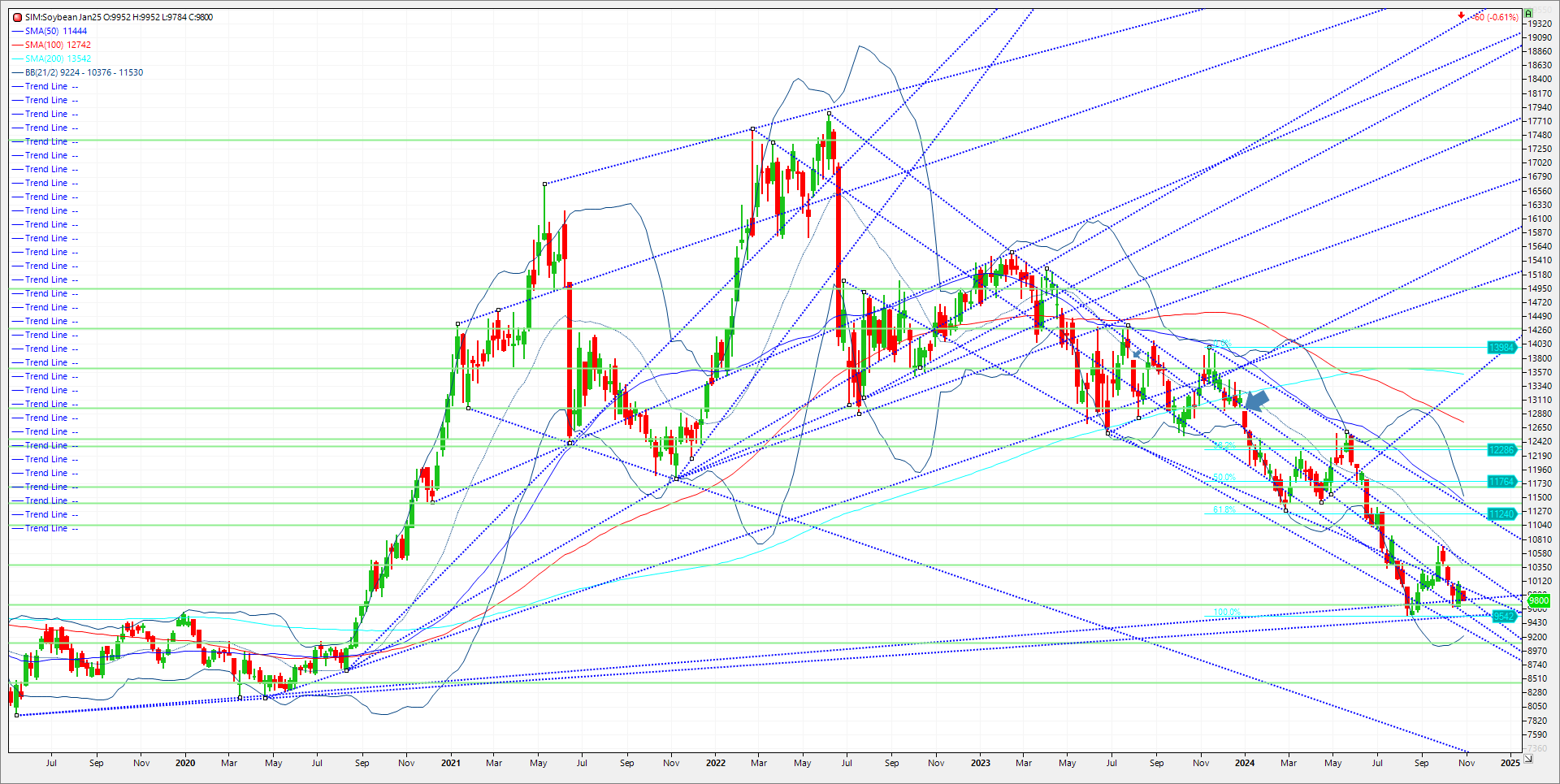

My strategy involves locking in $10.00 in beans out to late February using March 25 options. For beans, I am selling 40 cent wide put spreads at 38 cents with a max loss of 2 cents. This is done to finance and put a floor at $10.00 long puts until late February 2025. Basis March 2025 soybeans, buy the March 10. For corn, lock in $4.50 out to late April using May 2025 options. I suggest different months for corn. Buy the May 450 puts. Sell the Dec 25 530/500 put spread for 25 cents. I am trying to finance the May 450 puts at even money by selling the put spread further out on the calendar. This gives the opportunity long term to buy back the put spread cheaper from where I sold it, and at the same time locking 450 on the May 25 board for what one might have unpriced in the bin.

00 put is 38 cents. Sell the 1160/1200 put spread for 38 cents.

Risk: The maximum risk here is 40 cents or 2K per spread plus all trade costs and fees.