The surge in investment in artificial intelligence (AI) infrastructure and its deployment across various industries has led to new highs for companies in the AI space. Palantir Technologies (PLTR) has been one of the top performers, experiencing significant growth. Year-to-date, Palantir’s stock has increased by 161.7%, and over the past 52 weeks, it has risen nearly 200%.

The rapid rise in Palantir’s stock is primarily driven by the strong demand for its AI Platform (AIP), which continues to attract more clients and boost revenue. Over recent quarters, Palantir’s revenue growth has been consistently increasing, benefiting from the higher adoption of AI in the enterprise software segment.

Palantir has achieved notable revenue expansion while increasing its adjusted operating margin, reflecting solid underlying unit economics. However, despite the excitement around Palantir’s prospects in AI, Wall Street analysts are cautious about PLTR stock ahead of its third-quarter (Q3) earnings report and see significant downside potential. Let’s explore the factors that could impact Palantir’s Q3 financials and share price. Palantir will release its Q3 earnings after the close on Monday, Nov. 4. The company’s leadership remains optimistic and expects the momentum to carry through the third quarter. Palantir’s management forecast Q3 revenue of between $697 million and $701 million, reflecting a year-over-year increase of about 25-26%.

Palantir has demonstrated accelerating revenue growth over the past four quarters. It began with a 17% increase in Q3 of 2023. The growth rate then rose to 20% in Q4, 21% in Q1 of 2024, and 27% in Q2. Although the Q3 forecast indicates a slight moderation in growth, this outlook might be conservative considering the solid momentum in Palantir’s business, especially within its U.S. commercial segment. Palantir’s U.S. commercial business has gained significant traction mainly due to its AIP. This has been crucial in attracting new clients and expanding relationships with existing ones. The company’s customer base grew by 41% year-over-year in Q2, reaching 593 clients. This increasing customer base and robust growth from major clients could further drive revenue growth. In addition to commercial, the company’s government business is also showing solid expansion, led by the strong demand for its government software solutions.

Palantir’s deal pipeline provides a solid foundation for future revenue. As of Q2 end, it had $4.3 billion in total remaining deal value, a 26% year-over-year increase. Additionally, remaining performance obligations (RPO) grew by 41% year-over-year to $1.4 billion. Given the ongoing demand for Palantir’s solutions like AIP, these metrics are expected to rise, offering a solid base for future revenue growth.

Despite the current strength in Palantir’s business, there’s a chance it may exceed Q3 expectations and potentially lead management to revise full-year revenue guidance. In fact, during Q2, Palantir had already raised its 2024 revenue outlook to between $2.742 billion and $2.750 billion. However, despite the strong fundamentals and growth momentum, analysts have maintained a cautious stance on Palantir.Analysts are forecasting a 40% drop in Palantir Technologies Inc. (PLTR) stock prior to the release of its Q3 earnings report. The primary reason for this prediction is the company’s current valuation, which has risen significantly above that of its industry peers.

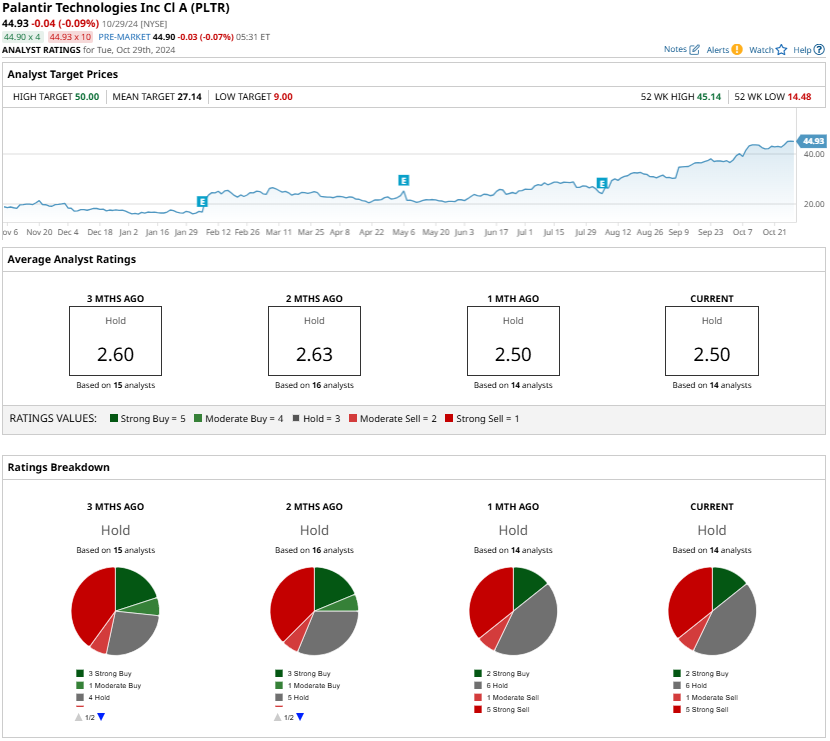

Palantir’s stock has experienced a year-long rally, resulting in the stock trading at elevated multiples. This has prompted analysts to assign a “Hold” rating to the stock. The average price target set by analysts is $27.14, suggesting a potential downside of nearly 40% from its current trading price. The high valuation has sparked concerns that even a minor miss in revenue or a deceleration in growth could trigger a sharp decline in Palantir’s stock price. The forthcoming Q3 earnings report is crucial for determining the trajectory of PLTR stock. If Palantir can maintain its growth and increase its annual guidance, it may help to mitigate some of the concerns regarding its valuation. Conversely, any indication of a slowdown could result in a substantial decrease in the stock price, aligning with analysts’ worries about its current valuation.Despite Palantir’s robust fundamentals and the potential benefits from the growing trend of AI adoption, investors are advised to carefully consider the associated risks.

A high valuation implies that there is a limited room for error. The company’s performance in Q3, particularly its ability to meet or surpass market expectations, will be crucial in determining whether Palantir can sustain its upward trajectory or experience a substantial market correction.