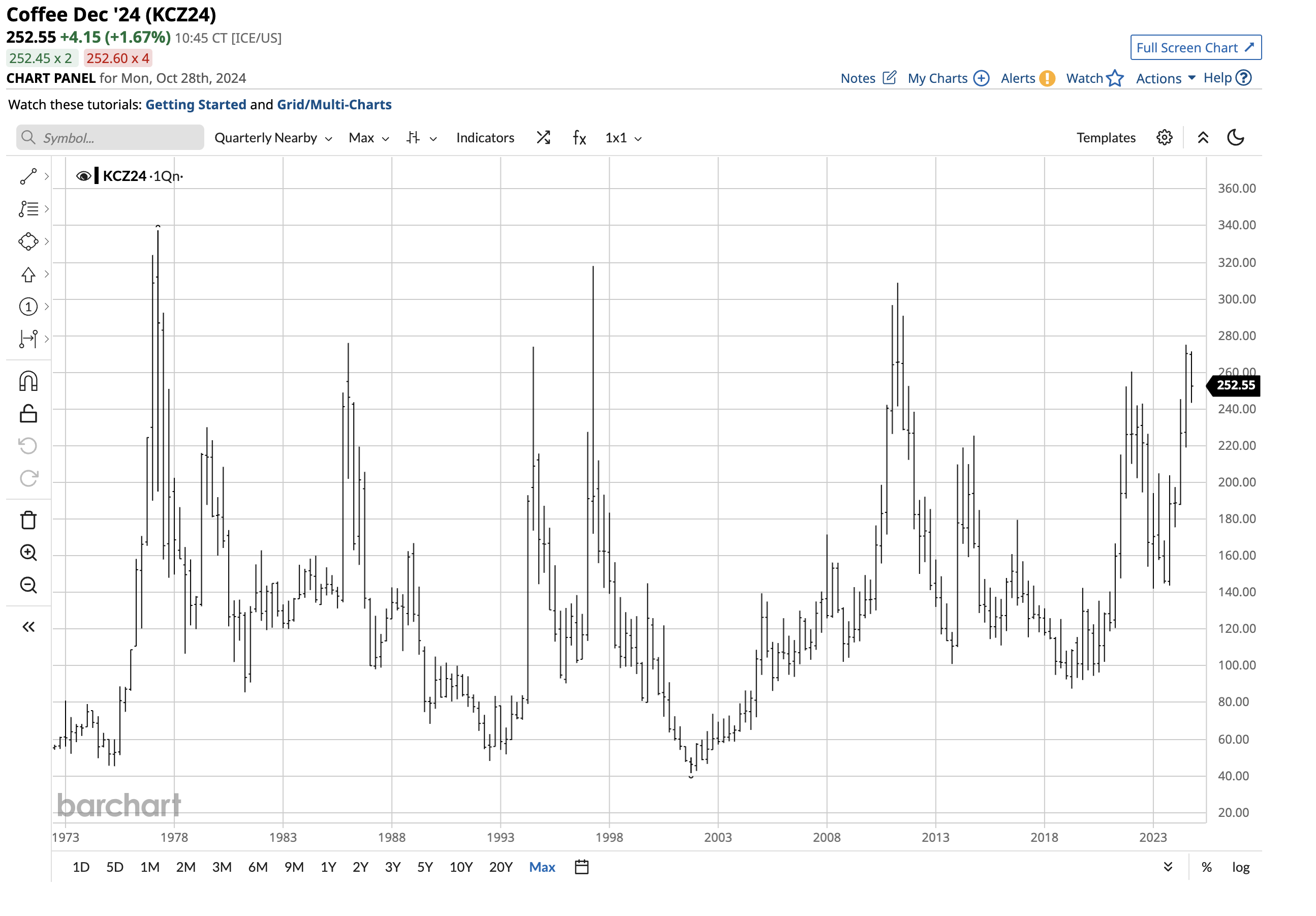

Arabica coffee futures emerged as the top-performing soft commodity in Q3 2024, showing an impressive 18.04% increase. Over the first nine months of 2024, ICE Arabica coffee futures saw a significant rise of 43.52%.

In a Barchart article dated September 6, 2024, discussing the price action in the Arabica coffee futures market, it was noted that Arabica coffee futures have rebounded close to their February 2022 highs. A breakthrough above the $2.6045 technical resistance level could potentially drive coffee futures to test the $3 per pound mark for the fourth time.

As of September 6, December ICE Arabica coffee futures were trading at $2.3890 per pound. Although prices experienced a brief surge in late October, they have since retreated from the recent September 2024 peak of just over $2.75 per pound.

Arabica coffee futures continue to exhibit a bullish trend, indicating positive market sentiments and potential for further growth.

ICE Arabica coffee futures reached a high of $2.

In September 2024, Arabica coffee futures reached a high of $2.7505 per pound, marking a significant increase from the May 2019 low of 87.60 cents per pound. This bullish trend, as seen in the ten-year chart, has more than tripled the price of this soft commodity.

The twenty-year chart reveals that this recent high is the highest price since September 2011.

Supply concerns have been driven by Brazilian growing conditions. The country’s adverse weather conditions, including the worst drought in seven decades and above-average temperatures, have impacted coffee production.

These conditions have also affected other commodities, with sugar and frozen concentrated orange juice prices rising due to Brazil’s leading position in global free-market sugar and orange production.

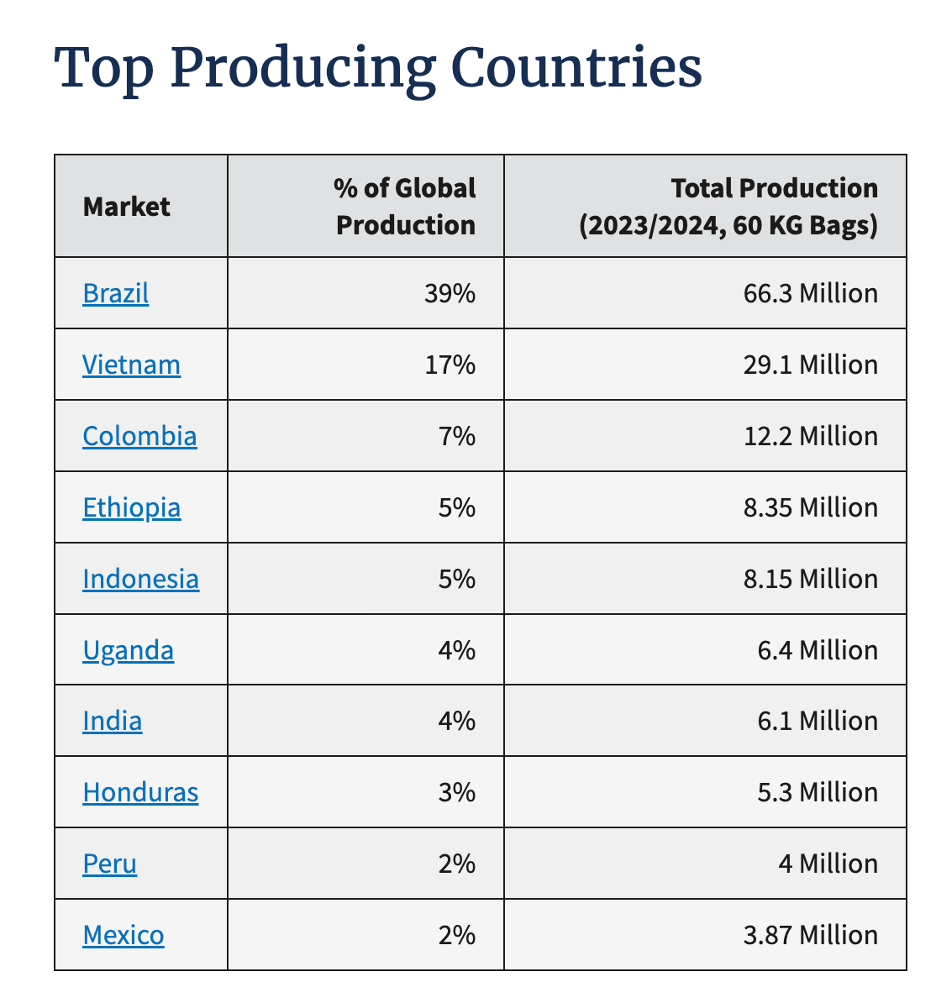

The global coffee market is largely influenced by the production and export dynamics of Brazil, which accounts for 39% of the world’s annual coffee bean supplies, making it the leading producer and exporter. Following Brazil is Vietnam, contributing 17% to the 2023/2024 coffee production, with a specialization in Robusta beans.

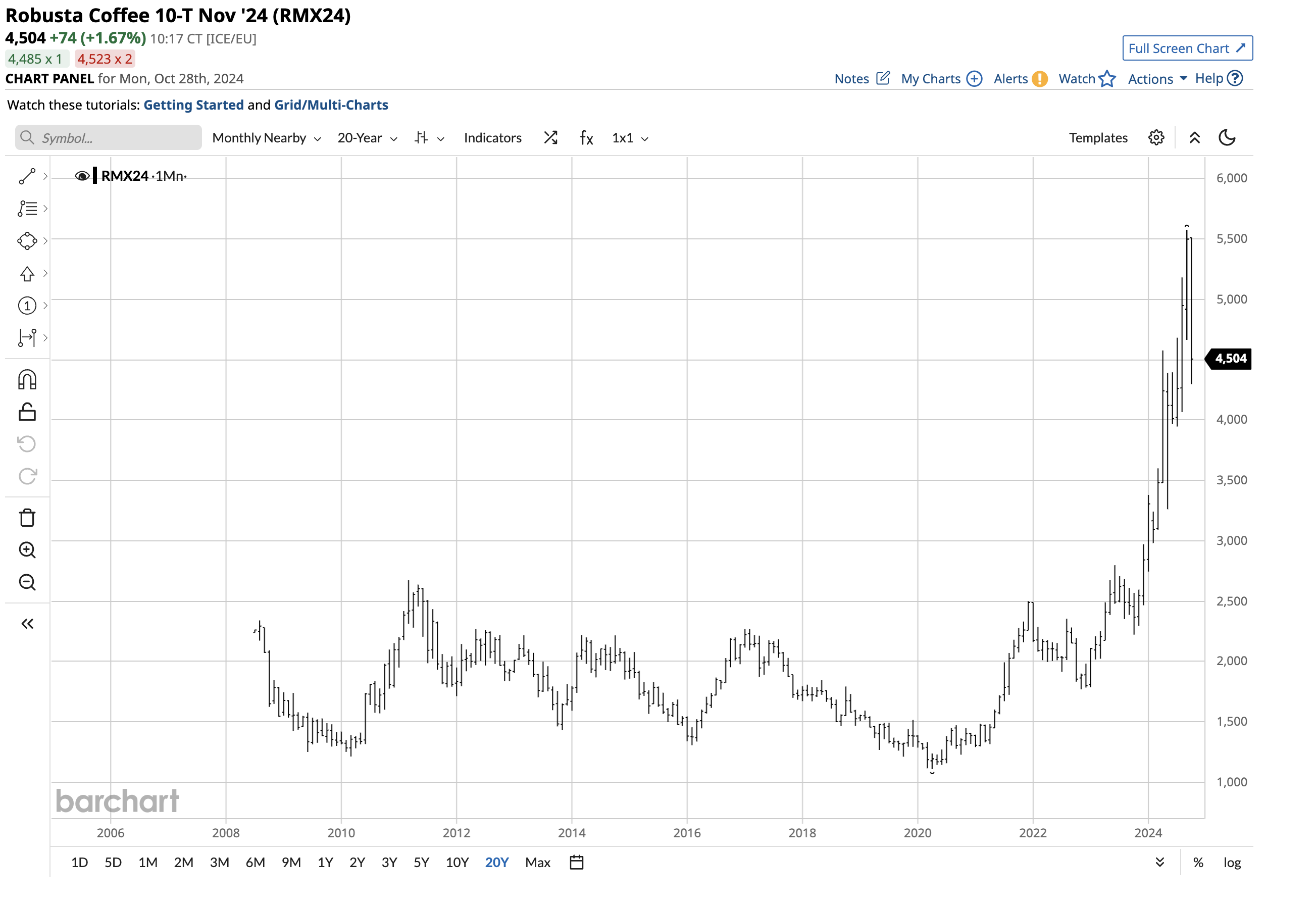

As per the USDA chart, ICE Arabica coffee bean futures reached their highest price in thirteen years in September 2024. Concurrently, ICE Robusta bean prices hit record highs. The long-term chart of ICE Robusta coffee bean futures in Europe shows a significant rise to $5,575 per metric ton.

Arabica futures saw an increase of 18.04% in Q3 and a 43.52% rise over the first nine months of 2024. In contrast, Robusta futures posted an over 37% gain in Q3 and a 93.5% increase over the first three quarters of 2024. Despite closing September and Q3 at $5,498 per ton, Robusta futures have moved lower in early Q4 but remain above $4,500 per ton.

The upside target in the ICE Arabica coffee futures market is $3 per pound. The long-term chart dating back to the early 1970s reveals that the price exceeded $3 per pound in 1977, 1997, and 2011, creating a series of slightly lower highs from the 1977 record high of $3.3750. In 2024, cocoa reached a new all-time high, surpassing its 1977 record peak. Frozen concentrated orange juice futures also hit the highest price in history last month. If Brazilian coffee bean production keeps declining and the weather is uncooperative, Arabica prices could follow Robusta prices and soar to new all-time highs above $3, challenging the 1977 $3.3750 per pound peak. For instance, if cocoa is taken as an example, the price exploded to more than double the previous 1977 high this year and remains above the pre-2024 high in October 2024.

With the cessation of the NIB ETN product in June 2023, market participants seeking exposure to coffee prices are left with limited options. The primary avenue for such investors is the futures market.

Arabica coffee futures and options are traded on the Intercontinental Exchange in the U.S., while Robusta futures and options are traded on the Intercontinental Exchange in Europe. These futures involve leverage and margin requirements, which can amplify the associated risks. The year 2025 is anticipated to be particularly volatile for coffee prices, potentially following the trend of cocoa prices. If the Arabica futures surpass the $3 target, coffee prices could soar significantly, as the agricultural commodity is heavily dependent on Brazilian supplies. Historically, coffee prices have experienced significant fluctuations; for instance, prices in Q3 were at $2.7505 per pound, which is three times higher than the May 2019 low. This potential for even higher peaks poses a clear and present risk to coffee consumers globally in the coming months.