The world is on the brink of entering the ‘Age of Electricity,’ a period where demand for electricity has surged past any other energy source and is expected to continue growing rapidly, as per the International Energy Agency’s (IEA) World Energy Outlook.

IEA Executive Director Fatih Birol stated, “Historically, we’ve seen the Age of Coal and the Age of Oil – now we are swiftly transitioning into the Age of Electricity, which will shape the global energy system in the future.”

Key highlights from the report include:

The ‘Age of Electricity’ is dawning on Wall Street, marking a significant shift in the investment landscape. The International Energy Agency (IEA) reports an annual increase in electricity demand equivalent to Japan’s entire annual consumption. This growth is propelled by several factors: the transition of industries and transportation to electric power, a surge in demand for cooling solutions, and the rapid expansion of data centers necessary for artificial intelligence (AI) applications.

Climate change further exacerbates this trend. The combination of rising incomes and increasing global temperatures is expected to create over 1,200 TWh of additional global demand for cooling by 2035. A case in point is India, where air-conditioning sales doubled following a series of intense heatwaves this year. Turning our focus to the United States, the U.S. electricity demand remained stable during the economic expansion of 24% in the 2010s. However, this is poised to change. According to energy consultancy Wood Mackenzie, the U.S. electric utility industry has been caught off guard by this impending surge in demand.According to a recent report, electric demand is projected to increase annually from 4% to as much as 15% in some regions by 2029, equivalent to a total capacity of 25 gigawatts (GW). The main driver is data centers. Wood Mackenzie has identified 51 GW of new data center capacity announced since January 2023. The U.S. is already home to about 5,000 data centers, accounting for a third of the world’s total. According to the IEA, AI-focused data centers used 4% of generated electricity two years ago. Investment bank Barclays’ analysts project it to hit 6% in 2026 and as much as 12% by the end of the decade. In fact, we could see $1 trillion worth of data centers built in just the next five years! These data centers will be competing with a growing industrial sector, such as semiconductors, which are projected to add another 15 GW of demand.

Shifting activities like heating and transportation to electricity could add another 7 GW of demand. Needless to say, this will be a major challenge.

Chris Seiple, vice chairman of power and renewables with Wood Mackenzie, said in a statement: ‘In most industries, demand growth of 2% to 3% per year would be easily managed and welcomed. In the power sector, however, new infrastructure planning takes five to 10 years, and the industry is only now starting to plan for growth.’ He added that ‘the last time the U.S. electricity industry saw unexpected new demand growth like this was during World War II.’ Between 1939 and 1944, manufacturing output tripled, and electricity demand rose 60%. So we have a ‘power problem’ here in America. And it’s a problem without a simple solution. GE Vernova. In addition to the data center build-out, America has an aging power grid – one not set up for the rigors of this new demand, and certainly not one ready to handle the rigors of more frequent extreme weather events.The dawn of the ‘Age of Electricity’ on Wall Street presents an almost ideal scenario for one company: GE Vernova (GEV).

Formerly a part of General Electric, GEV is now a global leader in the electric power industry. The company specializes in products and services that generate, transfer, control, convert, and store electricity. GEV’s mission is to design, manufacture, deliver, and service technologies aimed at creating a more reliable and sustainable electric power system, thereby enabling electrification and decarbonization.

Vernova’s installed base is responsible for generating approximately 30% of the world’s electricity, a testament to its significant impact on the industry. Raymond James Managing Director Pavel Molchanov aptly describes the company as a power industry ‘supermarket.’

GE Vernova’s power segment is predominantly its gas power business. With a long-standing history in gas turbines and the largest installed fleet globally, GEV is well-positioned to capitalize on the growing demand for electricity.

The ‘Age of Electricity’ is dawning on Wall Street, and this is the best stock to buy. The company’s electrification segment includes grid equipment such as power conversion, switchgear, transformers, and grid automation offerings.

In the third quarter, the company reported strong order growth for gas power and electrification, slightly offset by additional costs linked to its offshore wind backlog. This year is set to be an inflection point for gas power orders, with HA-turbine orders reaching 21 units year-to-date, compared to eight in 2023. Management anticipates a slight increase in gas power orders year on year for 2025. These turbines are designed to reduce carbon emissions and support flexible power generation needs.

The company’s electrification orders saw a 17% increase year on year in the quarter, with sustained demand for switchgear and transformers. The segment’s EBITDA margins reached 10%.

The world is poised to enter the ‘Age of Electricity’. According to the International Energy Agency’s (IEA) recently released World Energy Outlook, demand for electricity has grown more rapidly than any other energy source and is set to accelerate further. Fatih Birol, the IEA executive director, stated, ‘In energy history, we’ve seen the Age of Coal and the Age of Oil – and now we’re rapidly moving into the Age of Electricity, which will shape the global energy system going forward.’ Here are some key points from the report: Between 2010 and 2023, electricity demand grew by 2.7% annually, while overall energy demand increased by 1.4%. In the next 10 years, electricity demand will grow at a rate of 3% per year – six times faster than overall energy demand. From 2023 to 2035, the world’s electricity demand will increase by 2,200 terawatt-hours (TWh), representing a 6% overall increase.

The IEA stated that the growth in electricity demand, equivalent to adding Japan’s annual electricity demand to grids each year, is driven by the shift in industry and transport to electric power, increased demand for cooling, and the proliferation of data centers needed for artificial intelligence (AI). Climate change is also a factor, as rising incomes and increasing global temperatures will generate more than 1,200 TWh of extra global demand for cooling by 2035. For instance, in India, air-conditioning sales doubled after a series of brutal heat waves this year. The power demand story is similar in the United States. In the 2010s, the U.S. economy expanded by 24%, but electricity demand remained steady. However, this is about to change, and ‘the U.S. electric utility industry has been caught flat-footed,’ according to the energy consultancy Wood Mackenzie.

The recent report projects that by 2029, electric demand in some regions will increase annually from 4% to as much as 15%, equivalent to a total capacity of 25 gigawatts (GW). The main driver is data centers. Wood Mackenzie has identified 51 GW of new data center capacity announced since January 2023. The U.S. is already home to about 5,000 data centers, accounting for a third of the world’s total. According to the IEA, AI-focused data centers used 4% of generated electricity two years ago. Investment bank Barclays’ analysts project that this will hit 6% in 2026 and as much as 12% by the end of the decade. In fact, we could see $1 trillion worth of data centers built in just the next five years! These data centers will be competing with a growing industrial sector, such as semiconductors, which are projected to add another 15 GW of demand.

Shifting activities like heating and transportation to electricity could add another 7 GW of demand. This will undoubtedly be a major challenge. Chris Seiple, vice chairman of power and renewables with Wood Mackenzie, stated: ‘In most industries, demand growth of 2% to 3% per year would be easily managed and welcomed. However, in the power sector, new infrastructure planning takes five to 10 years, and the industry is only now starting to plan for growth.’ He further added that ‘the last time the U.S. electricity industry saw unexpected new demand growth like this was during World War II.’ Between 1939 and 1944, manufacturing output tripled, and electricity demand rose 60%. So, there is a ‘power problem’ in America, and it’s a problem without a simple solution. In addition to the data center build-out, America has an aging power grid – one not set up for the rigors of this new demand and certainly not ready to handle the rigors of more frequent extreme weather events.

Add it all up, and GE Vernova (GEV) finds itself in almost ideal conditions. Formerly part of General Electric, it is a global leader in the electric power industry. Its products and services generate, transfer, control, convert, and store electricity. It designs, manufactures, delivers, and services technologies to create a more reliable and sustainable electric power system, enabling electrification and decarbonization. Vernova’s installed base generates around 30% of the world’s electricity. Raymond James Managing Director Pavel Molchanov describes the company as a power industry “supermarket.” GE Vernova’s power segment mainly consists of its gas power business. It has a long history in gas turbines and holds the largest installed fleet of gas turbines globally.

The company’s electrification segment comprises grid equipment such as power conversion, switchgear, transformers, and grid automation offerings. Its third-quarter earnings demonstrated strong order growth for gas power and electrification, though partially offset by additional costs related to its offshore wind backlog. This year is set to be an inflection point for gas power orders. HA-turbine orders have reached 21 units year-to-date, compared to eight in 2023. Management anticipates a slight year-on-year increase in gas power orders in 2025. These turbines are designed to cut carbon emissions and meet today’s flexible power generation needs. The company’s electrification orders rose 17% year on year in the quarter, as demand for switchgear and transformers remained sturdy.

The dawn of the ‘Age of Electricity’ on Wall Street presents a unique investment opportunity. Among the stocks, GE Vernova stands out as the best option to consider.

In the recent quarter, GE Vernova reported a 4% growth, with expectations of further expansion in 2025. The company’s robust orders signal a strong potential for continued revenue growth and profit margin expansion. EBITDA margins are anticipated to increase from under 6% in 2024 to over 13% by 2028, as GE Vernova capitalizes on its higher-margin backlog.

Currently, GE Vernova’s earnings are projected to grow at an average annual rate of 21% over the next five years. This growth rate implies that earnings could double in approximately 3.5 years. Given that share prices often mirror earnings, this offers investors a significant potential return on investment.

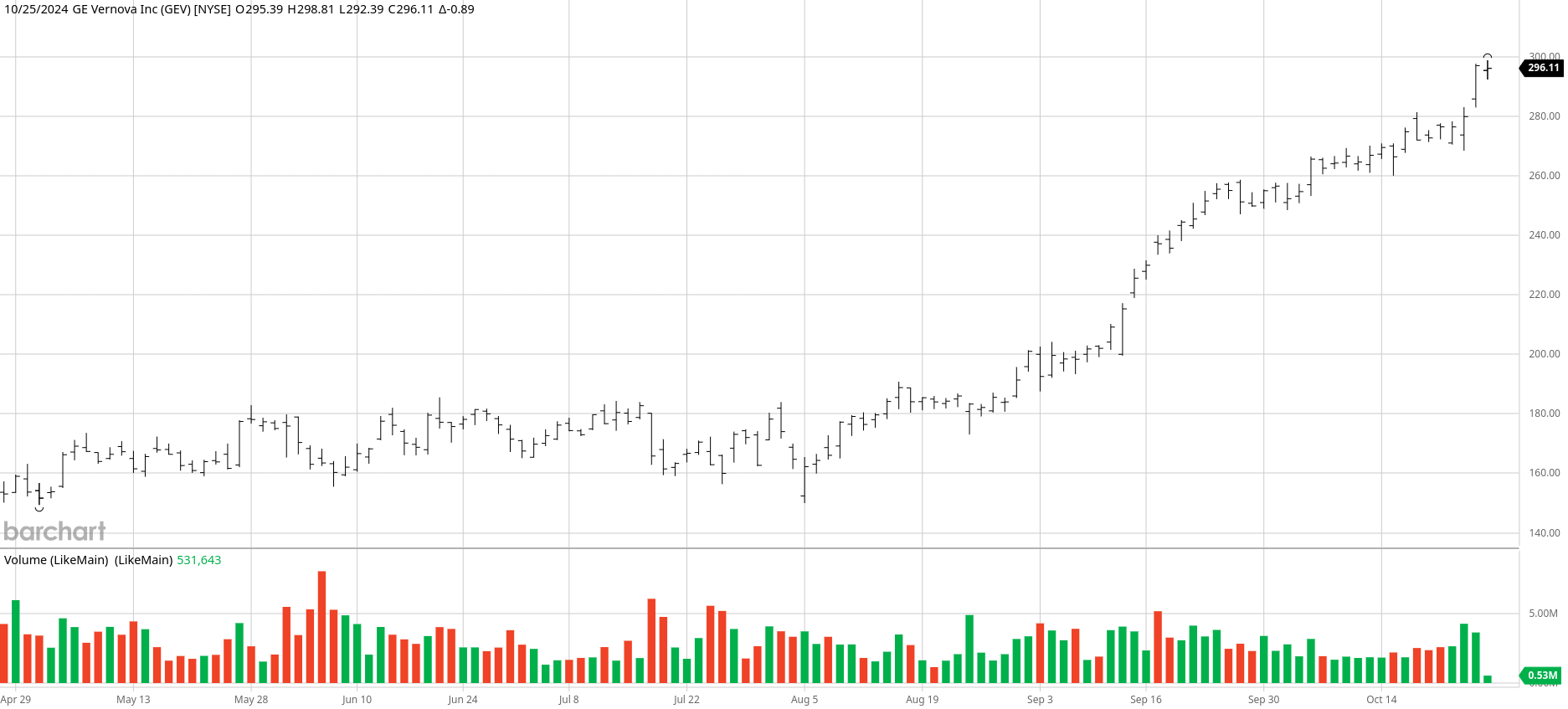

Despite the stock trading at around $140 in April and more than doubling in value since then, GEV remains a strong buy on any meaningful price pullback. Investors should consider purchasing GEV stock at any price below $307.