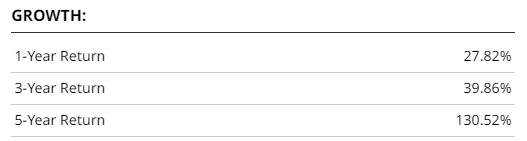

Equity traders frequently overlook seasonality (market cycles). Commodity traders, however, are well aware of the importance of seasonal patterns. Here’s an opportunity for equity traders to take advantage of a seasonal pattern in the corn market that has led to an astonishing 130% 5-year return for this company. Additionally, this company pays a dividend.

A well-known equity market axiom is ‘Sell in May and Come Back After Labor Day.’ For this article, we’ll modify it to ‘Buy in October and Come Back After Memorial Day.’

Commercial entities produce commodity products. There are many commodity products, but for this upcoming opportunity, we’ll focus on the seasonality of the corn market.

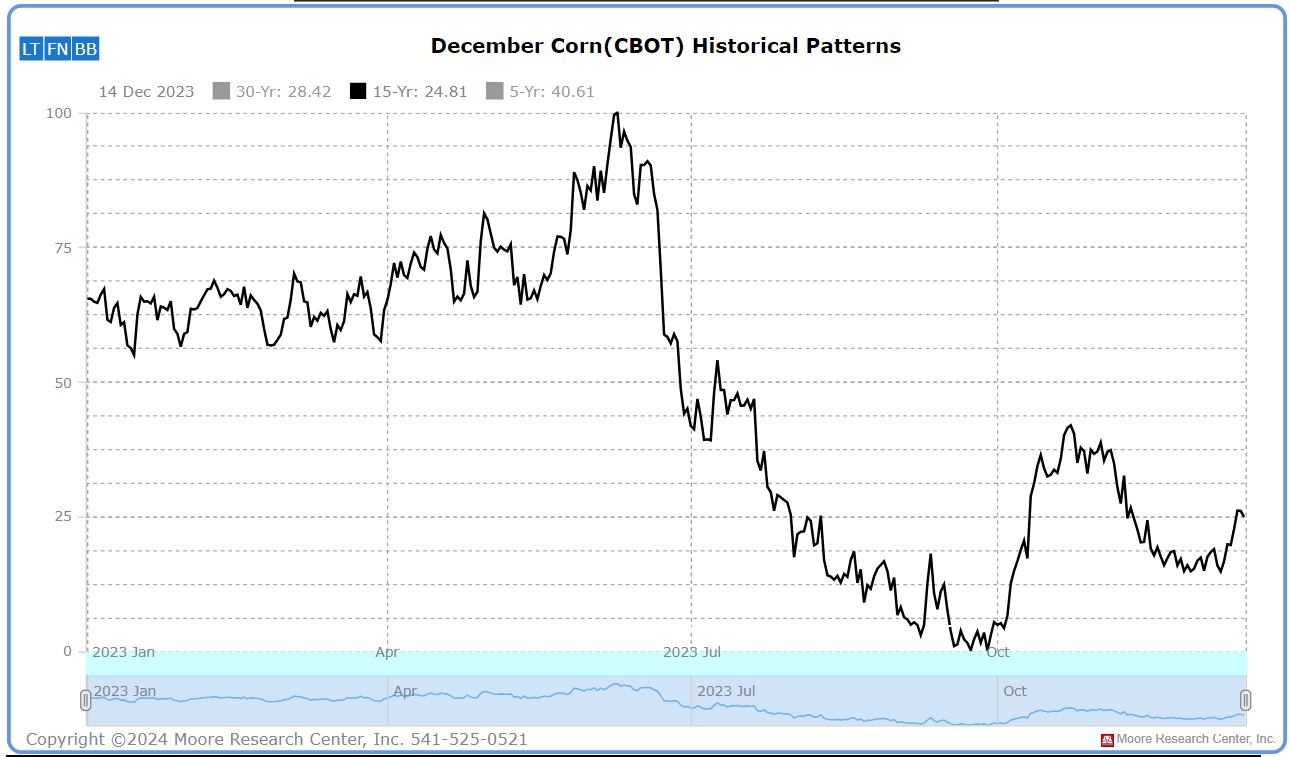

Source: Moore Research Center, Inc. (MRCI). The US is the world’s largest producer of corn. Corn is planted in spring and harvested in fall like clockwork every year. The previous chart is research from MRCI, showing the times when the price has been at a seasonal low and high (black line) during the past 15 years. It should be noted that although seasonal patterns can offer valuable insights, they should not be the only basis for trading decisions. Traders must consider other technical and fundamental indicators, risk management strategies, and market conditions to make well-informed and balanced trading choices. Corn historically reaches its seasonal high from late May to mid-June. As corn is used for livestock feed, exports, and ethanol production, prices rally as the supply is depleted throughout winter.

As the planting season concludes, commercial producers actively sell futures contracts to hedge against potential price declines due to the anticipated excess supply of corn in the fall. Historically, corn reaches its seasonal low price in late October, at the end of the harvest season, when supply peaks and prices are lower compared to the spring planting season.

At this juncture, corn producers can eliminate their spring hedges by repurchasing their short futures positions, offsetting the lower prices they receive when selling their grain to an elevator due to the oversupply.

Futures traders often leverage these seasonal patterns to pinpoint times of the year when a product may hit seasonal highs or lows, thereby gaining an advantage and increasing the likelihood of successful trades.

Traders can utilize the standard-size futures contract (ZC) or the mini-size (XN). Equity traders can trade the exchange-traded fund (ETF) named CORN.

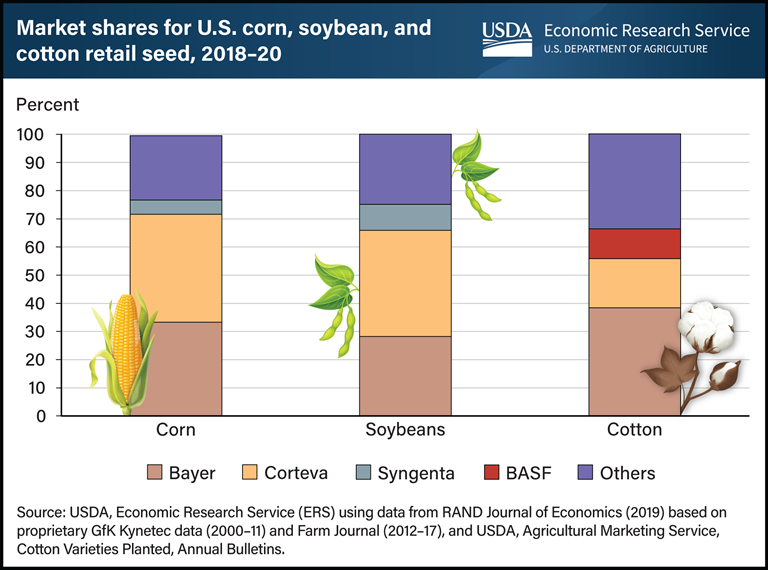

How does this present an opportunity for an equity trader? Futures traders will trade the corn contract and capitalize on the price movement of that product. Equity traders seeking a dividend and avoiding the financial risk of trading a physical commodity like corn would look for a stock with the same edge as the corn market. We discussed the spring planting season and how historically, corn prices are at their seasonal high. However, if planting occurs every spring, a trader should ask what is being planted that results in a consistent pattern of higher prices. Did you say corn seed? Exactly! If corn producers are planting every spring, they will need the seed to be planted, leading to the question of which publicly traded company sells the most corn seed in the US.Corteva, Inc. (CTVA), an agriculture products provider, is based in Indianapolis, IN. The company has been a leader in developing and supplying corn, soybean, and sunflower seed markets for nearly a century. Corteva Agriscience collaborates with farmers globally to enhance productivity and sustainability through seed products and management recommendations.

A key focus of Corteva is to increase yield potential, protect against diseases, pests, and weeds, and develop new solutions for food, feed, and fuel, benefiting both farmers and consumers. In terms of seed sales, corn seed constitutes 68% of Corteva’s revenue, while soybeans contribute 20%.

Corteva and Bayer are the dominant players in the U.S. seed market, controlling over half of the corn, soybean, and cotton seed markets. This positions Corteva as a strong investment candidate, especially after the corn harvest in October, when its dividend yields and potential for a 130% return over five years make it an attractive choice for investors.

CTVA is part of the S&P 500. The 52-week high is $61.21, and the 52-week low is $43.22. The average daily volume is around 2.8 million shares. 81.54% of the shares are institutionally owned. The daily CTVA shows a seasonal window from October to June for higher prices (green boxes). During this period, producers plan and purchase for their upcoming planting season needs. Thus, more demand for corn seed from CTVA seasonally increases its share price. In 2022 (red box), the seasonal pattern failed. Will CTVA rally into the spring planting season from the current price to the end of October? CTVA continues to grow and is currently in solid institutional hands. Institutions understand the correlation between corn planting and the seeds needed to plant.

Incorporating seasonality into an equity trading strategy can significantly enhance opportunities for those who look beyond traditional stock market cycles. This is especially true when considering companies like CTVA, which offer essential agricultural products.

The seasonal pattern in the corn market can provide a unique advantage for equity traders. By leveraging the historical patterns of corn planting and harvesting, a consistent buying and holding window for CTVA shares can be identified from October through Memorial Day. This period aligns with increased demand for corn seed as farmers prepare for the spring planting season.

While the seasonality pattern presents a compelling opportunity, it is crucial for traders to remain mindful of broader market conditions and to practice proper risk management. CTVA’s institutional support and consistent dividend payments make it an attractive option for equity traders seeking both growth potential and stability. Its position as a significant player in the corn seed market further solidifies its appeal.

Traders can incorporate this seasonal insight into a diversified strategy. By doing so, they may capitalize on this niche opportunity and enhance their portfolio with a company positioned to benefit from the agricultural cycle.