Summary: Carvana (CVNA) showcases strong technical indicators. It has a 100% technical buy signal, 327.59+ Weighted Alpha, and a 617.91% gain in the past year. The company’s e-commerce platform for used car trading has driven significant growth. Revenue is expected to increase by 21.90% this year and 16.00% next year. Analysts hold mixed views with 5 strong buy, 3 buy, 13 hold, and 2 sell ratings. Price targets range from $72 to $250. Despite volatility, Carvana’s long-term prospects seem favorable, with earnings projected to grow at a compounded annual rate of 67.90% over the next five years. The Chart of the Day belongs to on-line used car dealership Carvana (CVNA). The stock was found using Barchart’s powerful screening functions to identify stocks with the highest technical buy signals, highest Weighted Alpha, superior current momentum, and a Trend Seeker buy signal. Then, the Flipchart feature was used to review the charts for consistent price appreciation.

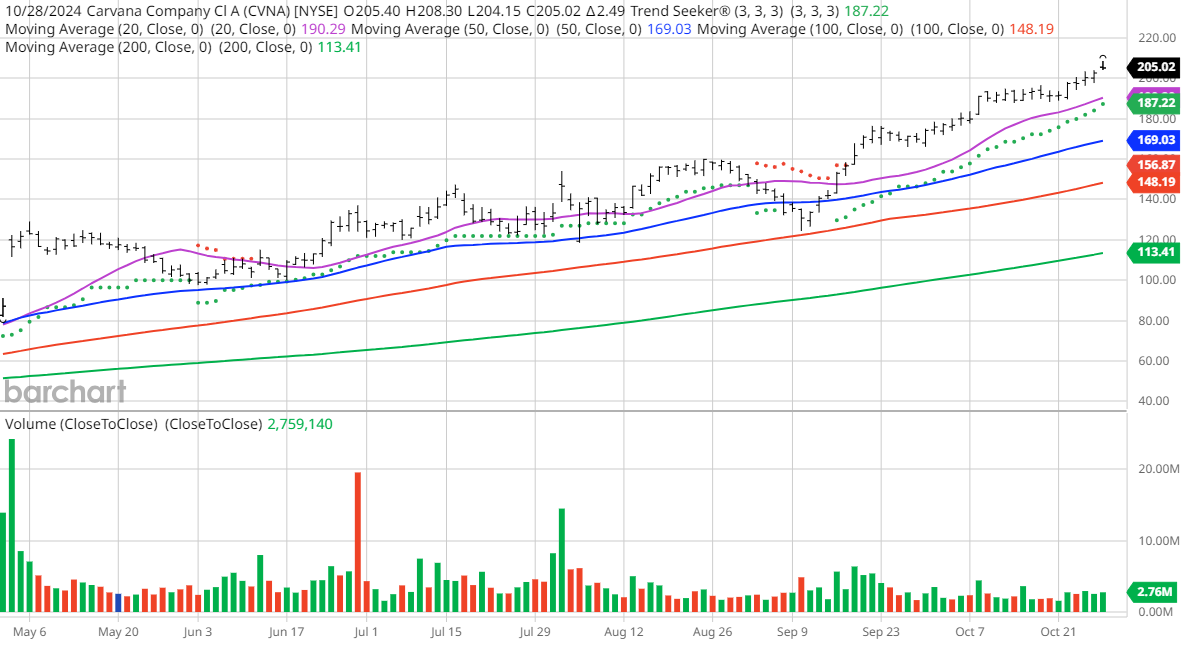

Carvana Co., founded in 2012 and based in Tempe, Arizona, operates an e-commerce platform for buying and selling used cars in the United States. Its platform enables customers to research and identify a vehicle, inspect it using 360-degree vehicle imaging technology, obtain financing and warranty coverage, purchase the vehicle, and schedule delivery or pick-up from their desktop or mobile devices. The company also operates auction sites. Since the Trend Seeker signaled a buy on 9/18, the stock gained 26.76%. CVNA Price vs Daily Moving Averages. Barchart’s Opinion Trading systems are listed below. Please note that the Barchart Opinion indicators are updated live during the session every 20 minutes and can therefore change during the day as the market fluctuates.

Barchart Technical Indicators show 100% technical buy signals. Weighted Alpha is 327.59+. There was a 617.91% gain in the last year. Trend Seeker buy signal is present. 3.44 – 60 month Beta. Above its 20, 50 and 100 day moving averages. 15 new highs and up 20.85% in the last month. Relative Strength Index is 79.56%. Technical support level at $198.53. Recently traded at $205.02 with 50 day moving average of $169.03.

Fundamental Factors: Market Cap is $41.02 billion. Revenue is expected to grow 21.90% this year and another 16.00% next year. Earnings are estimated to increase an additional 129.60% next year and continue to increase at a compounded annual rate of 67.90% for the next 5 years. Analysts and Investor Sentiment: Wall Street analyst gave 5 strong buy, 3 buy, 13 hold and 2 sell opinion on the stock. Analysts’ price targets are between $72 and $250. Value Line rates the stock its average rating of 3 with a price target of $165 or 20% below today’s close. Comment: “Long-term prospects for Carvana appear favorable, as its turnaround plan progresses.”CFRAs MarketScope rates the stock a hold. MorningStar gives the stock its average rating of 3 with a fair value of $181 or 11% overvalued. 27,520 investors monitor the stock on Seeking Alpha. Additional disclosure: The Barchart Chart of the Day highlights stocks that are experiencing exceptional current price appreciation. They are not intended to be buy recommendations as these stocks are extremely volatile and speculative. Should you decide to add one of these stocks to your investment portfolio, it is highly suggested you follow a predetermined diversification and moving stop loss discipline that is consistent with your personal investment risk tolerance and reevaluate your stop losses at least on a weekly basis.