Cathie Wood, CEO and CIO of ARK Investment Management, is a prominent figure in the investment industry. Recognized for her daring and innovative investments in companies like Tesla (TSLA), Block (SQ), and Robinhood (HOOD) before they were widely popular, Wood’s investment approach is anything but traditional.

Currently overseeing billions of dollars in assets, Wood’s flagship ETF, the Ark Innovation ETF (ARKK), boasts an AUM of approximately $5.7 billion. Her every move is closely watched by market participants, particularly when it involves her preferred stocks.

Recently, it was reported that Wood sold Tesla shares worth $22.22 million after the company’s historic post-earnings surge. This move by the maverick investor has sparked interest in her current investment choices, especially in the tech sector.

Tesla still holds a prominent position in Cathie Wood’s portfolio. It’s safe to assume her bullish long-term thesis on Tesla remains intact. So, where is Wood deploying fresh capital? More tech stocks, specifically mega-cap tech stocks. With the Magnificent Seven names in the spotlight during earnings season, let’s see what the maverick investor is buying. #1. Amazon. Founded in 1994, Amazon (AMZN) is a tech giant with interests in e-commerce, cloud services, artificial intelligence (AI), and streaming. Founded by one of the world’s richest people, Jeff Bezos, Amazon is also one of the most valuable companies in the world, with a market cap of $2 trillion. Notably, AMZN stock is up 22.9% year-to-date and accounts for 1.

Slated to report its Q3 earnings after the market closes tonight, Amazon reported its sixth consecutive quarterly earnings beat in Q2. EPS almost doubled to $1.26 from the prior year’s figure of $0.65, and it also came in higher than the consensus estimate of $1.03. Total net sales for the quarter were $148 billion, up 10.1% from the year-ago period. Over the past 10 years, the company has grown its revenue and earnings at impressive CAGRs of 22.14% and 73.38%, respectively. Cash flow activities from operations remained solid, with Amazon reporting net cash from operating activities of $25.3 billion, compared to $16.5 billion in the year-ago period. The company closed the quarter with a sizeable cash balance of $71.2 billion, much higher than its long-term debt levels of $54. Amazon accounts for 16% of Wood’s flagship Ark Innovation ETF.

Cathie Wood, known for her disruption-minded investment approach, is investing in three mega-cap tech stocks instead of Tesla. These stocks are Amazon, Microsoft, and Alphabet’s Google Cloud. Her bet on Amazon is not only due to its solid balance sheet, which is comparable to Tesla’s, but also because of Amazon’s dominance in high-growth markets.

Amazon Web Services (AWS) is a key factor in this investment, as it is a dominant player in the cloud infrastructure market with a 31% market share. This is a significant lead over Microsoft’s 25% and Google Cloud’s 11%. AWS is Amazon’s most profitable division, with Q2 2024 revenue reaching $26.3 billion, showing a 19% year-over-year growth. This division accounts for 17.8% of Amazon’s overall sales but a staggering 63.3% of its operating income.

In the realm of AI, Amazon is creating a vertically integrated ecosystem to enhance services for AI model developers. Amazon Bedrock is one such offering that provides streamlined access to hardware, software, and data, further solidifying Amazon’s position in the AI market.

Cathie Wood, a prominent investor, is opting for three mega-cap tech stocks over Tesla. These stocks are part of an ecosystem that includes Amazon Q, a generative AI assistant, and Amazon’s custom-designed AI chips, Trainium and Inferentia. These chips are cost-effective alternatives to Nvidia’s H100, enabling Amazon to maintain competitive operating costs and reduce dependency on third-party suppliers.

Amazon Prime Video, the world’s second-largest streaming platform, boasts over 200 million subscribers. Additionally, Amazon’s advertising platform is among the largest globally, ranking just behind Alphabet and Meta. Amazon’s digital advertising market share has increased to 13.9%, up from 10.7% in 2021, highlighting its expanding influence across various sectors.

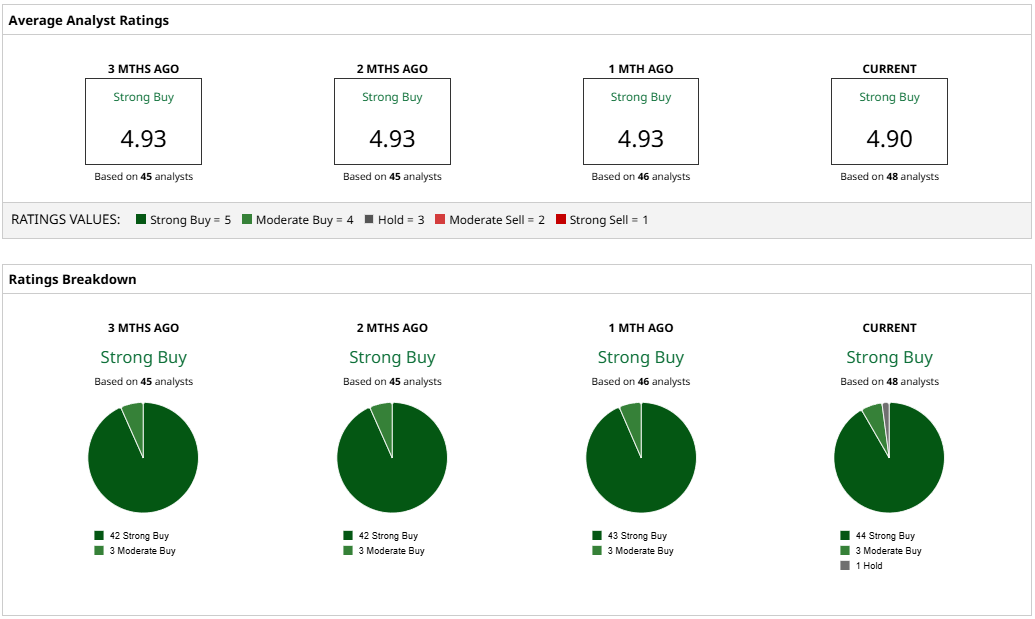

Analysts are overwhelmingly bullish on Amazon stock, with a consensus rating of “Strong Buy” and a mean target price of $226.

Cathie Wood, a prominent figure in the investment world, is known for her strategic stock picks. Among them, three mega-cap tech stocks have caught her attention instead of Tesla. These stocks offer significant upside potential and are backed by strong analyst ratings.

#1. The first stock is not mentioned in the original content, but we can infer it’s a significant pick by Cathie Wood.

#2. AMD – Advanced Micro Devices (AMD), a semiconductor giant founded in 1969 and based in Santa Clara, is one of Wood’s choices. With a market cap of $240.5 billion, AMD is a leading supplier of microprocessors and related technologies for computing and graphics industries. Their products are utilized in personal computers, servers, workstations, embedded systems, and gaming consoles. Despite a 1.2% decline in 2024, AMD has seen a substantial increase of 309%.

#3. The third stock is not detailed in the provided content, but it is implied to be another mega-cap tech stock that Wood is buying instead of Tesla.

AMD stock has a 1.40% weight in the Ark Innovation ETF. In the past five years, it has seen certain growth. Though the shares sold off in response to a light Q4 forecast, AMD’s third-quarter results beat estimates on both revenue and earnings. The latest quarter’s revenues reached $6.8 billion, with an overall 18% increase. Core data center segment revenues surged a whopping 122% year over year to $3.5 billion. Adjusted earnings increased by 31% from the prior year to $0.92, edging past the consensus estimate. Net cash from operating activities was $628 million, up 49.2% from the previous year. The company had about $4 billion in cash balance and no short-term debt. AMD’s data center segment is expected to continue robust growth driven by high demand for its AMD Instinct GPUs and 4th Gen EPYC CPUs.

Cathie Wood’s recent investment choices have shifted towards three mega-cap tech stocks, bypassing Tesla. Among these, Advanced Micro Devices (AMD) stands out due to its recent product launches and market positioning. The Instinct MI325X and its MI300X GPU, specifically designed for AI workloads, position AMD as a formidable competitor against Nvidia’s H100 in the AI acceleration market.

CEO Lisa Su has noted strong customer and partner interest in the MI325X, with production shipments expected to commence shortly. Additionally, the company’s management has projected the AI GPU market to reach a staggering $500 billion by 2028, signifying substantial long-term growth potential.

Over the past decade, AMD has demonstrated robust growth, with revenues and earnings compounding at CAGRs of 15.29% and 43.30%, respectively. Analysts are also predicting that AMD will outperform the industry in terms of revenue and earnings growth. The forward revenue growth for AMD is estimated at 11.69%, while earnings are anticipated to increase by 60.27%, significantly higher than the sector medians of 6% and 7%.

Cathie Wood, a renowned investor, is focusing on three mega-cap tech stocks as alternatives to Tesla. These companies are leading the way in their respective fields and offer significant growth potential.

AMD, one of the stocks, is seeing a 64% increase in its data center products, which are gaining popularity among major cloud providers such as Microsoft and Google. These companies are now deploying AMD’s 4th generation EPYC CPUs. AMD is also poised to benefit from the ongoing supply shortages of Nvidia’s Blackwell GPUs, which are fully booked for the next year. This creates an opportunity for AMD to expand its presence in the AI accelerator market. The recent acquisition of Silo AI by AMD is a strategic move to strengthen its position in AI. Silo AI has been crucial in scaling large language model training on LUMI, Europe’s fastest supercomputer, which is powered by AMD Instinct MI250X GPUs. Silo AI’s client base, which includes Nvidia, underscores the strength of AMD’s AI solution capabilities. This acquisition not only reinforces AMD’s position in AI but also adds a new revenue stream with deployed AI solutions complementing AMD’s hardware offerings.AMD’s software ecosystem has significantly improved through its ROCm open-source platform. In the last 10 months, it has seen a 2.4x gain in AI inferencing and a 1.8x boost in training performance. With compatibility for AI frameworks like PyTorch and TensorFlow, ROCm makes AMD’s offerings more accessible and attractive to customers seeking versatile AI solutions.

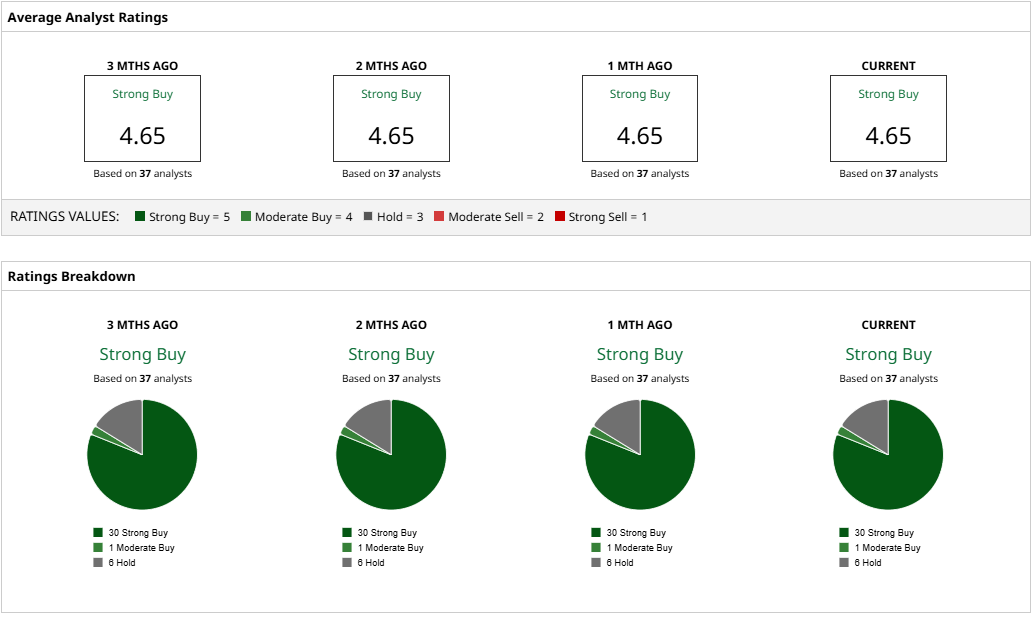

Beyond data centers and AI, AMD leads in gaming console processors with an 83% market share. The company’s advancements in chiplet architecture and 3D stacking technologies further diversify its portfolio, reinforcing AMD’s position as a formidable player in the semiconductor landscape. Given the company’s rapidly expanding AI credentials and diversified semiconductor portfolio, analysts have deemed AMD stock a “Strong Buy” with a mean target price of $193.06. This indicates an expected upside potential of about 34% from current levels.

Out of 37 analysts covering the stock, 30 have a “Strong Buy” rating, 1 has a “Moderate Buy,” and 6 have a “Hold” rating. #3. Meta Platforms We conclude our list of recent Wood picks with Mark Zuckerberg-led Meta Platforms (META), in focus today after last night’s earnings. Founded two decades ago as Facebook, Meta is a global leader in social media and virtual reality technology. It rebranded itself in 2021 as “Meta” to reflect its broader focus on building a “metaverse” beyond social media. Valued at a massive market cap of $1.5 trillion, Meta stock has been a stark outperformer this year, gaining 60% – even in light of today’s 4.6% pullback. Further, the stock also offers a dividend yield of 0.25%. META currently accounts for 2.Meta’s third-quarter results were impressive. Revenue for the quarter was $40.6 billion, up 19% from the previous year. Earnings soared by 37% to $6.03 per share, outpacing the consensus estimate of $5.29. Net cash from operating activities in Q3 was about $25 billion. The company closed the quarter with a cash balance of $45 billion, much higher than its short-term debt levels of about $2 billion. The company’s user count, or family daily active people, totaled 3.29 million during the third quarter, representing a growth of 5% compared to one year earlier. While investors are responding negatively today to plans for increased AI capex – a reaction that’s not new for the company. 61% in the Ark Innovation ETF.

Cathie Wood, a prominent investor, is opting for three Mega-Cap Tech Stocks over Tesla. One of these is META, which has shown impressive growth by adding around 150 million new active users to its social media platforms within the last year. Despite its large size, META has managed to increase its revenues and earnings at compound annual growth rates (CAGRs) of 31.07% and 35.97% over the past decade, respectively.

Analysts are expecting META to continue this growth, projecting forward revenue and earnings growth rates of 16.60% and 42.08%, respectively. META has also made significant strides in AI and wearable technology, establishing itself as a frontrunner in these sectors. In July 2024, META launched the Llama 3.1 405B, an advanced openly available AI foundation model. It is competitive with top models such as GPT-4, GPT-4o, and Claude 3.5 Sonnet, as suggested by internal evaluations. META’s competitive edge was further enhanced in October with the introduction of lightweight quantized Llama models, allowing developers to run AI applications directly on smartphones.Cathie Wood, a prominent investor, is focusing on alternative mega-cap tech stocks to Tesla. These include companies like Meta, which is enhancing its AI ecosystem with the Llama 3.2 1B and 3B models. These compressed versions are designed to improve accessibility for mobile app developers.

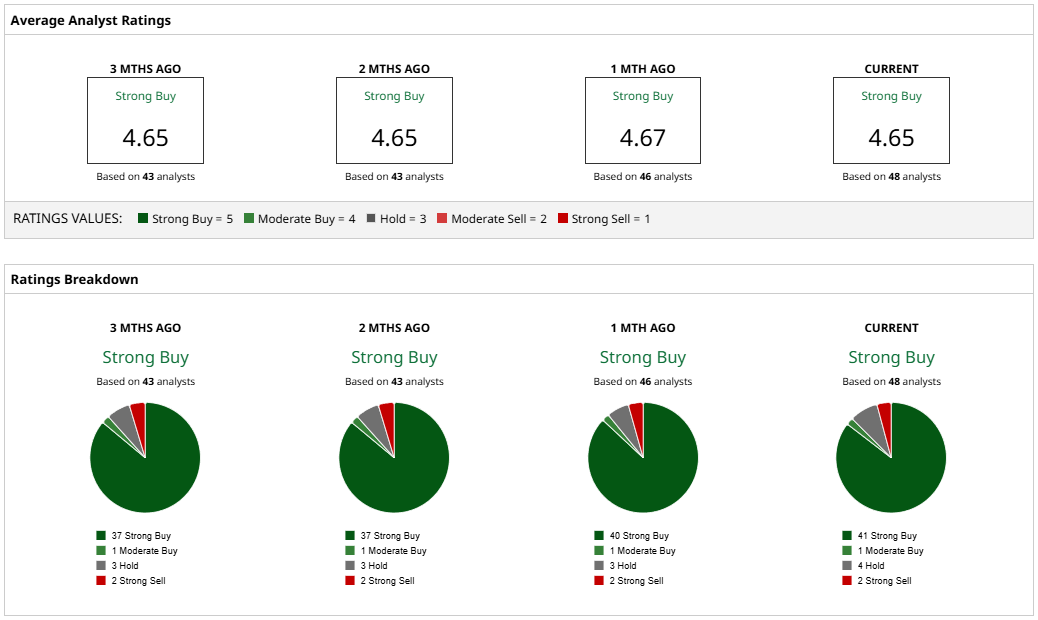

Meta has established partnerships with leading hyper-scalers such as Amazon, Microsoft, Alphabet, Nvidia, and Databricks. This collaboration allows enterprise customers to utilize Llama for AI training and inference tasks within public or hybrid cloud infrastructures. The models are engineered to integrate seamlessly with various GPUs, servers, and software platforms. Meta’s advanced AI capabilities also bolster its advertising business, offering more targeted marketing experiences to marketers and enhancing user engagement on its social networking platforms. In addition to AI, Meta has made significant progress in the wearables market with the AI-enhanced Ray-Ban glasses. These glasses provide hands-free content capture and integrate with popular apps like Spotify, potentially increasing user engagement and boosting advertising revenue.Meta has reportedly faced losses of around $55 billion in its Reality Labs segment since 2019. However, it is investing heavily in the development of smart eyewear. The aim is to disrupt consumer technology and make augmented reality (AR) more practical in daily life. Early signs of success are reports that the glasses have sold out and become the top-selling product in approximately 60% of Ray-Ban stores across Europe, the Middle East, and Africa. By focusing on both AI and wearable technology, Meta is strategically positioning itself to capitalize on emerging trends in consumer technology and enhance user experiences across its platforms. Analysts have rated META stock as a “Strong Buy,” with a mean target price of $624.17, reflecting an expected upside potential of about 10.5% from current levels.

Among 48 analysts covering the stock, 41 have a ‘Strong Buy’ rating. One has a ‘Moderate Buy’ rating. Four have a ‘Hold’ rating. And two have ‘Strong Sell’ ratings.