Lean hogs continued to make new highs in yesterday’s trade. However, has the market gone too far too fast? For Live Cattle (December), December live cattle futures broke lower yesterday. This took prices down near 4-star support which was outlined from the start of the week as 184.55-185.20. So far, the Bulls have been able to defend this level, which has limited the technical damage. But a failure to hold here could turn the tide and trigger additional long liquidation from funds. This is something we’ve mentioned several times over the last week as Funds have grown their largest net long position since last October (when the market first rolled over). Not to say that it will happen again, but the risk is there coupled with potential headline risks from the outside markets. Resistance: 189.47-190.075, 191.47-191.

Cattle futures experienced a decline on Wednesday, with 62Pivot values at 187.675-188.00 and support levels at 184.55-185.20, and 182.82-183.325. Daily Cattle and Beef Summary indicated that cutout values softened, with choice cuts falling 1.17 to 319.44 and select cuts decreasing by .64 to 289.32. The 5-area average price for live steers remained steady at 189.36, in line with the week’s start. Wednesday’s slaughter count was reported at 124,000 head, matching the same day last week but 1,000 more than the same day last year.

Weekly Export Sales saw a downturn, with net sales of 13,900 MT for 2024, which is a 17 percent decrease from the previous week and the prior 4-week average.

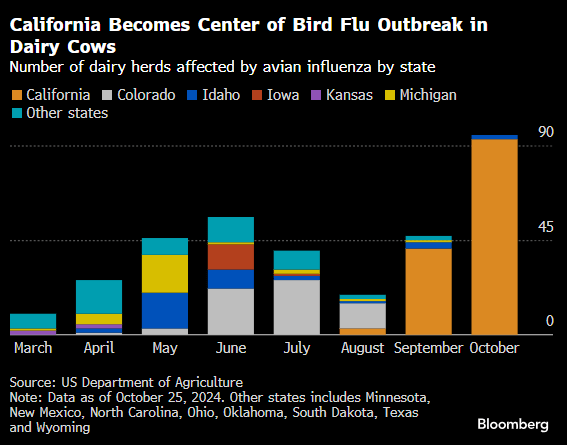

In a Bloomberg update, dairy farmers in California are facing a growing outbreak of avian flu among their herds, a situation they are reluctant to discuss publicly but cannot afford to ignore.

In California, bird flu has affected over 170 herds since late August, making up nearly half of all US cases in dairy cows detected since the outbreak began in March.

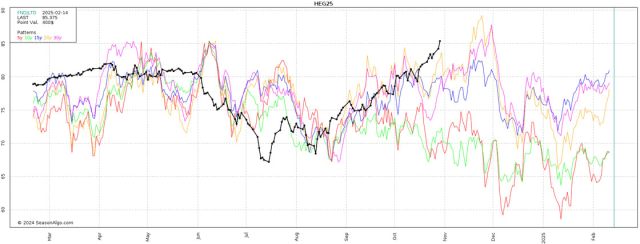

**Seasonal Tendency Update**: Here is an analysis of historical price averages for February futures across 5, 10, 15, 20, and 30-year timeframes. (Note: Past performance is not necessarily indicative of future results). The chart indicates that the first half of November is typically a challenging period for the market to achieve a significant rally. It remains to be seen if this pattern holds true this year.

As previously mentioned, market volatility remains relatively low, which could make options an attractive strategy for managing risk or expressing market opinions with limited exposure.

**Lean Hogs (February)**: Yesterday, we released a video discussing the conditions for a mean-reversion in lean hog prices.

As previously mentioned, we are considering this as a counter trend trade. Hence, we prefer looking at the options market to limit risks if prices continue to rise. For tailored strategies suitable for you, contact the trade desk. We avoid blanket trade recommendations as each client’s risk profile is different. Resistance: 86.225. Pivot: 84.30 – 83.65. Support: 82.05 – 82.27, 80.90 – 81.20. Weekly Export Sales: Net sales of 44,800 MT for 2024 are noticeably up from the previous week and 16 percent higher than the prior 4-week average. US detects H5N1 bird flu in a pig for the first time – Reuters. H5N1 bird flu was confirmed in a pig on a backyard farm in Oregon, which is the first detection of the virus in swine in the country. The U.S. Department of Agriculture announced this on Wednesday.

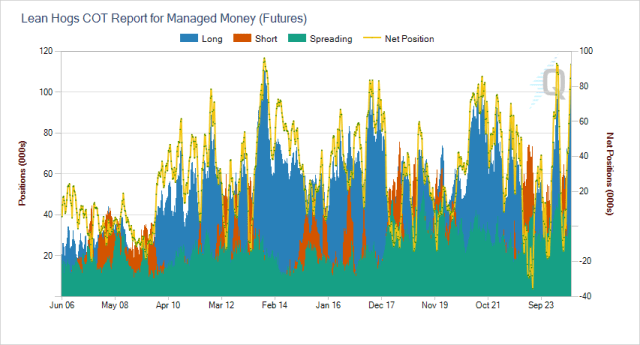

Pigs can become co-infected with bird and human viruses, raising concerns for the spread of bird flu. The USDA stated there is no risk to the nation’s pork supply from the Oregon case and the risk to the public from bird flu remains low. Commitment of TradersFunds are close to a record net long position. Friday’s report showed them net long 92,646 futures/options contracts. Provided by CMESeasonal Tendency Update. Below is a look at historical price averages for February futures on 5, 10, 15, 20, and 30 year time frames. Past performance is not necessarily indicative of future results. Provided by Season Algo. Stay ahead of the herd! Subscribe to our daily Livestock Roundup for exclusive insights into Feeder Cattle, Live Cattle, and Lean Hogs.

Futures trading is inherently risky and may not be suitable for all investors. It is crucial to consider whether such trading aligns with your financial status. At Blue Line Futures, we offer proprietary trading levels and market biases directly to your inbox every day. Sign up for free futures market research.

Our trading advice is grounded in reliable information from trade and statistical services, which we believe to be accurate. However, we cannot guarantee the accuracy or completeness of this information, and it should not be solely relied upon. Our advice is based on our good faith judgment at a specific time and is subject to change without notice.

Please be aware that there is no guarantee that the advice we provide will lead to profitable trades.

All trading decisions are made by the account holder. Past performance is not necessarily an indication of future results. Blue Line Futures is a member of NFA and is under NFA’s regulatory oversight and examinations. However, it should be noted that the NFA does not have regulatory oversight authority over underlying or spot virtual currency products, transactions, exchanges, custodians or markets. Therefore, carefully consider whether such trading is suitable for you considering your financial condition.

Performance Disclaimer: Hypothetical performance results have many inherent limitations. Some of these limitations are described below. No representation is being made that any account will or is likely to achieve profits or losses similar to those shown. In fact, there are often sharp differences between hypothetical performance results and the actual results subsequently achieved by any particular trading program.One of the limitations of hypothetical performance results is that they are generally prepared with the benefit of hindsight. Hypothetical trading does not involve financial risk. No hypothetical trading record can completely account for the impact of financial risk in actual trading. For instance, the ability to withstand losses or adhere to a particular trading program despite trading losses are material points that can also adversely affect actual trading results. There are numerous other factors related to the markets in general or the implementation of any specific trading program. All of these factors cannot be fully accounted for in the preparation of hypothetical performance results and can adversely affect actual trading results.