Gold prices have been on a continuous upward climb ahead of next week’s U.S. presidential election. The popular currency hedge, gold, has received a high-profile boost from billionaire investor Paul Tudor Jones. He recently warned on CNBC that “all roads lead to inflation.” Investors are also observing a shift toward gold by BRICs nations. Central banks in these countries have been heavy buyers of bullion this year as they aim to replace U.S. dollar reserves. However, while gold futures (GCZ24) reached another record high today, above $2,800, the only gold producer included in the S&P 500 Index ($SPX) had its worst day since 2008. Should investors consider buying the dip, or is there something seriously wrong? Here’s a closer look.

Newmont Corporation (NEM), a leading mining company, is involved in the exploration, production, processing, and refinement of precious metals such as gold, silver, and base metals like zinc, copper, lead, and molybdenum. With 17 managed operations across nine countries, Newmont is headquartered in Denver and boasts a market cap of $54.4 million.

Newmont has a history of consistent dividend payments, spanning over 30 years, with a current yield of 2.09% based on the quarterly payout of $0.25 per share. Over the past 52 weeks, NEM’s stock has seen a gain of 21.3%, and it has risen by 13.4% year-to-date. However, this positive trend has been marred by a recent 18.7% decline over the past five days, including a significant 14.7% drop on October 24th, following the company’s reported earnings that fell short of estimates.

In their third-quarter results, Newmont missed expectations significantly on labor costs. This has led to a sharp decline in the stock price, prompting the question of whether this is an opportune moment to buy the dip in Newmont stock.

Earnings of $922 million, or $0.81 per share, fell short of analysts’ $0.83 per share estimates. Revenue increased 84% year-on-year to $4.61 billion, driven by higher gold prices, yet still missed Wall Street’s expectations. Management attributed the earnings miss to higher labor costs. They are also making progress on debt reduction and divesting non-core assets. Newmont retired $233 million in debt since the last earnings call and is on track to generate at least $2 billion in gross proceeds from divesting non-core assets. The miner generated $1.6 billion of cash flow from operations and $760 million in free cash flow during Q3. It returned $786 million to investors through share repurchases and quarterly dividends. Newmont approved an additional $2 billion buyback program in the quarter, bringing the total authorization to $3 billion.

After the recent earnings report, Newmont Corporation (NEM) has seen a 14% drop in its stock price. This raises the question: is it a good time to buy the dip?

The company reported a strong liquidity position, ending the quarter with $7.1 billion in total liquidity. Additionally, the all-in sustaining costs for the fourth quarter are projected to be around $14.75 per ounce, marking an 8% decrease from the previous quarter.

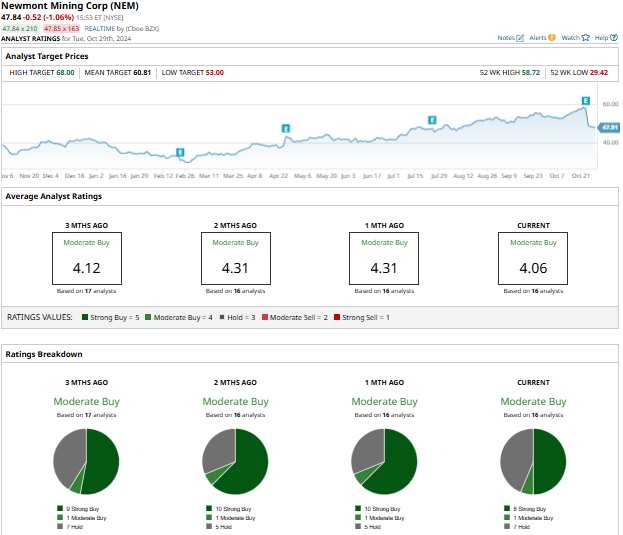

Analysts’ Ratings on NEM

UBS has recently downgraded its rating on NEM from ‘Buy’ to ‘Hold’ following the earnings announcement and adjusted its price target to $54. Despite this, the majority of analysts maintain a positive outlook. With 16 analysts covering the stock, the average rating for Newmont is a ‘Moderate Buy’. The average price target is $60.23, suggesting a potential upside of more than 28% from the current levels.

Investment Considerations

For investors interested in the company’s strategy to reduce debt and divest non-core assets, NEM appears to be a bargain at the moment. It is valued at 8.1x cash flow and 7.33x EV/EBITDA, which is a discount compared to its historical valuations and the median valuations of the materials sector.