DT Midstream (DTS) has a market cap of $8.49 billion and operates in two segments: Pipeline and Gathering, providing integrated natural gas services. Since the Trend Seeker buy signal on 8/8, it has shown a 20.35% gain with strong technical indicators and consistent price appreciation. Fundamental factors include a P/E of 21.06, a 3.31% dividend yield, and expected revenue and earnings growth over the next five years. Analysts’ opinions are mixed with 3 strong buys, 1 buy, 5 holds, and 2 sells; price targets range between $66 and $92. The Chart of the Day belongs to the midstream natural gas distribution company DT Midstream (DTM). I found the stock by using Barchart’s powerful screening functions to find stocks with the highest technical buy signals, highest Weighted Alpha, superior current momentum and having a Trend Seeker buy signal then used the Flipchart feature to review the charts for consistent price appreciation.

DT Midstream, Inc., along with its subsidiaries, offers integrated natural gas services across the United States. The company is organized into two primary segments: Pipeline and Gathering.

**Pipeline Segment**: This segment is responsible for owning and operating interstate and intrastate natural gas pipelines, storage systems, and natural gas gathering lateral pipelines. It also handles the transportation and storage of natural gas for intermediate and end-user customers.

**Gathering Segment**: The Gathering segment owns and operates gas gathering systems, which are involved in the collection of natural gas for delivery to plants for treating, to gathering pipelines for further gathering, or to pipelines for transportation. This segment also provides associated ancillary services such as compression, dehydration, gas treatment, water impoundment, water transportation, water disposal, and sand mining.

Since the Trend Seeker signaled a buy on 8/8, the stock has experienced a significant gain of 20.35%. This performance highlights the potential of DT Midstream’s stock in the market.

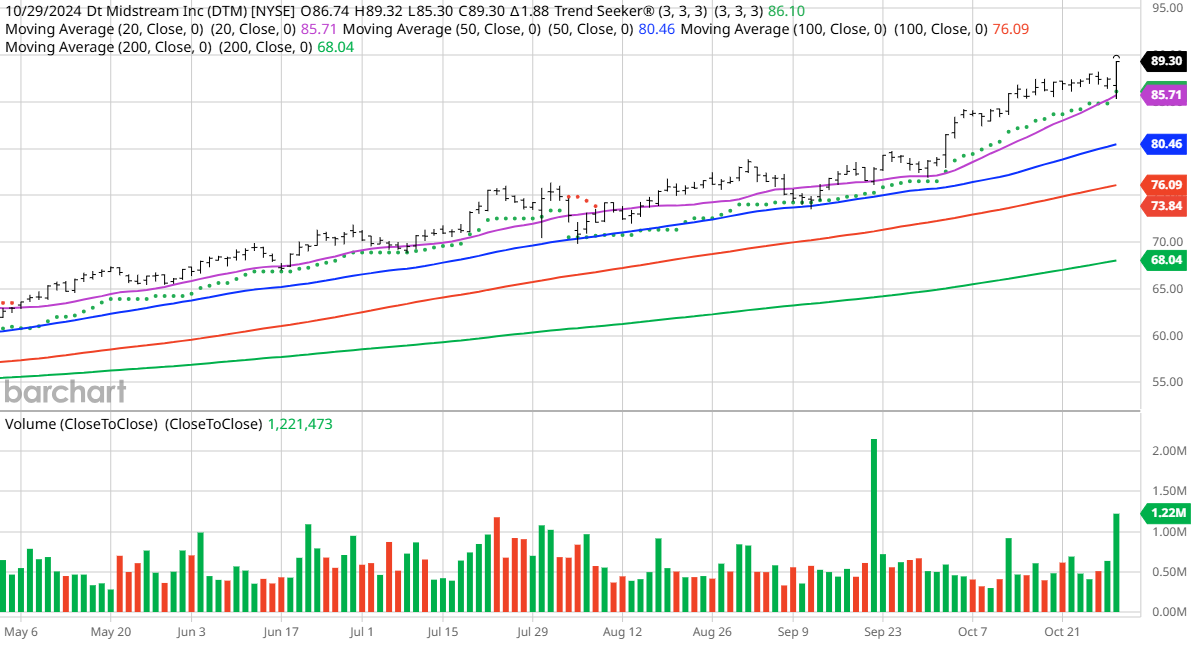

DT Midstream serves natural gas producers, local distribution companies, electric power generators, industrials, and national marketers. The company was incorporated in 2021 and is headquartered in Detroit, Michigan. Barchart’s Opinion Trading systems are listed below. Please note that the Barchart Opinion indicators are updated live during the session every 20 minutes and can therefore change during the day as the market fluctuates. The indicator numbers shown below may not match what you see live on the Barchart.com website when you read this report. Barchart Technical Indicators: 100% technical buy signals, 67.68+ Weighted Alpha, 68.55% gain in the last year, Trend Seeker buy signal, 74 – 60 month Beta, Above its 20, 50 and 100 day moving averages, 14 new highs and up 14.88% in the last month, Relative Strength Index 77.

DT Midstream’s stock in the natural gas distribution sector has recently traded at $89.30, with a technical support level at $86.67 and a 50-day moving average of $80.46.

Fundamental factors for DT Midstream include a market capitalization of $8.49 billion, a price-to-earnings ratio of 21.06, and a dividend yield of 3.31%. Revenue is expected to grow by 6.00% this year and by another 8.40% next year. Earnings are projected to increase by an additional 10.50% next year, followed by a compounded annual growth rate of 3.00% over the next five years.

Investor sentiment is crucial in stock performance. While not influenced by the crowd, it’s essential to consider the market trends. Wall Street analysts have given a mix of opinions: 3 strong buy, 1 buy, 5 hold, and 2 sell. Analysts’ price targets range from $66 to $92. Value Line rates the stock above average with a rating of 2, CFRA’s MarketScope rates it as a hold, and MorningStar gives it an average rating of 3 with a fair value of $88.

Currently, 10,618 investors are monitoring the stock on Seeking Alpha. The Barchart Chart of the Day highlights stocks experiencing exceptional current price appreciation, and DT Midstream is among them.

They are not intended to be buy recommendations. As these stocks are extremely volatile and speculative. If you decide to add one of these stocks to your investment portfolio, it is highly suggested that you follow a predetermined diversification and moving stop loss discipline. This should be consistent with your personal investment risk tolerance. And reevaluate your stop losses at least on a weekly basis.