In the grain markets, we experienced another mixed morning. On Tuesday, wheat futures saw an uptick, with the December contract closing at 570’4, marking an increase of 11’6 or 2.10%. Trading volume across all maturities totaled 125,918 contracts, with the December maturity accounting for 67,415 of those. Open interest overall decreased by 585 (0.14%), settling at 415,985 outstanding contracts for the day. The December maturity specifically saw a drop of 2.53%, or 585 contracts, ending at 198,434.

Technical Analysis: Wheat futures have managed to maintain our ‘MUST HOLD’ support level, which remains between 557 1/2 and 560 1/2 this week. For the bulls to ignite a more significant rally, they need to push through and close above the pivot range of 582 3/4 to 585 1/2. Key resistance levels are identified at 596-600, 615-617 1/2, and 629 1/2 to 634. Support levels are crucial at 557 1/2 to 560 1/2 and 544 1/4.

Fundamental Insights: The weekly export sales estimates for wheat are within the range of 350,000 to 650,000 metric tons (MT).

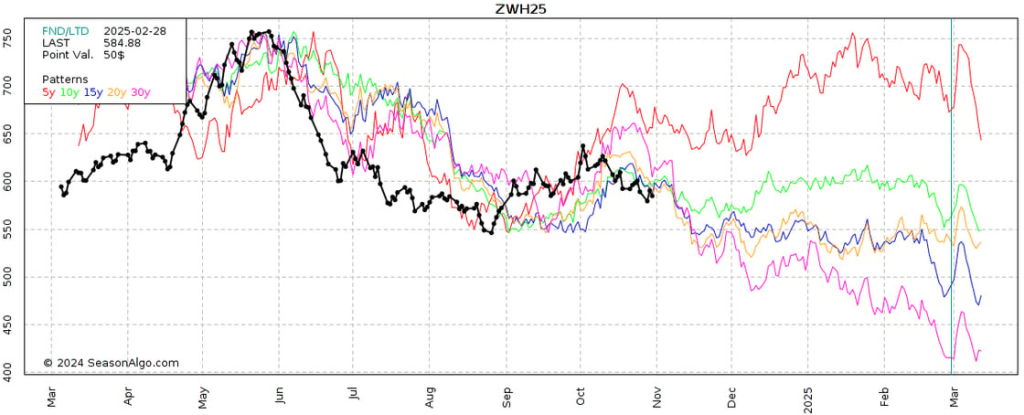

Avg Est: 488,000. Last Week: 533,000 MT. Russian Exports. SovEcon sees wheat exports at 45.9m tons, down from 47.6m tons citing “a decrease in the crop forecast and increased intervention by the Ministry of Agriculture in market operations”. Popular Options. Option volumes were highest for the Dec 600 call (858) and the Dec 570 put (2,151). Options with the greatest open interest are the Dec 600 call with 8,238, and the Dec 550 put with 7,693. Volatility Update. Implied Volatility finished the session slightly up with WVL higher by 0.14, to end the day at 29.82. The 30-day historical volatility finished the day off by 0.53% to 24.46%. The WVL Skew finished the day lower, dropping by 0.37 to end at 5.72. Seasonal Tendencies Update. Below is a look at historical price averages for March wheat futures on a 5, 10, 15, 20, and 30 year time frames (Past performance is not necessarily indicative of future results).

Futures trading carries a significant risk of loss and may not be suitable for every investor. It is crucial to carefully assess whether such trading aligns with your financial status.

Trading advice provided is based on information from trade and statistical services, as well as other sources that Blue Line Futures, LLC considers reliable. However, we do not vouch for the accuracy or completeness of this information, and it should not be treated as such.

Our trading advice represents our honest judgment at a specific time and is subject to change without prior notice. There is no assurance that the advice we offer will lead to profitable trades.

All trading decisions are ultimately made by the account holder. It is important to note that past performance is not a guarantee of future results.

Blue Line Futures is a member of the National Futures Association (NFA) and is under its regulatory oversight and subject to examinations.

Another mixed morning in grain markets has been observed.

However, it’s crucial to note that the National Futures Association (NFA) does not have regulatory oversight authority over underlying or spot virtual currency products, transactions, or virtual currency exchanges, custodians, or markets. Therefore, it’s imperative to carefully consider whether such trading aligns with your financial condition.

With cyber-attacks increasingly targeting firms in healthcare, finance, energy, and other sectors, Blue Line Futures is committed to your safety. We will never contact you via third-party applications. Our employees exclusively use firm-authorized email addresses and phone numbers for communication.

Please be aware that no representation is being made that any account will or is likely to achieve profits or losses similar to those displayed. It’s important to recognize that there are often significant differences between hypothetical performance results and the actual results subsequently achieved by any particular trading program.

Hypothetical performance results have limitations. One such limitation is that they are generally prepared with the benefit of hindsight. Additionally, hypothetical trading does not involve financial risk. No hypothetical trading record can completely account for the impact of financial risk in actual trading. For instance, the ability to withstand losses or adhere to a particular trading program despite trading losses are material points that can adversely affect actual trading results. There are numerous other factors related to the markets in general or the implementation of any specific trading program which cannot be fully accounted for in the preparation of hypothetical performance results, and all of these can adversely affect actual trading results.