Warren Buffett’s investment in Kraft Heinz (KHC) hasn’t been as successful as expected. KHC is one of the only Buffett stocks that’s negative over the past 3-year and 10-year periods. The billionaire investor himself has admitted that buying Kraft Heinz was one of his biggest investment mistakes. However, things might be improving for the company that produces products ranging from ketchup to mac and cheese. It is reported that Kraft Heinz is preparing to sell its Oscar Mayer hot dog and lunch meat business for approximately $3 billion. Sources indicate that there are two interested buyers – JBS SA’s Pilgrim’s Pride Corp and Sigma Alimentos. This sale could assist Kraft Heinz in getting back on track by concentrating on what it does best. The global food industry is large and continues to grow, with expectations to reach $12.

Kraft Heinz (KHC), known for brands like Heinz ketchup, Kraft cheese, and Oscar Mayer meats, has built its business around these household names. They’ve focused on keeping costs low and running efficiently to stay profitable, even when times are tough.

With the stock down 3% Wednesday on poorly received earnings, things seem pretty dire for KHC. But as Buffett himself would say, that’s often the best time to buy.

Looking at the numbers, KHC stock seems pretty cheap right now. Plus, it offers a healthy dividend yield of 4.60% to reward investors who are willing to wait for better days.

Kraft Heinz Company (KHC), which constitutes 3.5% of the Berkshire Hathaway (BRK.A) equity portfolio, has been a long-term underperformer. This year has been particularly challenging, with KHC’s stock down by 8.8% year-to-date, including Wednesday’s decline. A significant contributing factor to this weakness is the reduced sales of Lunchables, following concerns raised by Consumer Reports about lead and sodium levels in April.

In Kraft Heinz’s recently published Q3 report, the company reported an adjusted EPS of $0.75, slightly surpassing estimates. However, the revenue of $6.38 billion was down by 2.9% annually, missing the mark. Despite this, adjusted operating income increased by 1.4%, and the adjusted gross profit margin improved by 30 basis points to 34.3%.

Organic sales for Q3 were down by 2.2%, exceeding the expected decline of 2.0%. On a year-to-date basis, net cash from operating activities increased by 6.7% to $2.8 billion by the end of Q3, while free cash flow saw an almost 10% improvement, reaching $2.

Kraft Heinz Company (KHC) has been facing challenges, with organic net sales expected at the low end of its prior guidance,预示着2%的下降至持平增长。2024年调整后的每股收益(EPS)预计在$3.01至$3.07之间,与华尔街共识的$3.02相比较。

第三季度,Lunchables对KHC的负面影响显著,CEO Carlos Abrams-Rivera在电话会议上表示,这些挑战抵消了一些积极进展。至少有一位分析师要求管理团队在不考虑Lunchables和Capri Sun(由于配方变化而挣扎)的情况下,解释业务的基本面。

在这种背景下,Kraft Heinz可能以约$30 billion的价格出售其Oscar Mayer部门,这将是一个重大举措。

Notably, Lunchables are a part of the Oscar Mayer umbrella. Any potential sale of that unit would have significant implications for KHC’s current brand struggles. This divestiture could provide Kraft Heinz with additional capital to reinvest in growth areas or strengthen its balance sheet.

The stock’s current valuation metrics suggest it’s a bargain. The stock’s forward Price/Earnings (P/E) ratio stands at 11.51, significantly lower than the sector average of 17.7x and its own historical average of 13.3x. The company’s Price/Cash Flow ratio of 9.65 is also signaling a discounted valuation. For income-focused investors, Kraft Heinz offers an attractive dividend yield of 4.60%, based on its quarterly payout of $0.40 per share. That’s significantly higher than the Consumer Staples average of 2.Kraft Heinz (KHC) has a consistent dividend history, with 99% of its payments made over 11 consecutive years.

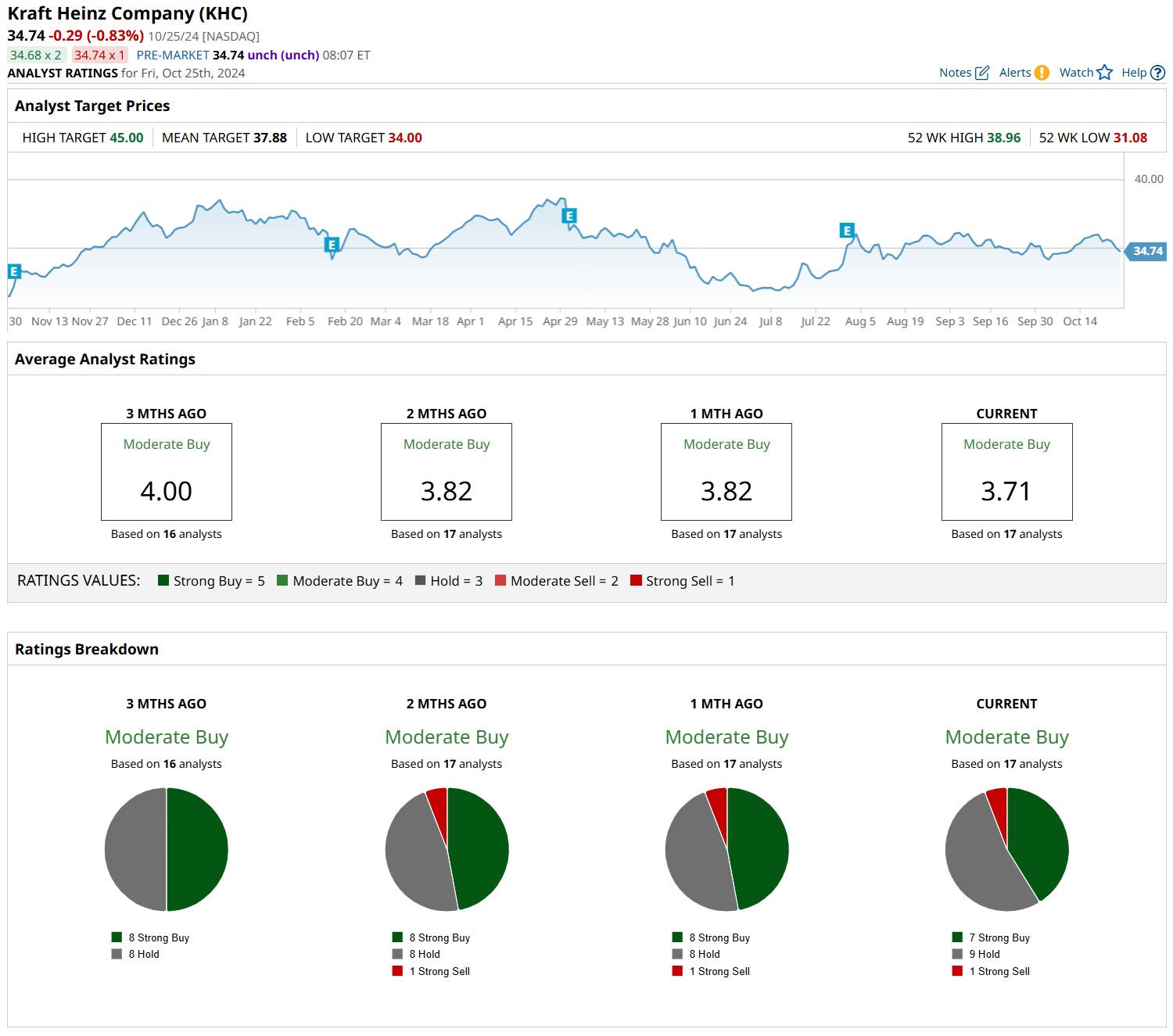

Analysts’ Opinions on Kraft Heinz Stock: Wall Street has given Kraft Heinz a ‘moderate buy’ rating. Out of 17 analysts, 7 rate it as a ‘strong buy,’ 9 suggest a ‘hold,’ and 1 recommends a ‘strong sell.’ The average price target for KHC is $37.88, indicating a potential upside of 12.3% from the current price.

Kraft Heinz’s Challenges and Strategic Moves: Despite facing challenges, Kraft Heinz is committed to shareholder returns and has strategic moves in place. The company is focused on revitalizing its struggling brands and returning value to shareholders, offering a mix of stability and growth potential.

Wall Street’s Cautious Outlook and KHC’s Valuation: While Wall Street’s outlook remains cautious, Kraft Heinz’s current valuation and the possibility of crucial strategic initiatives make this Warren Buffett stock worth considering for those who are willing to invest in a potential turnaround.