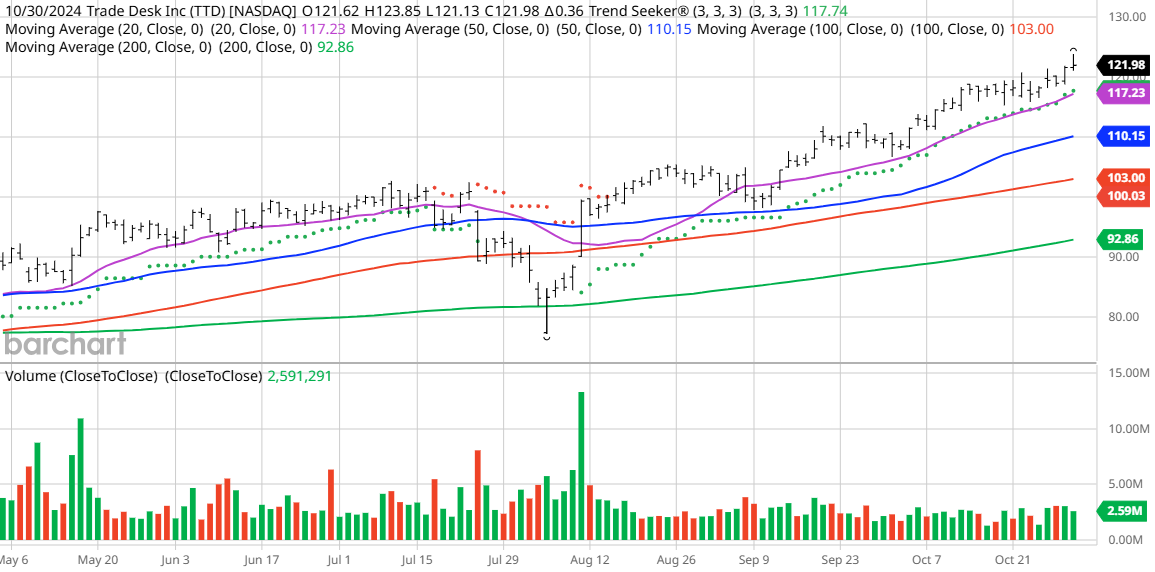

The Trade Desk (TTD), a technology company, is featured in our Chart of the Day. The stock was identified using Barchart’s advanced screening tools, which pinpointed it as one with the strongest technical buy signals, top Weighted Alpha, and superior momentum, along with a Trend Seeker buy signal. A review of the charts using Flipchart revealed consistent price appreciation.

Since the Trend Seeker buy signal on 8/15, the stock has seen a significant gain of 21.37%.

The Trade Desk, Inc., established in 2009 and headquartered in Ventura, California, offers data and value-added services to advertising agencies, brands, and service providers for advertisers.

Barchart’s Opinion Trading systems are updated live every 20 minutes during the session, reflecting market fluctuations. The indicators provided below may not align with the live data on Barchart.com when you access this report.

Barchart Technical Indicators:

– 100% Technical Buy Signals

– Weighted Alpha of 62.02

– 79.51% gain in the last year

– Trend Seeker Buy Signal

– 60-month Beta of 1.48

– Above its 20, 50, and 100-day moving averages

– 15 new highs and an 11.24% increase in the last month

– Relative Strength Index at 73

The Trade Desk’s stock has recently traded at $121.98, with a 0.7% technical support level at $119.66 and a 50-day moving average of $110.15.

From a fundamental perspective, the company boasts a market cap of $59.74 billion and a P/E ratio of 237.96. Revenue is expected to grow by 25.80% this year and another 20.40% next year. Earnings are projected to increase by 27.80% this year, an additional 18.00% the following year, and continue to grow at a compounded annual rate of 24.85% for the next five years.

Analysts and investor sentiment vary. While not influenced by the crowd, it’s important to note that if major firms and investors are selling off a stock, it can be challenging to profit against the trend. Wall Street analysts have given the stock 22 strong buy, 5 buy, 5 hold, and 4 sell opinions. Price targets range from $40 to $150.

Value Line has rated the stock with an average rating of 3 and a price target of $148, indicating a potential 20% gain. CFRA’s MarketScope has rated the stock a 4-star buy with a price target of $130. MorningStar has given the stock its lowest rating, with a fair value of $52, suggesting the stock is 113% overvalued. Seeking Alpha reports that 89,080 investors are monitoring the stock.

The Barchart Chart of the Day features stocks that are experiencing exceptional current price appreciation, highlighting The Trade Desk among them.

Investors should be aware that the stocks mentioned are not intended to be buy recommendations due to their extreme volatility and speculative nature.

If you decide to include any of these stocks in your investment portfolio, it is highly recommended to implement a predetermined diversification strategy and adhere to a disciplined moving stop loss policy.

This approach should align with your personal investment risk tolerance and involve a regular reassessment of your stop losses, ideally on a weekly basis.