5 | Giddy Up

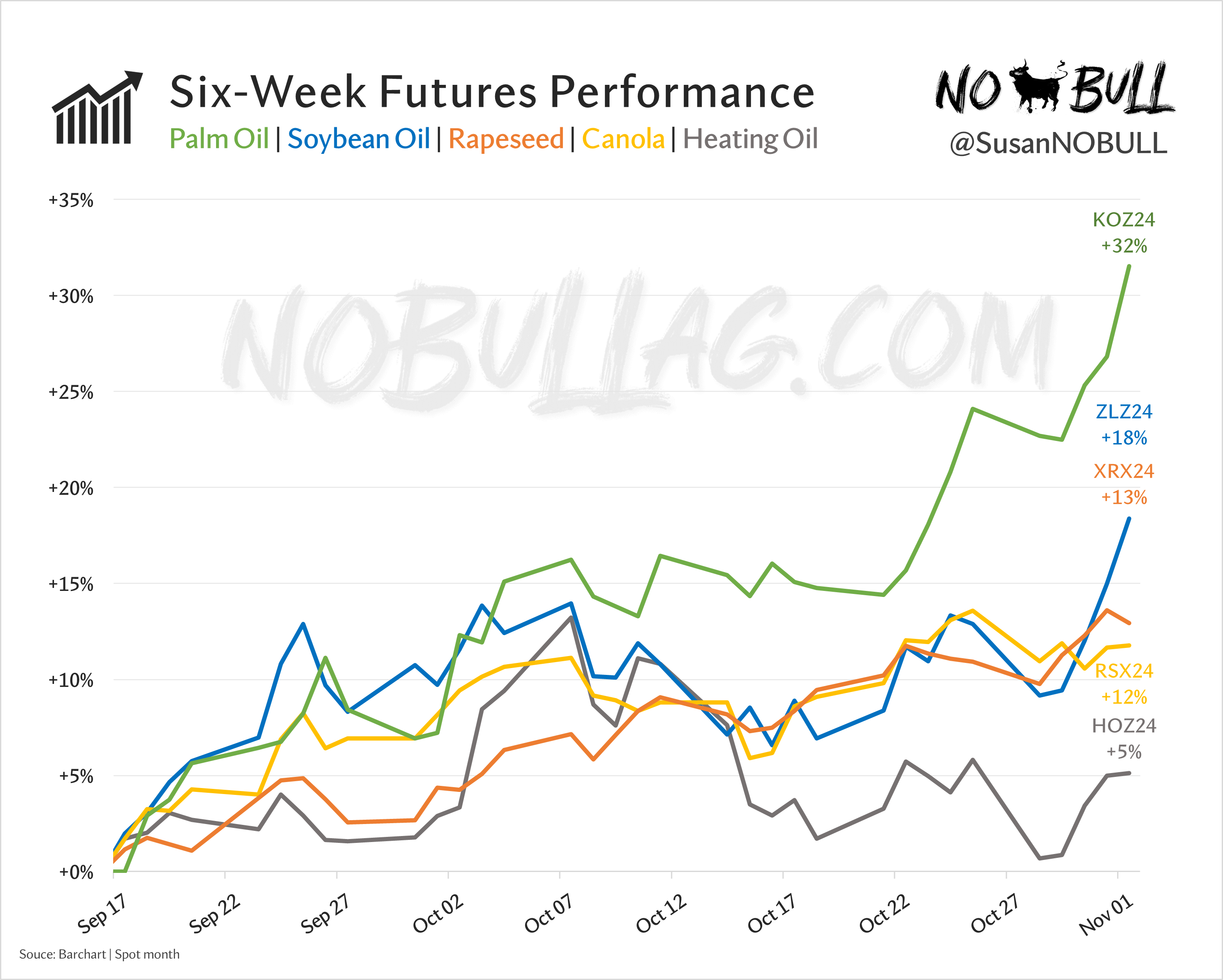

In the world of veg oils, it has been a wild six weeks. Front-month palm oil has rallied by 32%, soybean oil is up by 18%, European rapeseed futures have increased by 13%, and canola has risen by 12%. Heating oil, however, is the odd one out in energy markets due to growing concerns of an economic slowdown and a wave of geopolitical factors.

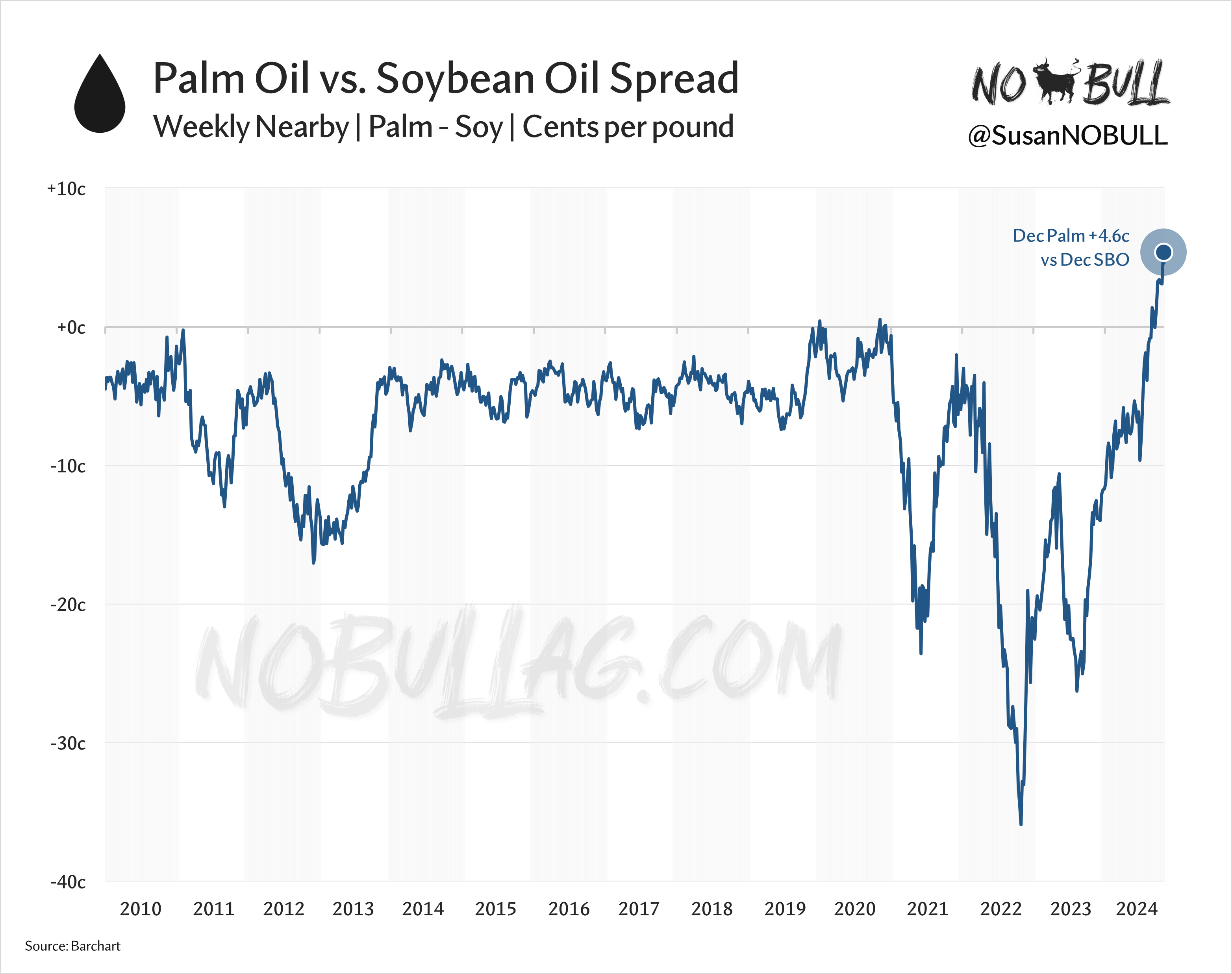

4 | Pricey Palm

Palm oil continues its upward journey amid ongoing production concerns and seasonal slowdowns. Additionally, growing biofuel mandates are leaving less supplies for export on the world market. As a result, palm oil has moved to a historically wide premium over soybean oil, nearly 5 cents per pound as of Friday’s close. This current premium is in sharp contrast to the lows of 25 and 35 cents per pound discount in recent history and the prior 10-year average near a 6-cent discount to soy.

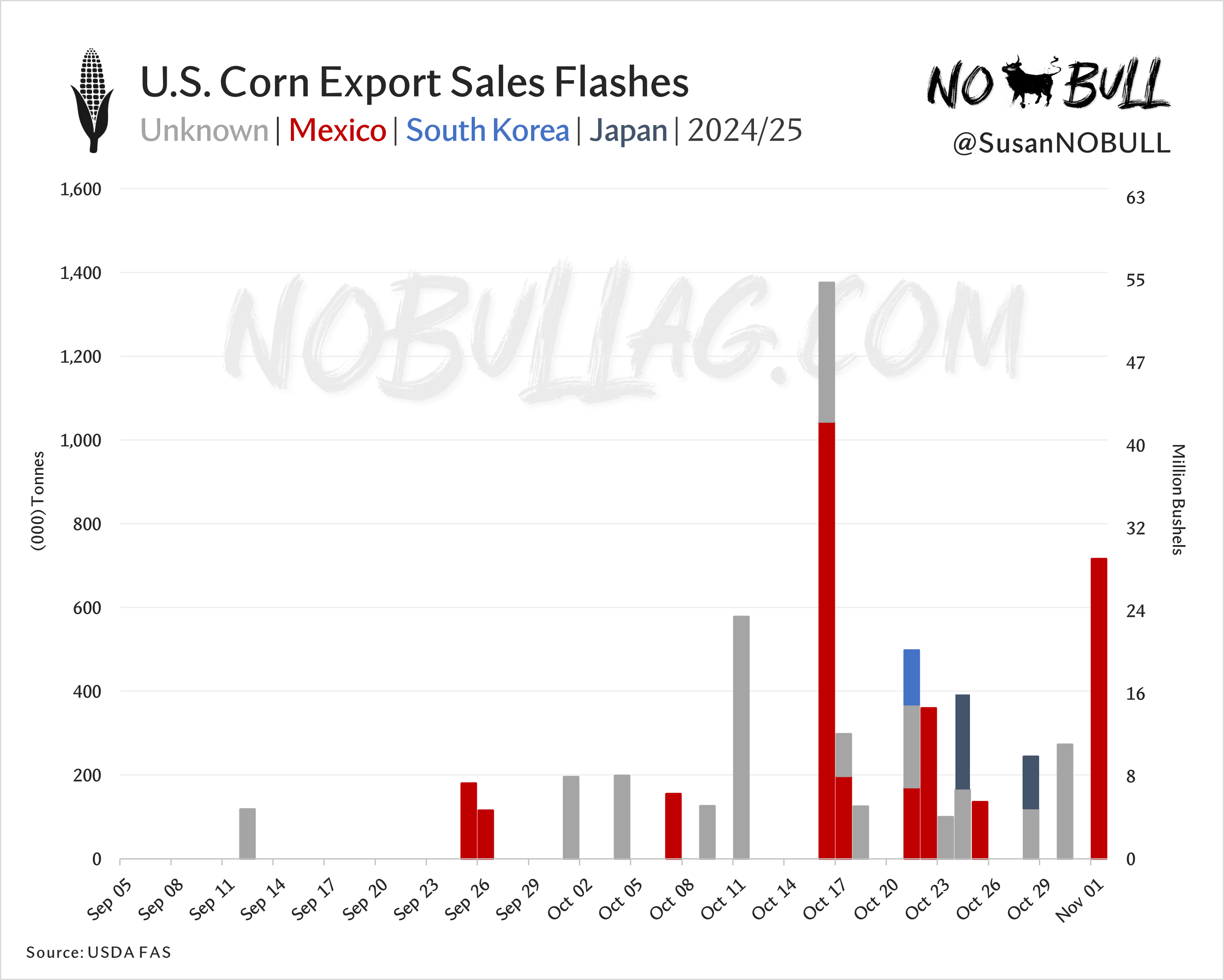

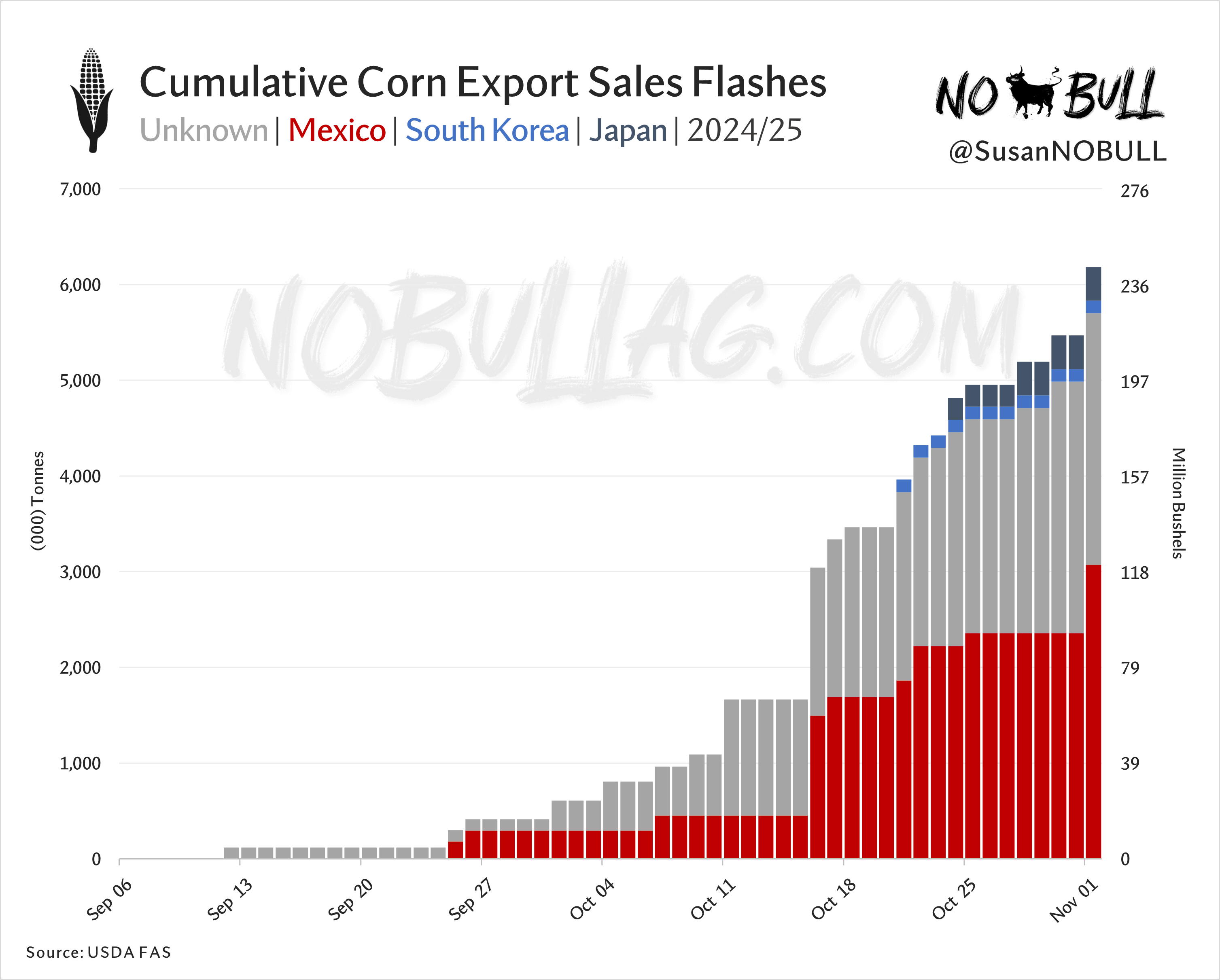

3 | Flashy

US corn remains the most price-competitive among major exporters in the world, leading to a rash of export flash sales. In recent weeks, the US has accumulated 6.

In the 2024/25 marketing year, a staggering 2mmt (243 million bushels) of flash sales have been recorded, with Mexico accounting for half of these sales. Additionally, 43% of these flash sales are categorized as Unknown.

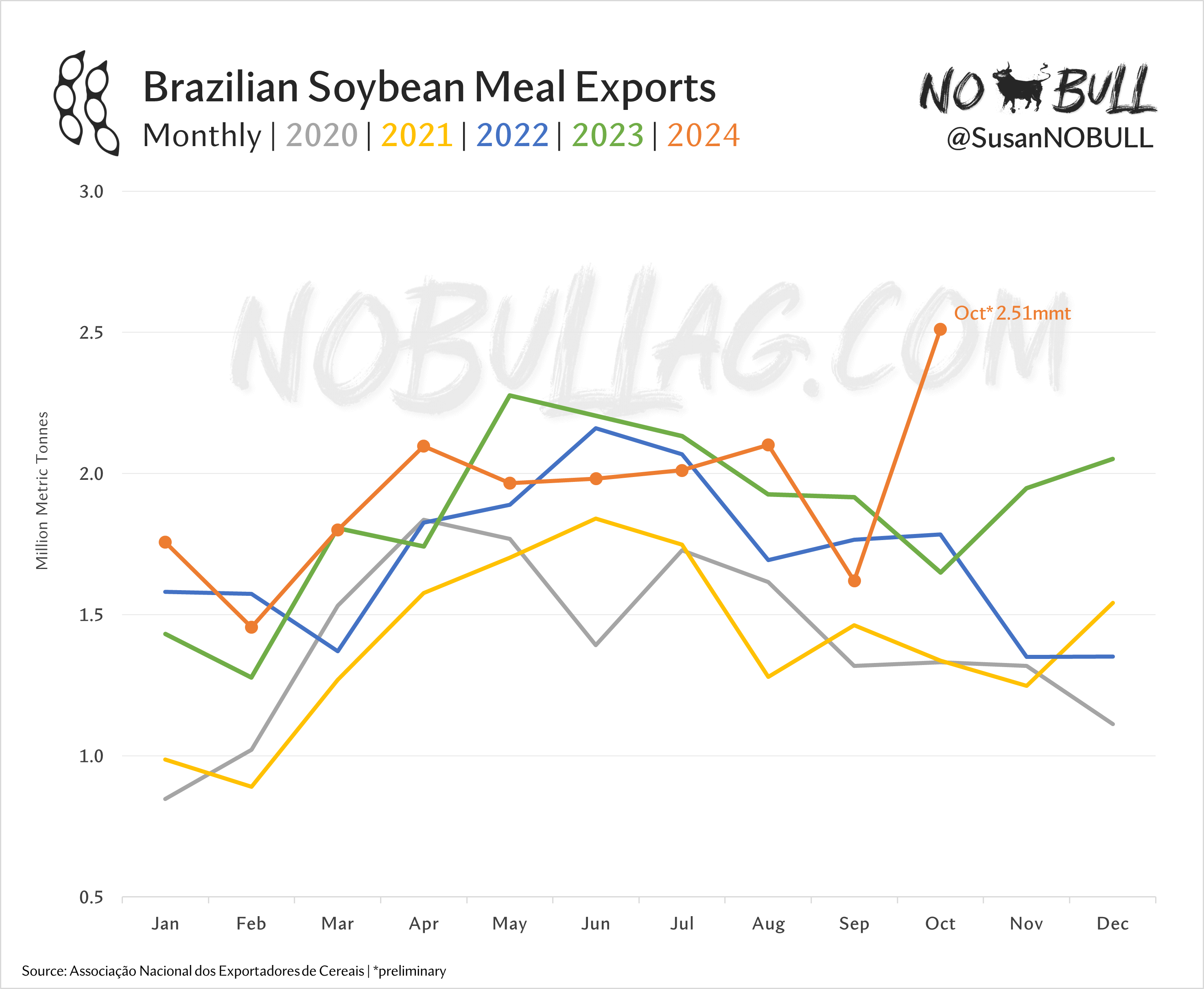

Brazilian soybean meal exports reached an all-time high in October, setting a new monthly record by over 700tmt, which is a 10% increase from the previous record set in May 2023. This surge was primarily driven by an increase in European demand in anticipation of the EU Deforestation Regulation, set to take effect on December 30, 2024. European buyers, fearing stricter import rules, have front-loaded their purchases of soybean meal that would be directly impacted by the new regulation.

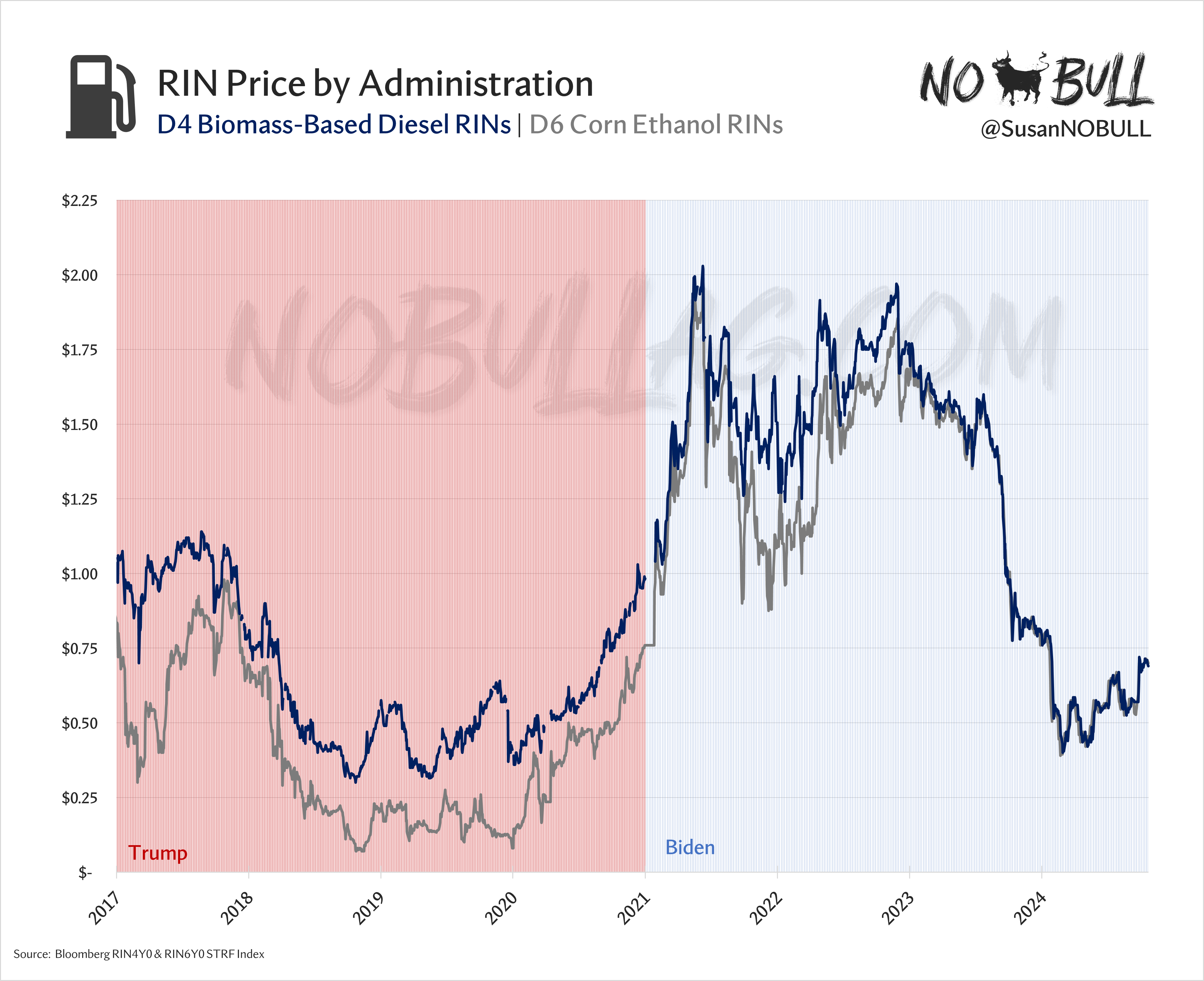

With only a few days left until the U.S. elects a new leader, it’s intriguing to examine RIN values by administration. Notably, during Trump’s first term, he was known for distributing SREs (Small Refinery Exemptions) liberally, akin to handing out Snickers on Halloween.

The convergence of D4 RINs and D6 compliance in recent months is noteworthy.

Policy has always played a significant role in US agricultural markets.

However, it has now taken on a leadership position, for better or worse, as low carbon fuel initiatives reshape demand.