Artificial Intelligence technology concept by NicoEINino via Shutterstock. The broader markets are trading close to all-time highs. The ongoing earnings season is extremely crucial for stocks priced at a premium. If tech stocks with elevated valuations can’t deliver strong earnings growth, share prices will likely experience a steep pullback in the near term. Palantir (PLTR) is one such tech stock with high stakes this season. It is scheduled to report its Q3 earnings after the close on Monday, Nov. 4. Let’s see if PLTR stock is a good buy ahead of its Q3 results. Palantir Technologies (PLTR), co-founded by Peter Thiel, went public in early 2020 after operating as a venture-backed start-up for over 15 years. It is valued at a market cap of $100.

Palantir, with a market cap of $6 billion, builds and deploys software platforms for the U.S. intelligence community to aid in counter-terrorism operations. Palantir Gotham is a software platform enabling users to identify patterns in large data sets, helping operators plan and execute real-world responses to threats. The company also offers Palantir Foundry, transforming organizational operations by creating a central data operating system for easy integration and analysis. Over the years, Palantir has focused on diversifying revenue and reducing dependency on government clients, who still account for 54% of total sales. The aim is to help enterprises bridge the gap between AI application prototypes and deployable end-user products.

Palantir stock, denoted as PLTR, has seen a remarkable surge of 154% in 2024, and it has almost tripled within the last 12 months. In September, Palantir replaced American Airlines (AAL) in the S&P 500 Index ($SPX), which led to an increase in share prices.

What are the expectations for Palantir’s Q3 performance in 2024? Palantir became profitable in Q4 of 2022, and its annual revenue growth has been accelerating over the last four quarters. The company is leveraging artificial intelligence (AI) to acquire and engage customers, which has led to increased demand for its services. Palantir has raised its revenue forecast twice in 2024, and it reported a net income of $135.6 million in the June quarter.

As Palantir prepares to release its Q3 earnings on Monday, investors are considering whether to buy the stock. In the previous quarter, Palantir reported revenue of $533 million and earnings of $0.07 per share. For the upcoming Q3 report, the consensus estimates are set at $701 million in revenue and $0.09 in adjusted earnings per share. This indicates a significant revenue increase of over 30% and an earnings growth estimate of 28.6% year over year from the $2.75 billion reported previously.

Palantir has also raised its annual revenue estimates from U.S.-based companies by $11 million, bringing the total to $672 million for 2024. The company’s performance has been strong, with a forecasted surge in revenue and a notable growth in earnings.

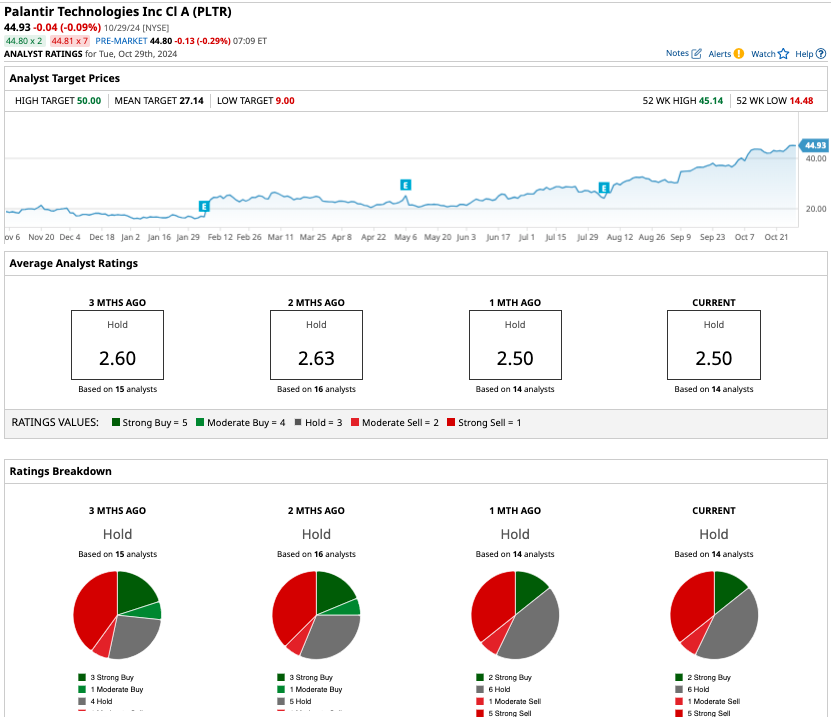

Despite this positive outlook, the stock market’s response has been lukewarm. Out of 14 analysts covering Palantir, the consensus rating is a ‘hold,’ with only two ‘strong buy’ ratings. The average 12-month target price for PLTR stock is $27.14, suggesting a potential downside of at least 37%. Investors are thus cautious, weighing the potential gains against the risks associated with the stock.

Is it wise to invest in Palantir Technologies Inc. (PLTR) stock ahead of its Q3 earnings announcement on Monday? Let’s analyze the financial data.

Over the past year, Palantir has generated a free cash flow of $696 million. Currently, the stock is valued at 143 times its trailing free cash flow, making it quite expensive. Looking at earnings expectations, analysts predict a significant increase from $0.25 per share in 2023 to $0.43 per share by 2025. With the stock priced at 104.4 times forward earnings, there is a risk of a pullback if Palantir’s Q3 results fall short of Wall Street’s expectations.