Palo Alto Networks Inc HQ sign – by Tada Images via Shutterstock. Palo Alto Networks (PANW), a company boasting large free cash flow (FCF) margins, is appealing to value investors. Additionally, its put options premiums are high, attracting short sellers. For instance, investors can achieve a short-put yield of over 2.4% by shorting 8% out-of-the-money (OTM) strike prices expiring in just over three weeks. This article will detail this strategy. PANW stock is at $363.43 in midday trading on Tuesday, Oct. 29. The stock could potentially be worth significantly more. Thus, shorting out-of-the-money (OTM) puts is a great way to set a buy-in price. Price Targets for PANW Stock. In a recent Barchart article, it was discussed that PANW is worth $448 per share (“Palo Alto Networks Is Gushing Huge Amounts of Free Cash Flow – PANW Stock Could Be Worth 20% More.”)

Palo Alto Networks has emerged as an attractive investment for value buyers due to its robust free cash flow (FCF). On August 19, the company reported an adjusted FCF margin of 38.9% for the fiscal year ending July 31.

With analysts projecting revenues of $9.13 billion for the year ending July 25, Palo Alto Networks’ FCF is anticipated to reach $3.47 billion, based on a 38% FCF margin estimate. If the market values the company with a 2.5% FCF yield, the market cap could potentially increase to $138.8 billion, calculated as $3.47 billion divided by 0.025. This represents a 17.3% increase from the current market cap of $118.38 billion.

In essence, PANW stock is estimated to be worth at least $426.36 within a year, assuming a 38% FCF margin and a valuation of 40x FCF, which is the inverse of a 2.5% FCF yield.

Analysts widely agree on the undervaluation of PANW. Yahoo! Finance indicates that the average analyst price target is $385, reinforcing the belief in Palo Alto Networks’ investment potential.

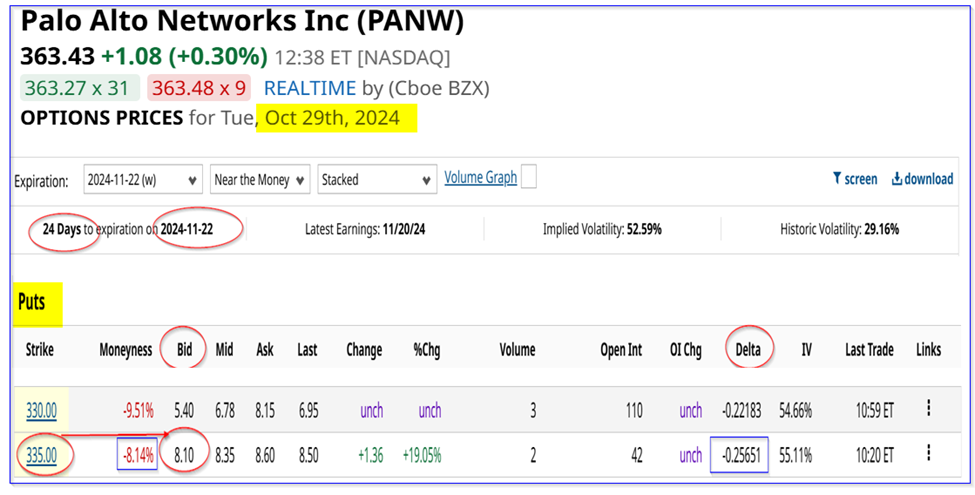

88. Barchart’s survey is $387.39 and AnaChart’s average is $386.50 from 35 analysts’ price targets. One way to play this is by setting a lower buy-in price target and getting paid while waiting. This can be achieved by selling short out-of-the-money (OTM) puts. For example, look at the Nov. 22 expiration period, which is 24 days from now (a little over three weeks away). It shows that the $335.00 strike price put option, over 8% below today’s trading price, has a bid price of $8.10. This means a short seller of these put options can make an immediate 2.418% yield. PANW puts – expiring Nov. 22 – As of Oct. 29, 2024. Here is how to do this. The investor secures $33,500 in cash or buying power with their brokerage firm. Then they can enter an order to “Sell to Open” 1 put contract at $335.

Palo Alto Networks, a company known for its robust free cash flow, is attracting value buyers with a strategic investment approach. An investor can set an 8% lower buy-in price and immediately receive a 2.4%+ yield over the next three weeks by purchasing out-of-the-money (OTM) put options expiring on November 22nd. This represents over 2.418% of the $33,500 invested, with the account receiving $810.00 immediately.

The strategy is particularly appealing as the expiration period of November 22nd is close to when Palo Alto Networks is likely to report its next quarterly results. If the stock remains flat, the put option could expire worthless. However, if the stock price falls to $335.00, the investor’s cash will be used to buy 100 shares, which could be a good buy-in price given the stock’s higher target price.

In such a scenario, the investor has the option to sell more OTM puts or covered calls, leveraging the potential for a higher target price and further enhancing the investment strategy.

Palo Alto Networks is a free cash flow gusher. Over the long term, this may work out to be a good investment.