Spread Edge Capital, a specialist in seasonal spread trading across various commodity markets, offers a unique approach to trading by simultaneously purchasing and selling the same commodity with different delivery dates.

Our weekly Newsletter provides clients with several seasonal spread trade opportunities, featuring a ‘Watch List’ of trades that meet our stringent screening criteria.

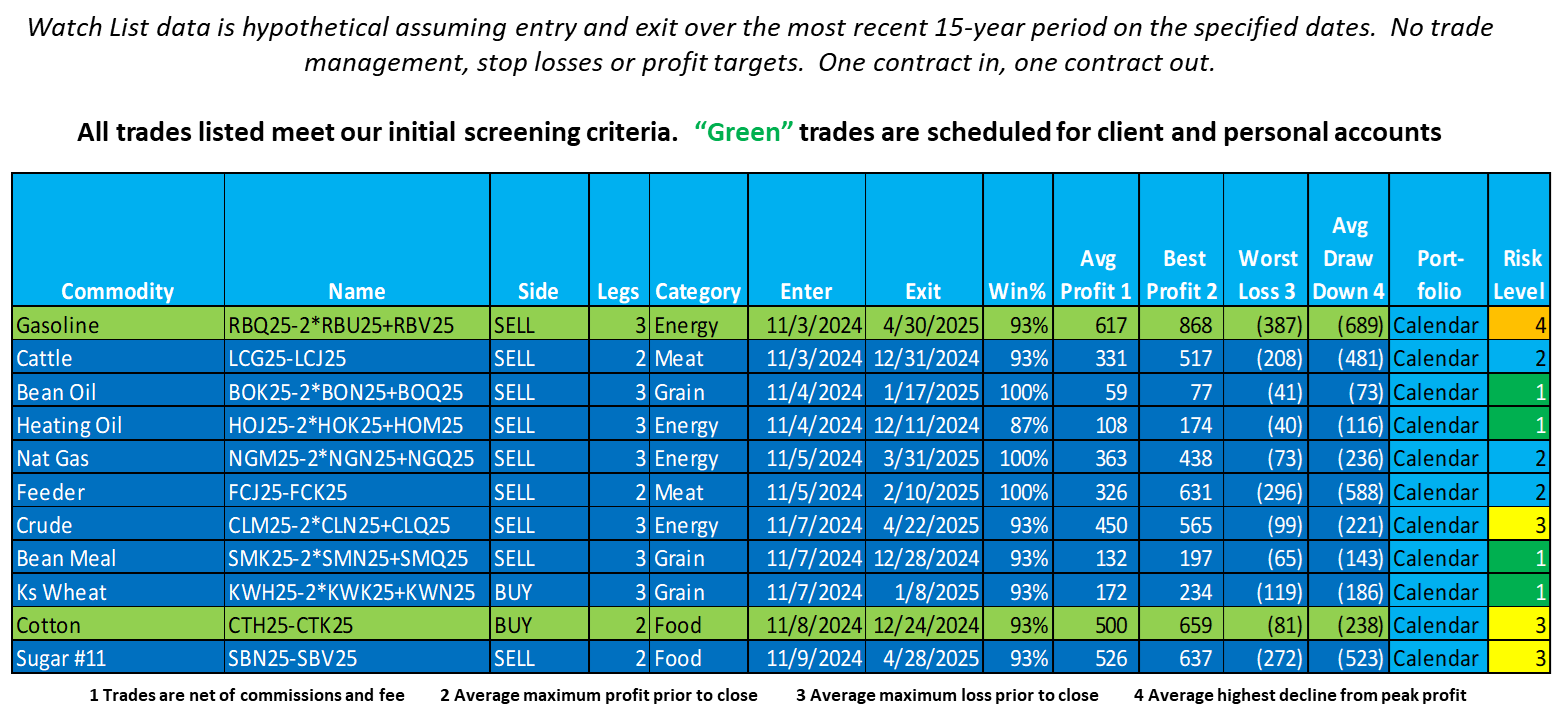

Included in the ‘Watch List’ are essential details such as markets, commodity symbols, entry and exit dates, win percentage, average profit, average drawdown, best profit, worst loss, and risk level (rated on a scale of 1-5). All information is based on hypothetical scenarios derived from the most recent 15 years of historical data.

This week, we have two trades planned for both clients and personal accounts. The focus of this article is on the Cotton calendar spread and the Gasoline butterfly spread.

Disclaimer: Hypothetical performance results have inherent limitations, as detailed below. No claim is made that any account will achieve profits or losses similar to those shown. In fact, there are often significant differences between hypothetical results and actual outcomes in any trading program.

One limitation of hypothetical performance is that they are typically prepared with hindsight. Furthermore, hypothetical trading does not involve financial risk, and no hypothetical trading record can fully account for the impact of financial risk in actual trading. For instance, the capacity to withstand losses or adhere to a trading program despite losses are critical factors that can negatively impact actual trading results.

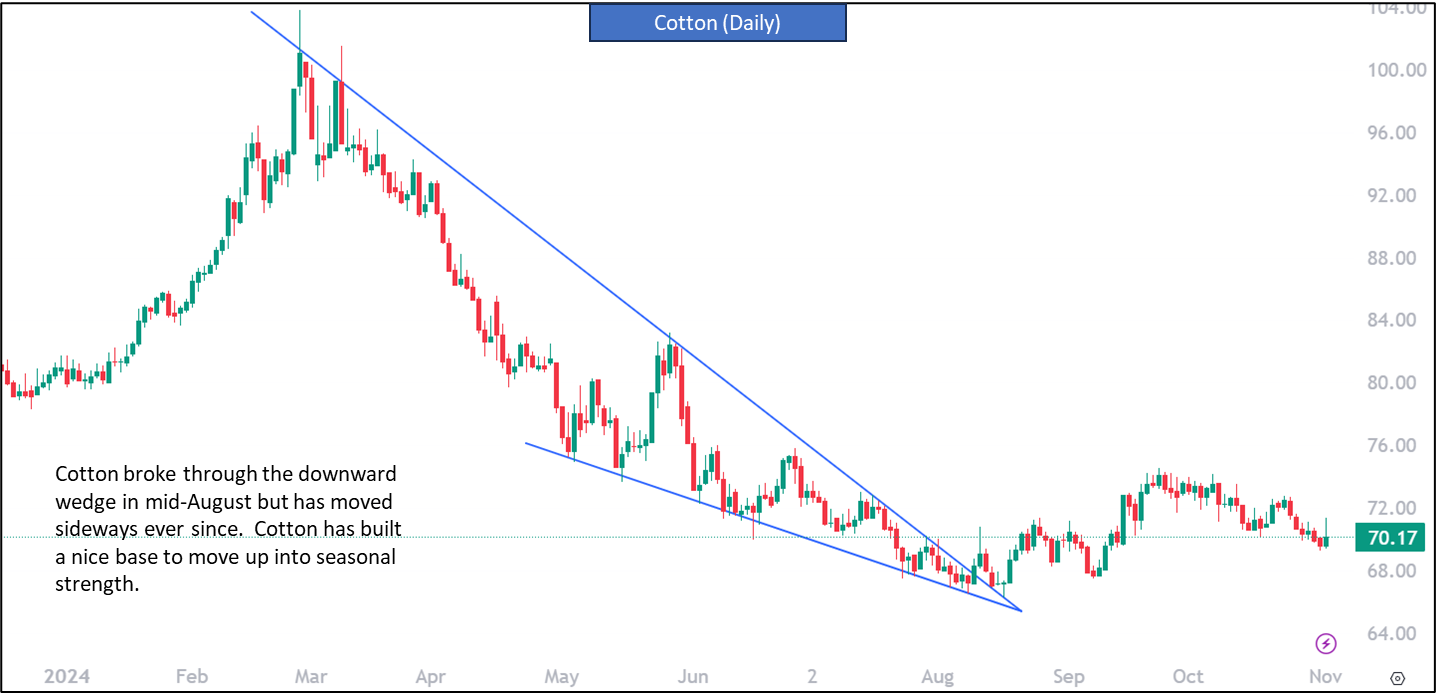

Technical Analysis: Cotton broke through the downward wedge in mid-August but has been moving sideways ever since. Cotton has built a nice base to move up into seasonal strength.

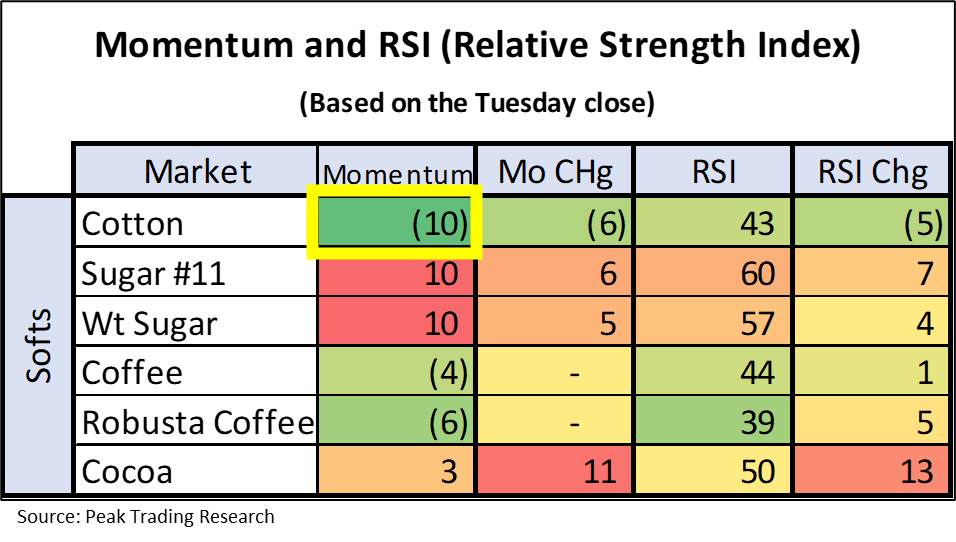

CTA Momentum: The CTA Positioning and Momentum Score is an accurate measure of current momentum and trend-following trader positioning using a (+10 / -10 scale). Momentum and trend following traders represent a large percentage of trading and can move markets significantly higher or lower. Cotton has a minimum (10) score indicating that CTAs are minimally invested and have plenty of trading capital to cover shorts or add new longs.

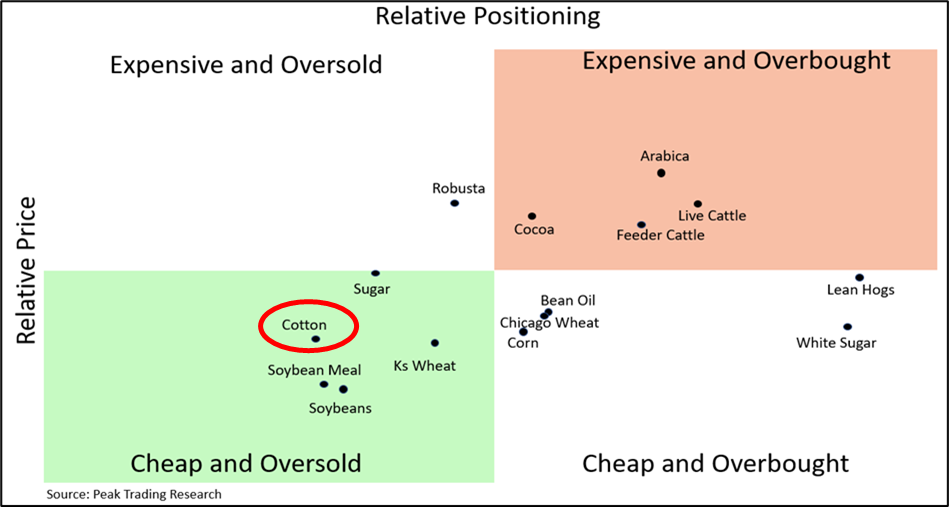

Relative Price and Positioning: The horizontal axis represents oversold versus overbought for relative positioning. COT current net position is compared to COT data over the past 24 months. The vertical axis shows cheap versus expensive for relative price. A comparison is made between the front month current price and the front month price over the past 24 months. Cotton is one of the most ‘Cheap and Oversold’ markets in the agriculture complex.

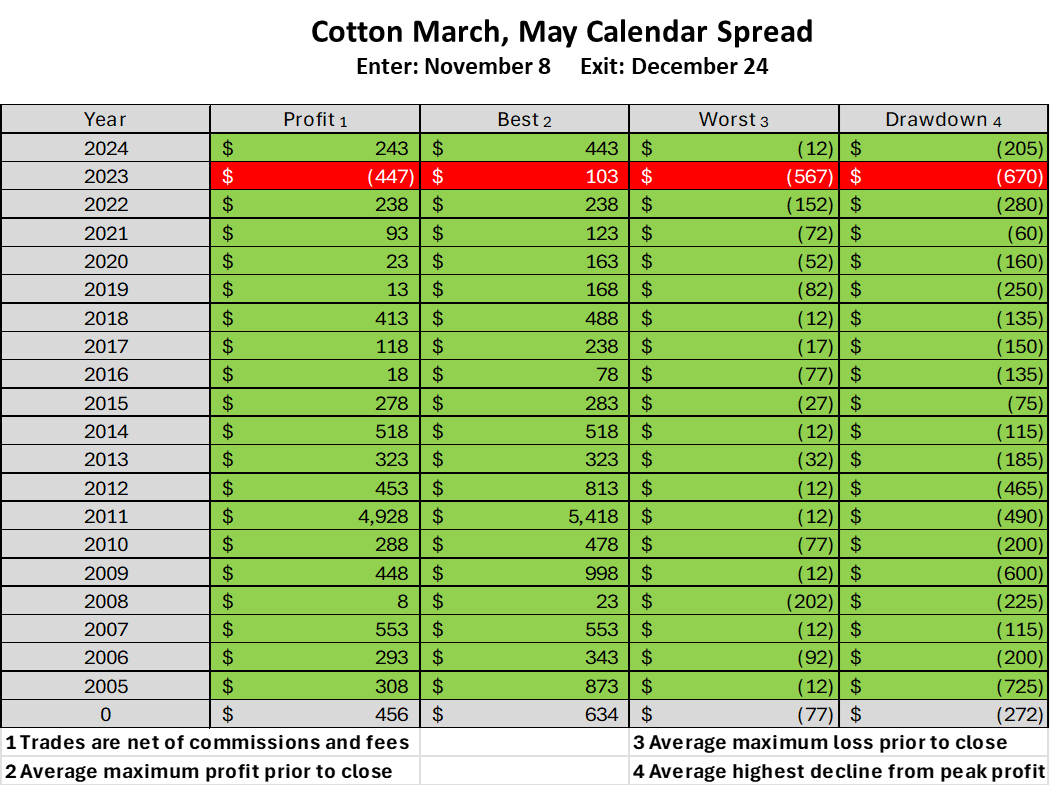

Seasonality: Seasonality data is generated by SeasonAlgo. Entry and exit dates are analyzed and scored for every expiration month combination. The Cotton March, May calendar spread has hypothetically profited in 19 of the past 20 years (net of fees and commissions). Disclaimer: HYPOTHETICAL PERFORMANCE RESULTS HAVE MANY INHERENT LIMITATIONS, SOME OF WHICH ARE DESCRIBED BELOW.No representation is being made that any account will or is likely to achieve profits or losses similar to those shown. In fact, there are frequently sharp differences between hypothetical performance results and the actual results subsequently achieved by any particular trading program. One of the limitations of hypothetical performance results is that they are generally prepared with the benefit of hindsight. In addition, hypothetical trading does not involve financial risk, and no hypothetical trading record can completely account for the impact of financial risk in actual trading. For example, the ability to withstand losses or to adhere to a particular trading program in spite of trading losses are material points which can also adversely affect actual trading results. There are numerous other factors related to the markets in general or to the implementation of any specific trading program which cannot be fully accounted for in the preparation of hypothetical performance results and all of which can adversely affect actual trading results.

Spread Charts represent the difference between front and back month contracts. It is simply the front month price minus the back month price. Spreads sold profit when the price gets more negative or less positive. Spreads bought profit when prices get more positive or less negative. To trade Cotton, I will buy the March, May calendar spread. The optimal entry date is Friday 11/8 based on the past 15 years of historical data.