Texas Instruments (TXN), a legacy semiconductor giant with a market cap of $188.4 billion, designs, manufactures, and sells chips for industries like industrial, automotive, electronics, communications equipment, and enterprise systems. It operates through two primary business segments: Analog offers power products such as battery-management solutions, switching regulators, power switches, and lighting products to manage power requirements. Embedded Processing offers microcontrollers, digital signal processors, and application processors for computing activity. TXN is a dividend stock that has generated massive wealth for shareholders. In the last 20 years, TXN stock has returned 821% to shareholders. Adjusting for dividend reinvestments, cumulative returns are much closer to 1,300%. With over two decades of consistent dividend growth, let’s see if you should invest in this future Dividend Aristocrat after its Q3 earnings. How Did Texas Instruments Perform in Q3 of 2024?

Texas Instruments reported Q3 2024 revenue of $4.15 billion, with adjusted earnings of $1.47 per share, exceeding Wall Street’s expectations of $4.1 billion and $1.36 per share, respectively.

Compared to the year-ago quarter, where Texas Instruments reported revenue of $4.53 billion and adjusted earnings of $1.80 per share, there was a decline of 8% in sales and a 21% reduction in adjusted earnings over the last 12 months.

The decline in sales and earnings for eight consecutive quarters is attributed to cyclical softness in the chip industry, especially for companies with significant exposure to the automotive sector.

Texas Instruments reported Q3 sales of $5.08 billion and earnings of $1.49 per share. Wall Street anticipates the company’s sales and earnings to decline until Q1 of 2025. Currently, Texas Instruments pays shareholders a quarterly cash dividend of $1.36 per share, resulting in a forward yield of 2.63%, which is more generous than the average SPX yield. The 5-year dividend growth rate is a healthy 11%. These payouts have increased consecutively for 21 years, putting TXN on track to become a Dividend Aristocrat by the end of this decade.

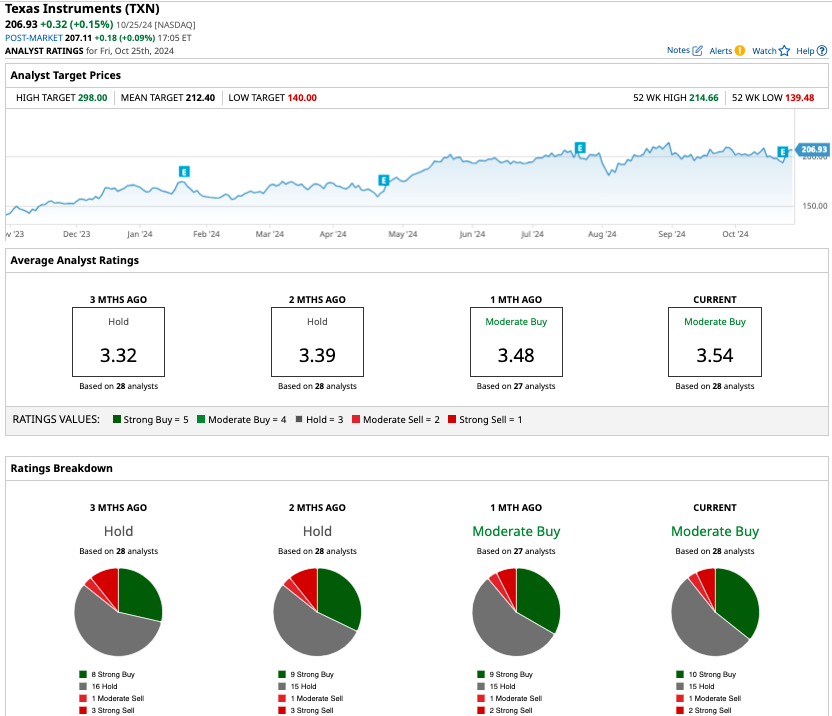

How Do Analysts Rate TXN Stock? After its latest quarterly results, Texas Instruments received a mix of brokerage notes. Analysts at Summit upgraded Texas Instruments stock to ‘outperform’ as they expect the company to grow earnings and recover from higher demand when the current downcycle ends in 2025.The chipmaker is witnessing a recovery in demand across end markets like personal computers, smartphones, consumer, enterprise systems, and communications infrastructure. However, end-markets such as industrial and automotive remain mixed. Analysts anticipate that strong EV demand will act as a tailwind for TXN. Summit believes that cyclical demand recovery across non-industrial verticals will result in outperformance in earnings next year. Separately, Benchmark reiterated a “Buy” rating on TXN with a target price of $230. The investment firm thinks its elevated inventory level should help TI compete aggressively for sockets while demonstrating its supply and capacity strengths in core markets. On the other hand, Morgan Stanley is much less enthusiastic. It backed an “Underweight” rating on the tech stock and raised its target price to $167 from $154, which is still below current prices.

Morgan Stanley analyst Joseph Moore anticipates that robust automotive demand from China will positively affect Texas Instruments in the near future. However, the firm estimates that Texas Instruments (TXN) will report sales of $3.98 billion and earnings of $1.29 per share in the current quarter, which is below the consensus forecasts.

TD Cowen takes a more neutral stance, maintaining a ‘Hold’ rating on TXN stock with a price target of $200. They suggest that the next two quarters are seasonally weak for TXN, indicating that revenue stability may not occur until Q2 of 2025.

The overall market consensus on TXN is a ‘Moderate Buy’, as per the 28 analysts covering the stock. The mean price target is $212.40, suggesting a potential upside of just 3% from the current levels.

Analysts project that Texas Instruments will conclude 2024 with adjusted earnings of $5.10 per share, a decrease from $7.

Considering whether to invest in TXN stock after its Q3 earnings report? In 2023, the company is expected to earn $0.07 per share, and by 2025, this is forecasted to rise to $5.92.

Currently, TXN stock is valued at 35 times its forward earnings, which might seem high when considering the stock’s cyclical nature.