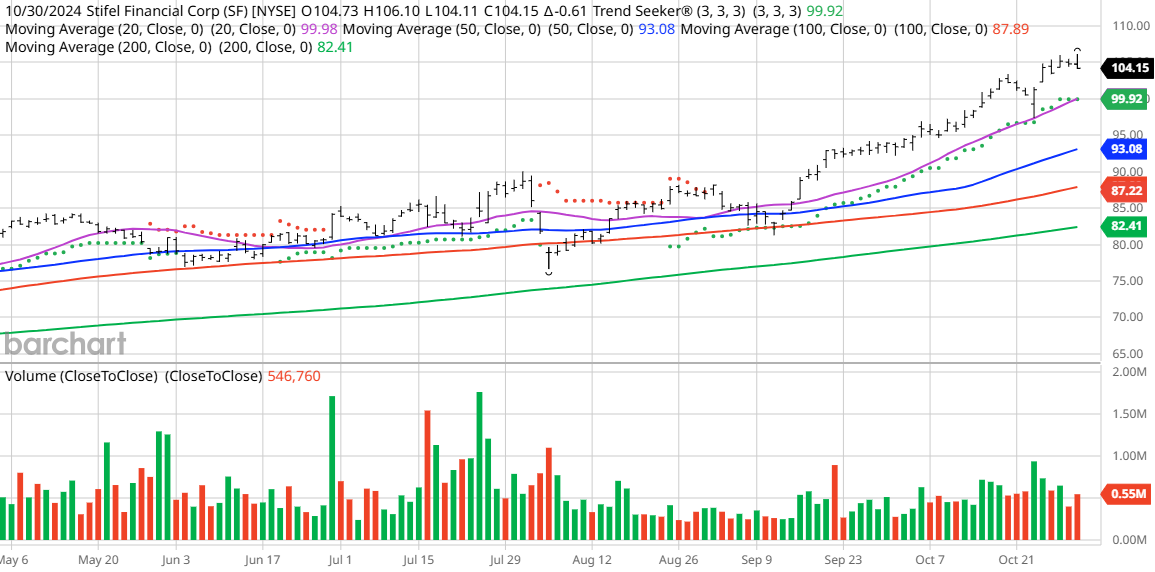

The Chart of the Day is for the financial services stock Stifel Financial (SF). I discovered the stock by utilizing Barchart’s powerful screening functions to find stocks with the highest technical buy signals, highest Weighted Alpha, superior current momentum, and having a Trend Seeker buy signal. Then, I used the Flipchart feature to review the charts for consistent price appreciation. Since the Trend Seeker signaled a buy on 8/30, the stock has gained 18.16%. Stifel Financial Corp. is a financial services and bank holding company. It provides retail and institutional wealth management and investment banking services to individual investors, corporations, municipalities, and institutions in the United States and internationally. It operates in three segments: Global Wealth Management, Institutional Group, and Other.

Stifel, established in 1890 and headquartered in Saint Louis, Missouri, offers a comprehensive range of financial services. The company specializes in private client services, encompassing securities transactions and financial planning. Additionally, it provides institutional equity and fixed income sales, trading, research, and municipal finance services.

Investment banking is another forte of Stifel, which includes services such as mergers and acquisitions, public offerings, and private placements. The company also extends its reach to retail and commercial banking, offering personal and commercial lending programs along with deposit accounts.

Stifel is actively involved in the underwriting of corporate and public finance and delivers financial advisory and securities brokerage services. Barchart’s Opinion Trading systems, which are updated live every 20 minutes during market sessions, reflect the company’s performance and can change throughout the day as the market fluctuates.

Stifel has recently achieved new highs, with its stock performance reflecting strong technical indicators and positive fundamental factors.

**Technical Indicators:**

– 100% technical buy signals

– Weighted Alpha of 72.79, indicating a significant gain

– A remarkable 83.10% gain in the last year

– Trend Seeker buy signal at 1.09

– 60-month Beta, showing stability in market fluctuations

– Above its 20, 50, and 100-day moving averages

– 15 new highs achieved, with a 10.92% increase in the last month

– Relative Strength Index at 71.00%, suggesting strong momentum

– Technical support level at $103.47

– Recently traded at $104.15 with a 50-day moving average of $93.08

**Fundamental Factors:**

– Market Cap of $10.74 billion

– P/E ratio of 17.26, indicating a reasonable valuation

– Dividend yield of 1.55%, providing a steady income

– Revenue expected to grow by 11.60% this year and 9.10% next year

– Earnings estimated to increase by 38.50% this year, 17.70% next year, and continue to grow at a compounded annual rate of 14.18% for the next 5 years

**Analysts and Investor Sentiment:**

– Wall Street analysts have given 2 strong buy and 5 hold opinions on the stock

– Price targets range from $98 to $113

– Value Line rates the stock with an average rating of 3 and a price target of $108

– CFRA’s MarketScope rates the stock as a hold

– MorningStar gives the stock a below average rating of 2 with a fair value of $86, which is 21% overvalued

– 4,750 investors are monitoring the stock on Seeking Alpha

**Additional Disclosure:**

– The Barchart Chart of the Day features stocks experiencing exceptional current price appreciation.

Stifel has recently hit new highs, but these stocks are highly volatile and speculative.

It is important to approach such investments with caution. Should you choose to include these stocks in your portfolio, it is highly recommended to follow a predetermined diversification strategy and maintain a consistent moving stop loss discipline. This strategy should align with your personal investment risk tolerance and be reassessed at least on a weekly basis.