The natural gas market is undergoing a significant transformation in 2024, presenting lucrative opportunities for investors seeking dividend yields. As global demand for natural gas is anticipated to rise by 2.5% this year, there is a robust recovery from previous market challenges. This growth is occurring amidst a substantial shift in market dynamics, particularly in the U.S., where natural gas is projected to act as a pivotal ‘bridge fuel’ to supply data centers while nuclear energy and other alternative sources are scaled up.

Bank of America has recently reinitiated coverage of natural gas companies, highlighting that many stocks in this sector appear to be undervalued. Specifically, EQT Corporation (EQT) and Exelon Corporation (EXC) have been identified for their compelling risk profiles, with a market valuation that ‘discounts just $3.’

In the financial market, energy stocks can offer lucrative dividends. This November, two overlooked energy dividend stocks present significant buying opportunities. According to Bank of America (BofA), the projected buildout of liquefied natural gas (LNG) could boost domestic demand by 16%, potentially ‘tethering U.S. fundamentals to the global market.’ With a forward curve closer to $3.75, these energy stocks are prime for investment.

Let’s delve into the top energy dividend picks for this month.

#1. EQT Corporation (EQT)

EQT Corporation (EQT), with a market capitalization of $17.03 billion, stands as the largest natural gas producer in the United States. Primarily operating in the Appalachian Basin, which includes Pennsylvania, West Virginia, and Ohio, EQT focuses on the responsible development of natural gas resources using advanced drilling and production methods. Despite a 4.8% decline in EQT stock year-to-date, it has impressively gained 232% over the past five years.

Investors seeking overlooked energy dividend stocks should consider EQT Corporation. The company boasts a forward dividend yield of 1.63%, supported by a payout ratio of 47%. EQT has impressively increased its dividend for two consecutive years following a pause during the pandemic era, with a quarterly dividend of $0.157 per share.

EQT’s recent earnings report demonstrates robust performance, with sales volume reaching 581 billion cubic feet equivalent (Bcfe), exceeding expectations. The company’s capital expenditures were $573 million, which is below its guidance range, and its operating costs were even better than anticipated at $1.07 per thousand cubic feet equivalent (Mcfe).

Looking ahead to the fourth quarter of 2024, EQT projects total sales volume to be between 555 and 605 Bcfe, with an average price differential ranging from ($0.60) to ($0.50) per thousand cubic feet (Mcf). Two significant developments underscore EQT’s potential for growth and value creation, making it a compelling option for investors in the energy sector.

Investors seeking overlooked energy dividend stocks should consider the following two opportunities this November.

Firstly, EQT Corporation has solidified its position as America’s only large-scale, vertically integrated natural gas business by completing the Equitrans Midstream acquisition. This move is projected to establish a breakeven price for free cash flow around $2.00 per million British thermal units (MMBtu).

Secondly, EQT is progressing in its plans to produce clean hydrogen and low-carbon aviation fuel from its Appalachian natural gas resources. These initiatives could open up new revenue streams and enhance the company’s sustainability efforts.

Analysts are bullish on EQT, with a consensus rating of “moderate buy.” Among 20 analysts, 11 have rated it as a “strong buy,” one as a “moderate buy,” and eight as a “hold.” The average price target is $42.19, indicating an expected upside of approximately 15.5% from the current price.

#2. Exelon Corporation (EXC)

Exelon Corporation (EXC) is a prominent utility services holding company specializing in energy generation, delivery, and marketing.

Exelon, a company that emphasizes clean energy solutions, operates through several subsidiaries, including ComEd, which provides electricity to about 4.1 million customers in northern Illinois.

In 2024, Exelon’s stock has demonstrated resilience, gaining 9.5% year-to-date. Over the longer term, EXC has seen an increase of 24.3% in the past five years.

Exelon offers an appealing forward dividend yield of 3.83%, calculated based on its quarterly payout of $0.38 per share. The company has a consistent track record of paying dividends for 22 consecutive years, with two consecutive years of growth.

In its Q3 2024 earnings report, Exelon reported a GAAP net income of $0.70 per share and adjusted operating earnings of $0.71 per share. The company reaffirmed its full-year 2024 adjusted operating earnings guidance range of $2.40 to $2.50 per share and maintained a target for compounded annual growth of 5-7% through 2027.

This November, investors seeking to diversify their energy portfolios might consider overlooked stocks like Exelon. Recent developments have made Exelon an appealing option. Specifically, ComEd, an Exelon company, has received $50 million in federal funding from the Department of Energy (DOE) to enhance grid resilience and support clean energy investments in Illinois. This initiative is expected to total $116 million over five years.

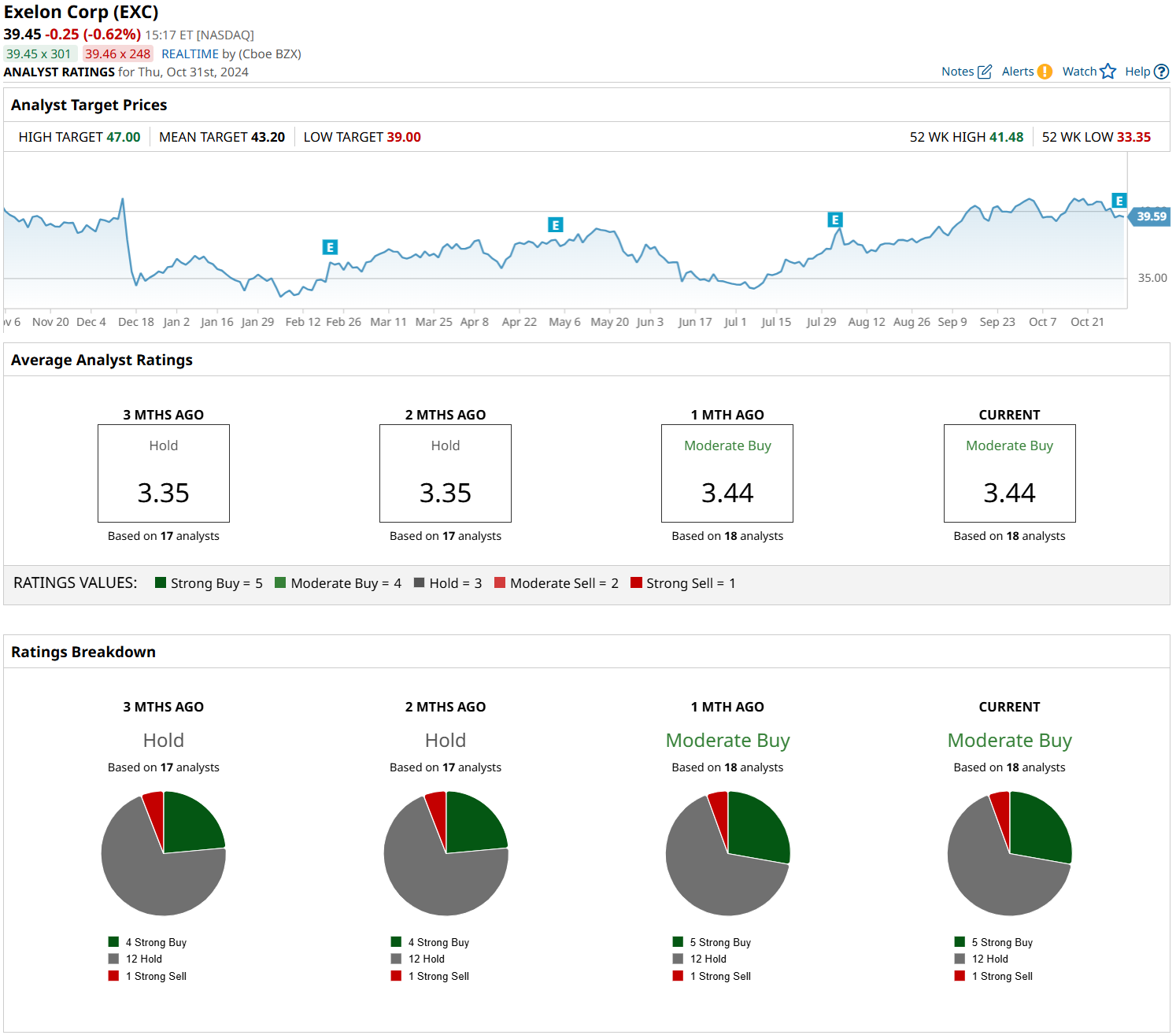

Analysts hold a cautiously optimistic view on Exelon, with an overall rating of a “moderate buy”. Among 18 analysts, five recommend a “strong buy”, 12 suggest a “hold”, and one rates it as a “strong sell”. The average target price is $43.20, which indicates a potential upside of about 9.9% from Thursday’s closing price. This consensus indicates that while Exelon may not be seen as a high-growth stock, its stability and reliable dividends offer an overlooked opportunity for conservative investors looking for steady returns this November.In November, investors seeking opportunities in the energy sector should not overlook EQT Corporation and Exelon Corporation. EQT Corporation demonstrates strong recovery momentum and strategic moves in the natural gas market, making it an attractive choice for those looking to invest in energy stocks.

Exelon Corporation, on the other hand, is recognized for its steady growth and commitment to clean energy, positioning it as a promising long-term investment. Both companies offer dividend-paying stocks that are well-positioned for long-term gains, providing solid income potential along with room for growth. For investors seeking overlooked energy stocks with potential for income and growth, EQT Corporation and Exelon Corporation might be worth considering for their portfolios.