Investing in growth stocks can be a lucrative strategy, albeit with inherent risks. These stocks may experience short-term volatility, but for those with a long-term investment horizon, the potential for significant returns is substantial.

### Uber Technologies

Uber Technologies (UBER) started as a ride-hailing service but has since diversified into a technology conglomerate. The company now dominates in mobility, food delivery, and freight sectors and is actively expanding into business, healthcare, autonomous vehicle technology, and artificial intelligence (AI).

Uber operates one of the largest ride-hailing and delivery networks globally, positioning it as a key player in the evolving technology landscape.

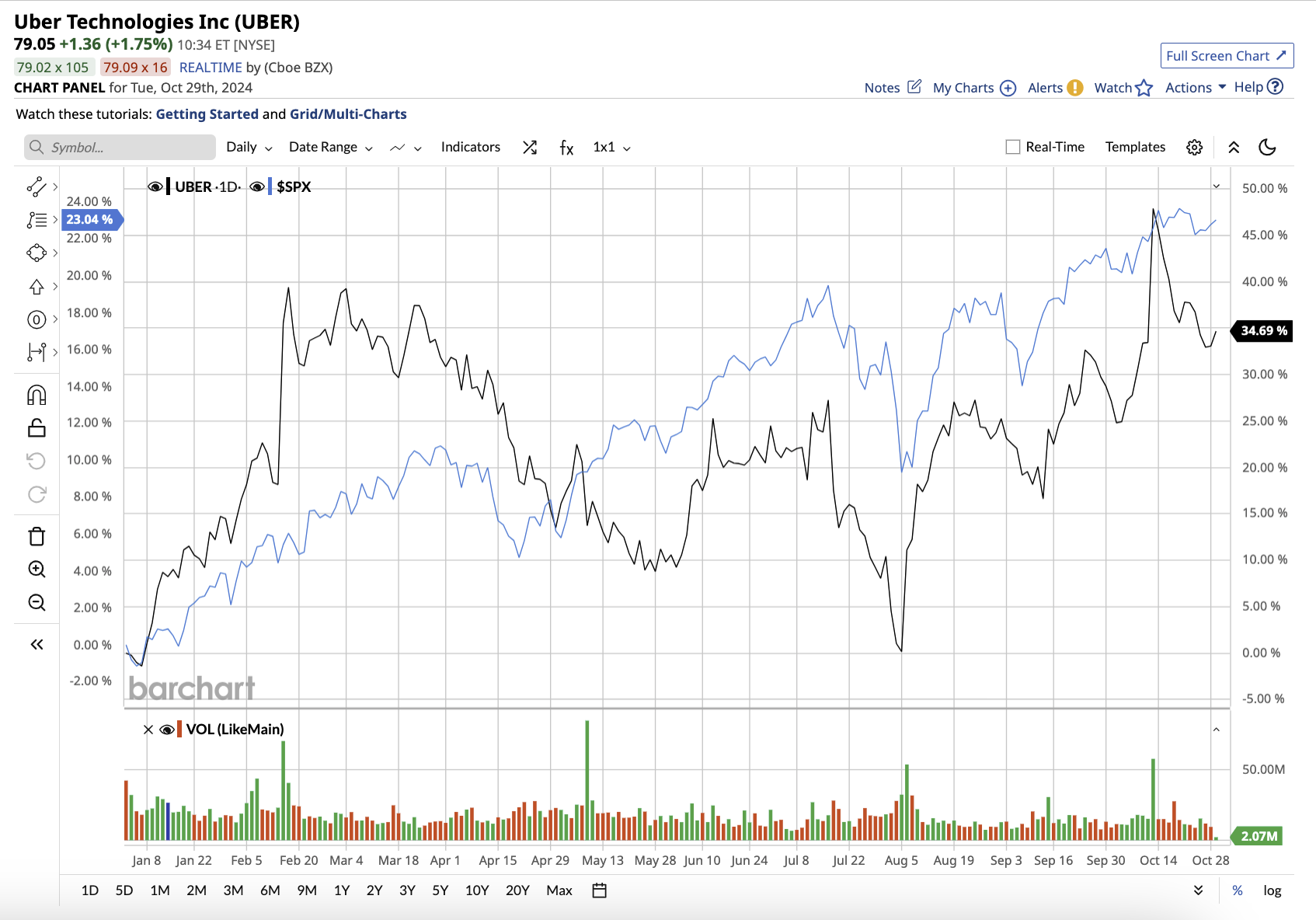

Uber has extensive reach and strong brand recognition, giving it an edge over smaller competitors. As of 2024, Uber stock has gained 28.6% year-to-date, while the S&P 500 Index ($SPX) has gained 22.3%. The ride-hailing service remains Uber’s most profitable business. Uber has witnessed strong revenue growth, driven by the recovery of the mobility business post-pandemic and continued demand for delivery services. In the most recent second quarter, Uber’s total revenue grew 16% year-over-year to $10.7 billion, with a 19% increase in gross bookings to $40 billion. Total trips rose by 21% to 2.8 billion. In Q2, mobility and delivery revenue increased in double digits, but freight revenue remained unchanged from the prior-year quarter. Active platform consumers stood at 156 million.

Investors seeking promising growth stocks for the next decade or longer should consider the following two companies.

Firstly, a company has reported a remarkable quarter with advertising revenue surpassing $1 billion, leading to a net profit of $1 billion. This achievement is a testament to its financial strength and growth potential.

Secondly, Uber has been making strategic moves to expand its food delivery business. It has acquired Delivery Hero SE’s foodpanda delivery business in Taiwan and entered into a strategic partnership with Instacart (CART). These moves are part of Uber’s broader expansion strategy.

Recently, Uber announced a multiyear strategic partnership with Avride to integrate delivery robots and autonomous vehicles into Uber and Uber Eats in the U.S. This partnership follows Uber’s collaboration with WeRide to introduce autonomous vehicles to the Uber platform in the UAE, starting with Abu Dhabi later this year.

Uber’s robust financial position, which includes $6.3 billion in unrestricted cash, cash equivalents, and short-term investments, along with a $1.7 billion free cash flow (FCF) balance, positions the company well for continued diversification and expansion of its operations.

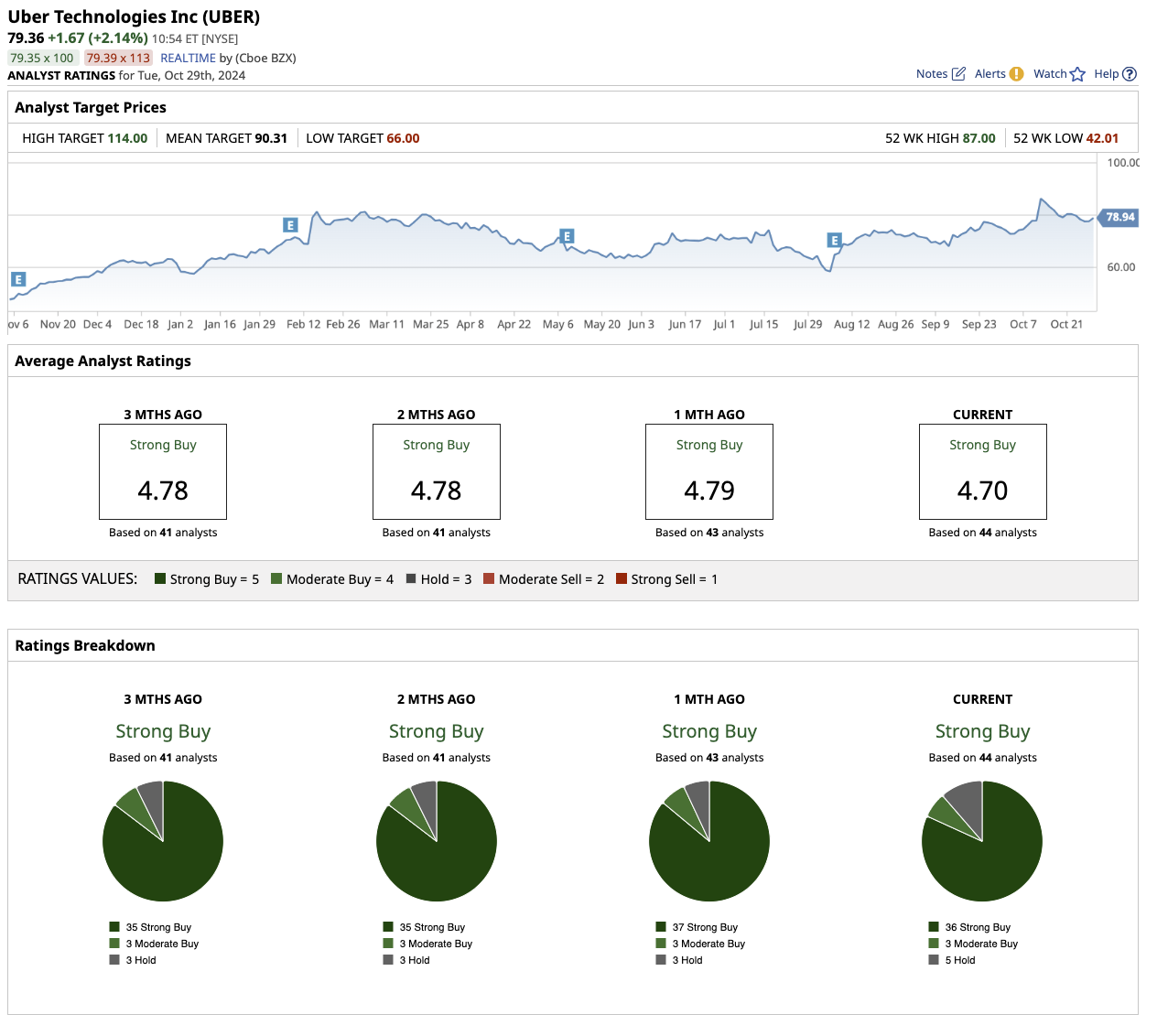

Investors seeking promising growth stocks for the long term should consider Uber Technologies, Inc. (UBER). Analysts predict that UBER’s earnings per share (EPS) will experience robust growth, increasing by 23% to $1.07 in 2024 and surging by 108% to $2.23 in 2025. Despite trading at a forward multiple of 34.9x based on 2025 earnings estimates, which may suggest a premium valuation, Uber’s transformative impact on the ride-hailing and delivery sectors, coupled with its ambitious expansion into autonomous vehicles and AI, positions it as a potential leader in the tech industry.

Uber’s growth potential is further supported by Wall Street’s positive outlook. Out of 44 analysts covering UBER, 36 have rated it a ‘strong buy,’ three have given it a ‘moderate buy’ recommendation, and five have suggested a ‘hold.’ The stock’s mean price target is $90.31, indicating a potential 14% increase from its current levels.#1. [Stock Name Unmentioned]. Its Street-high estimate of $114 indicates the stock might rally by up to 43.9% in the next 12 months.

#2. Avidity Biosciences (RNA). Avidity Biosciences is a cutting-edge clinical-stage biotechnology company that focuses on developing RNA-based therapeutics for rare muscle disorders. Its AOC (Antibody-Oligonucleotide Conjugates) platform combines antibodies and oligonucleotides. Avidity stock has soared 392.5% year-to-date, outperforming the broader market. The AOC program targets rare disorders such as myotonic dystrophy type 1 (DM1), facioscapulohumeral muscular dystrophy (FSHD), and Duchenne muscular dystrophy (DMD) with few treatment options. Currently, the company is testing AOC 1001, its lead candidate, for DM1, a genetic muscle disorder.Avidity, a company in the clinical stage, has recently initiated a global Phase 3 trial in June and received positive preliminary results from the Phase 1/2 EXPLORE44 trial for AOC 1044 (Del-zota) for DMD and AOC 1020 for FSHD.

In addition to its focus on genetic muscular disorders, Avidity plans to launch a cardiology pipeline in Q4 of this year, which could be a significant long-term growth driver if successful.

Despite not yet generating product revenue, Avidity relies on cash reserves and collaboration revenues, including agreements with larger biopharma companies like Eli Lilly (LLY) and Bristol-Myers Squibb (BMY), for milestone payments and R&D funding to sustain operations.

In the second quarter, RNA reported $2 million in collaboration revenue.

Avidity, with $1.3 billion in cash reserves during Q2, is a promising biotech stock in the RNA therapeutics sector. Despite the inherent risks of clinical-stage biotech companies, Avidity’s positive clinical trial results and strong cash position make it an attractive option for long-term, risk-tolerant investors who are bullish on the future of RNA therapeutics.

On Wall Street, RNA stock is highly regarded as a ‘strong buy.’ Out of 10 analysts, nine have given it a ‘strong buy’ rating, while one has a ‘moderate buy’ recommendation. The stock’s mean price target is $70, suggesting a potential increase of up to 57% from its current levels. Furthermore, the highest estimate of $96 indicates that RNA stock could potentially surge by as much as 115.4% within the next 12 months.