Investors seeking a dependable income stream from their investments can turn to Dividend Aristocrats (NOBL), a group of companies with a strong track record of growing earnings and cash flows through various economic cycles. These companies, part of the S&P 500 Index ($SPX), have a history of increasing their dividend distributions for at least 25 consecutive years.

Among the elite group of Dividend Aristocrats, Realty Income (O) and Altria (MO) stand out, each offering investors a yield of over 5%. These companies are known for their reliable dividend payouts and have a high likelihood of continuing to raise dividends in the future.

To enhance the income potential of your investment portfolio, let’s delve deeper into these two dividend stocks, which can provide a substantial yield of more than 5%.

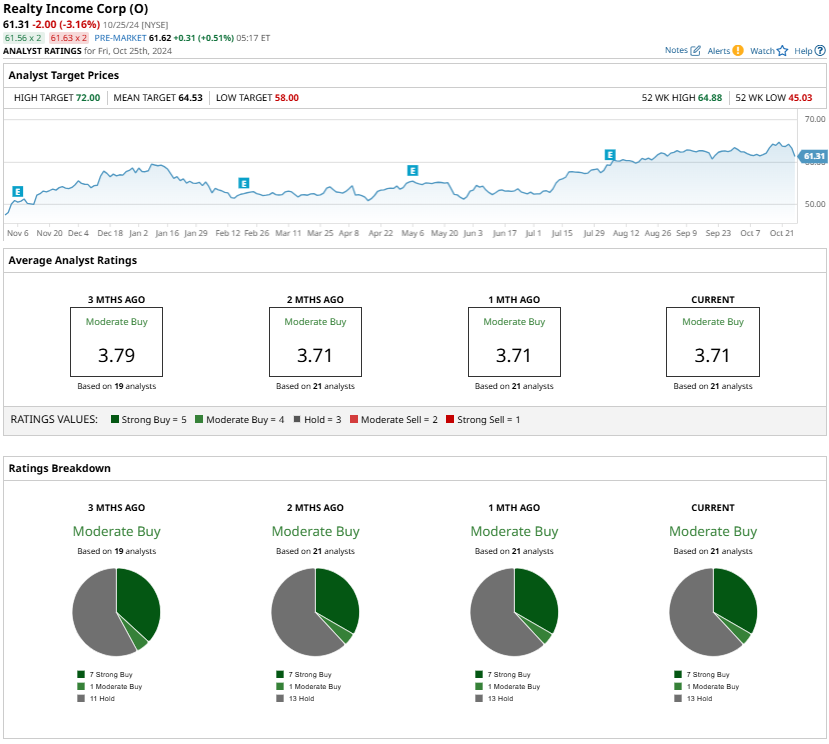

#1. Realty Income. Realty Income (O) is one of the most reliable Dividend Aristocrats when it comes to dependable dividend-paying stocks. The REIT (Real Estate Investment Trust) recently increased its monthly cash dividend to $0.2635 per share from $0.2630. This results in an annualized dividend of $3.162 per share, up from $3.156, demonstrating the company’s commitment to providing greater value to shareholders. Notably, this is the 127th increase in Realty Income’s dividend since it went public in 1994. Moreover, with a 30-year consecutive record of raising dividends, Realty Income is a compelling choice for passive income investors. The company’s payouts are backed by its solid real estate portfolio, which consistently generates significant earnings and cash flows.

Realty Income, as of June 30, 2024, owns or has an interest in 15,450 properties leased to 1,551 clients across 90 different industries.

This diverse portfolio includes commercial properties under long-term net lease agreements, with an average remaining lease term of approximately 9.6 years.

#2. Altria

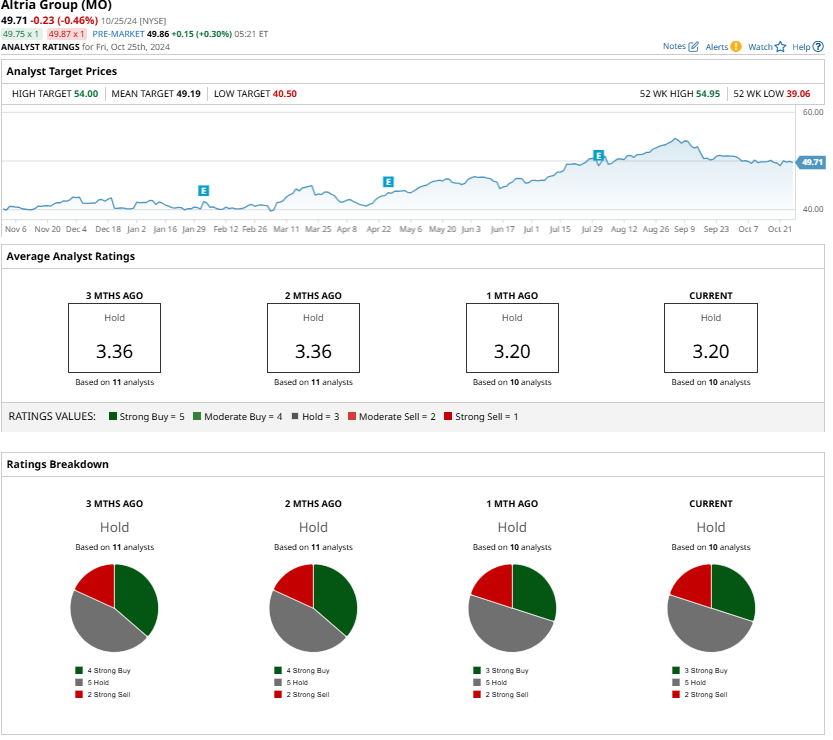

Altria (MO), a leading Dividend Aristocrat, is renowned for its strong dividend growth history and attractive yield. This prominent tobacco company is committed to enhancing shareholder value by consistently rewarding investors with higher dividends. Recently, Altria increased its quarterly dividend by 4.1% to $1.02 per share. This marked the 59th dividend hike in the last 55 years, reflecting its ability to grow earnings in all market conditions and return cash to investors. With a strong foothold in the tobacco industry, Altria continues to see earnings growth, supporting its capacity to pay and raise dividends. Additionally, the company is exploring opportunities in the smoke-free product market and has plans for significant growth by 2028.Management anticipates a significant increase in U.S. smoke-free volumes. Net revenues from these products are expected to double. Altria forecasts mid-single-digit growth in adjusted earnings per share (EPS) through 2028. This will lay the foundation for future dividend increases. Management also aims for a similar mid-single-digit growth rate in dividends. Additionally, Altria is focused on reducing its debt to strengthen its balance sheet and capitalize on new growth avenues. Wall Street analysts have a “Hold” consensus rating on Altria stock. However, its growing earnings base, solid dividend payment and growth history, visibility over future payouts, and a compelling yield of 8.2% make it a powerful income stock.