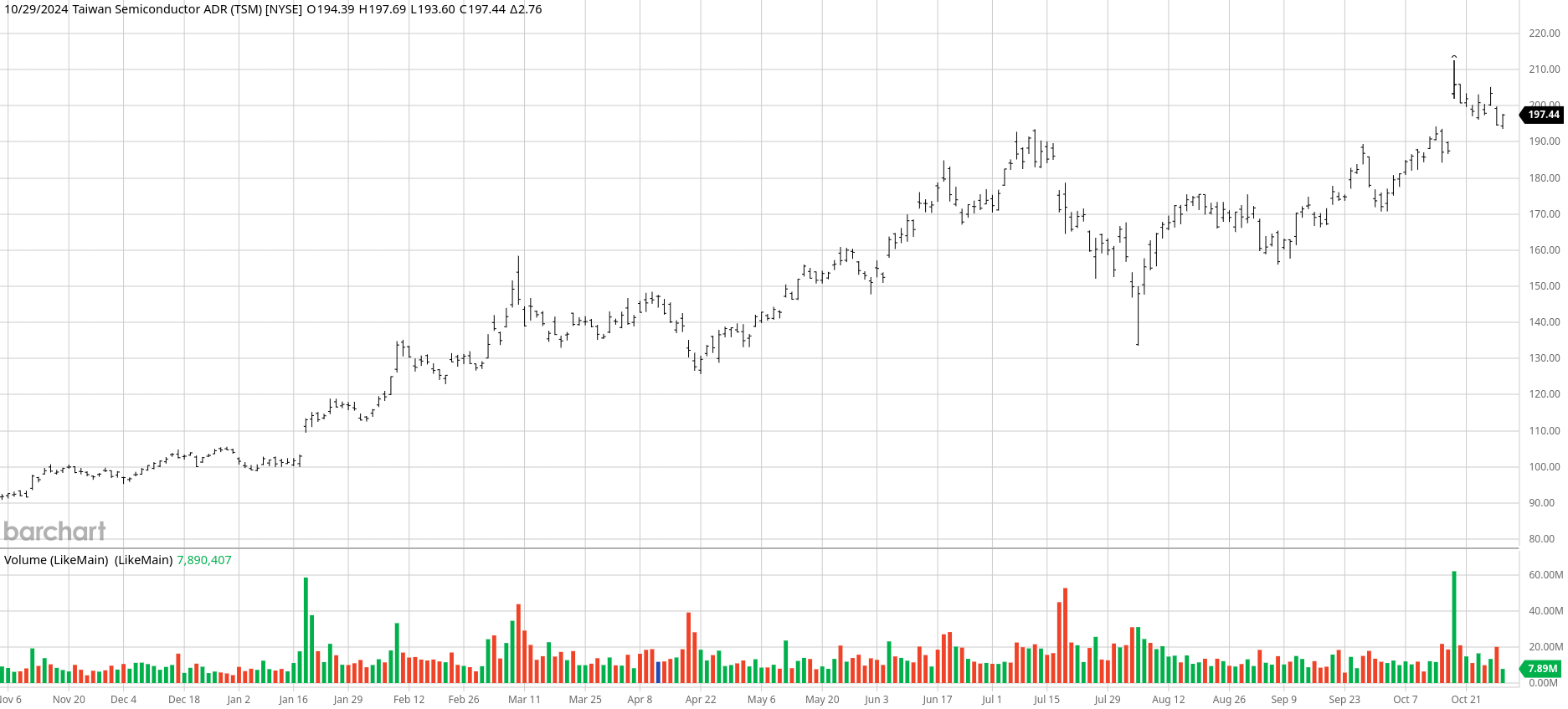

Taiwan Semiconductor Manufacturing Company (TSM), the world’s largest dedicated contract chip manufacturer with over 60% market share. Artificial Intelligence technology concept by NicoEINino via Shutterstock. TSM recently reported outstanding results, pushing its stock to a record high. It has been one of the biggest beneficiaries of the global race to develop artificial intelligence (AI). Since the debut of OpenAI’s ChatGPT in late 2022, its shares have more than doubled. For the third quarter, the company reported a 54% year-on-year jump in net profit to $10.1 billion, exceeding its forecast from just three months ago. Management also raised its growth outlook on the back of the AI boom and a broad-based recovery in other sectors, defying market jitters over the longevity of the current semiconductor industry upcycle.

Taiwan Semiconductor, also known as TSMC, dominates production of cutting-edge semiconductors. Chair and CEO CC Wei told investors that they continue to observe extremely robust AI-related demand. Taiwan Semiconductor expects revenue to grow nearly 30% this year, up from the previous projection in the mid-20% range. It expects revenue of $26.1 billion to $26.9 billion in the final quarter, raising the prior estimate for $24.9 billion. This robust outlook is in stark contrast to what was said by ASML Holding NV (ASML), the Dutch company that supplies lithography machines used to make the world’s most advanced chips. ASML reported orders that were half of Wall Street expectations, with the shortfall due to weakness at Samsung and Intel (INTC).

TSM Is Different. It appears to be isolated from the weakness in other parts of the semiconductor industry.

Taiwan Semiconductor Manufacturing Company (TSMC) remains a compelling investment in the semiconductor industry. Analysts predict a significant increase in revenue from AI server processors, with expectations for a tripling of sales in 2024, contributing to a substantial percentage of total sales.

TSMC’s broad business scope is evident in its production of chips for over 500 companies, including cutting-edge AI processors for Nvidia (NVDA) and iPhone chips for Apple (AAPL). This diverse client base provides TSMC with unparalleled scale and balance in the market. The company’s robust third-quarter performance, with revenue, gross margins, and operating margins surpassing initial forecasts, was driven by a resurgence in demand across various sectors, such as smartphones, industrial applications, and automotive chips. Looking ahead, TSMC is aggressively expanding internationally to achieve geographic diversification. The company is planning additional factories in Europe, with a focus on the AI chip market, complementing ongoing construction projects in Japan, Germany, and Arizona.Let’s take a quick look at Taiwan Semiconductor’s U.S. factory in Arizona. There has been huge progress in Arizona. Taiwan Semi achieved early production yields at its first plant in Arizona that exceeded similar factories in Taiwan. This is significant as the U.S. expansion project was initially plagued by delays and worker strife. The share of usable chips manufactured at its Phoenix facility is about 4 percentage points higher than comparable facilities in Taiwan. The success rate or yield is a critical measure in the semiconductor industry as it determines whether companies can cover the enormous costs of a chip plant. The first of three planned factories entered engineering wafer production in April with 4-nanometer process technology. The latest yield advancement is especially notable as the company has historically kept the most advanced and efficient plants in Taiwan only.

Taiwan Semiconductor Manufacturing Company (TSM), the world’s largest dedicated contract chip manufacturer, holds over a 60% market share.

TSM has been a significant beneficiary of the global push towards artificial intelligence (AI) development, with its shares more than doubling since the AI boom began in late 2022 with the launch of OpenAI’s ChatGPT. Recently, TSM reported exceptional results, leading to a record high in its stock value. The company announced a 54% year-on-year increase in net profit, reaching $10.1 billion for the third quarter, surpassing its previous forecast. TSM’s management has raised its growth expectations due to the ongoing AI boom and a broad-based recovery across various sectors, despite concerns about the longevity of the current semiconductor industry cycle.Taiwan Semiconductor, also known as TSMC, is a dominant player in the production of cutting-edge semiconductors. Despite the weakness observed in other parts of the semiconductor industry, TSMC appears to be isolated from these challenges.

CC Wei, the chair and CEO, informed investors that the company continues to witness extremely robust AI-related demand. He stated that TSMC expects revenue to grow nearly 30% this year, which is an increase from their previous projection in the mid-20% range.

The company anticipates revenue of $26.1 billion to $26.9 billion in the final quarter, which is a significant raise from the prior estimate of $24.9 billion. This positive outlook stands in stark contrast to ASML Holding NV (ASML), a Dutch company that supplies lithography machines for the production of the world’s most advanced chips. ASML reported orders that were half of Wall Street expectations, attributing the shortfall to weakness at Samsung and Intel (INTC).

Wei said he expects revenue from AI server processors to more than triple this year. In 2024, it is expected to lead to a mid-teens percentage of total sales. The results were broad-based. TSM produces chips for more than 500 companies, including the latest AI processors for Nvidia (NVDA) and iPhone chips for Apple (AAPL). This business model gives TSM unrivaled scale and balance. The company said its strong third-quarter performance, with revenue, gross margins and operating margins all exceeding earlier guidance, was supported by a recovery in demand across all segments, from smartphones to industrial applications and car chips. Longer-term, TSMC is pursuing a rapid international expansion to give it geographic balance. The company is planning more factories in Europe with a focus on the market for AI chips. This is on top of construction underway in Japan, Germany, and Arizona.

Investors may be interested in Taiwan Semiconductor’s recent achievements, particularly its U.S. factory in Arizona.

Huge Progress in Arizona: Taiwan Semi has made significant strides with its first plant in Arizona, achieving early production yields that surpass similar factories in Taiwan.

This U.S. expansion project, which was initially plagued by delays and worker disputes, has now shown remarkable progress. The facility in Phoenix, which manufactures chips, has a success rate that is about 4 percentage points higher than comparable facilities in Taiwan.

The success rate, or yield, is a critical measure in the semiconductor industry as it determines the ability of companies to cover the substantial costs associated with chip production.

The first of three planned factories began engineering wafer production in April, utilizing 4-nanometer process technology. This latest yield advancement is particularly noteworthy, as Taiwan Semiconductor has traditionally reserved its most advanced and efficient plants for its home base.

Taiwan Semiconductor Manufacturing Company (TSMC) remains a compelling investment option. During the recent earnings call, optimism was expressed about the U.S. push, with expectations for volume production of TSMC’s first fab to commence in early 2025. TSMC is confident in maintaining the same level of manufacturing quality and reliability in Arizona as in Taiwan.

Bloomberg Intelligence analyst Charles Shum commented on TSMC’s performance, highlighting their 57%-plus gross-margin guidance for the fourth quarter, which surpasses the consensus of 54.7%. This, along with the rapid increase in N3-node revenue, signals ongoing strong demand for TSMC’s AI chips, particularly from Nvidia and other major players. According to Shum, a sales growth of approximately 25% in 2025 appears attainable. This projection is underpinned by TSMC’s leadership in 3- and 5-nm process technologies and its advanced CoWoS proprietary semiconductor packaging technology.

I’m largely in agreement. Taiwan Semiconductor has a more than 90% share in leading-edge foundry processes (3- and 5-nanometer nodes). Its expanding gross margin outlook and leadership in AI chips, along with future investments supported by strong cash flow generation and net cash position (10% of assets as at end 2023), make its long-term earnings growth outlook resilient. High-performance computing will remain the company’s largest growth driver. The increasing in-house design of cloud computing and AI chips by U.S. and Chinese internet giants will benefit Taiwan Semiconductor for the next several years. Global tech groups all want their own homegrown chip. They may have the resources to design their own, but they must outsource manufacturing. That means the business of chip foundries – making the physical chips for other companies on a contract basis – now offers huge growth opportunities.

Taiwan Semiconductor’s stable business outside the realm of AI positions it more favorably compared to its competitors. This resilience allows the company to withstand any potential downturns in the market.

Investors are advised to consider purchasing TSM stock at any price below $202, as it continues to offer strong potential for growth and stability.