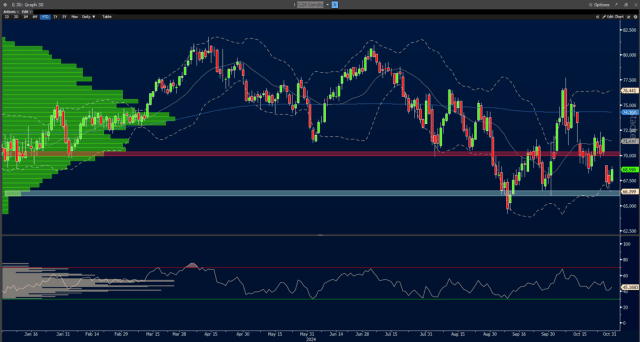

Yesterday, price action in the crude complex was muted as geopolitical headlines were calm. There has been a shift in middle-east rhetoric towards cooperation and ceasefire. Throughout the conflict, the trade has been to fade ceasefire talks, but it’s important to recognize they are happening. Overnight, price action has been stronger. WTI Crude Oil futures rallied 1.27 to 68.43 (+1.82%) after reports surfaced that OPEC+ could delay oil output hikes again. This makes sense as the Saudis have shown a preponderance to balance the market and willingness to do so. While still an unconfirmed report, it’s a headline worth paying attention to. Provided via Bloomberg. Estimates for today’s EIA report are as follows [thousand bbls]: Crude Oil: +1,805. Gasoline: +600. Distillates: -973. Last night, the API report showed the following [thousand bbls]: Crude Oil: -600. Gasoline: -300. Distillates: -1,500. If today’s EIA report shows draws in all three categories like last night’s API report did, expect a moderately bullish price reaction.

WTI Crude Oil futures have made a significant attempt to break through key resistance levels. This rally is attributed to potential delays in OPEC+ output and anticipated inventory expectations.

Stay informed about the energy markets by subscribing to our daily Energy Update, which provides essential insights into Crude Oil and more.

WTI Crude Oil prices are rallying due to potential delays in OPEC+ output and expectations surrounding inventory levels. It is important to note that trading advice provided reflects our good faith judgment at a specific time and is subject to change without notice. There is no guarantee that the advice we give will result in profitable trades. All trading decisions will be made by the account holder, and past performance is not necessarily indicative of future results.

Blue Line Futures, a member of NFA, operates under NFA’s regulatory oversight and examinations. However, it is crucial to be aware that the NFA does not have regulatory oversight authority over underlying or spot virtual currency products, transactions, exchanges, custodians, or markets. Therefore, carefully consider whether such trading is suitable for you, considering your financial condition.

No representation is being made that any account will or is likely to achieve profits or losses similar to those shown.

WTI Crude Oil experienced a rally due to potential delays in OPEC+ output and anticipated inventory levels.

It’s important to note that there can be significant discrepancies between hypothetical performance outcomes and the actual results obtained by any specific trading program. One limitation of hypothetical performance results is that they are often created with the advantage of hindsight. Moreover, hypothetical trading does not entail financial risk, and no hypothetical trading record can fully consider the impact of financial risk in real trading scenarios. For instance, the capacity to endure losses or maintain adherence to a trading program despite losses are crucial factors that can negatively impact actual trading outcomes. There are many other market-related factors or specific trading program implementations that cannot be comprehensively captured in hypothetical performance results, all of which can adversely impact actual trading results.